Bastei Lübbe's (ETR:BST) Shareholders Will Receive A Bigger Dividend Than Last Year

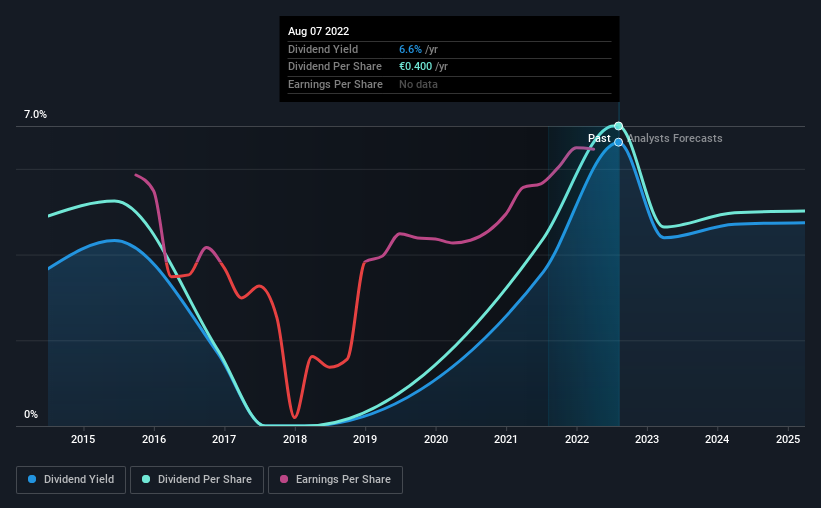

Bastei Lübbe AG (ETR:BST) has announced that it will be increasing its dividend from last year's comparable payment on the 19th of September to €0.40. This makes the dividend yield about the same as the industry average at 6.6%.

See our latest analysis for Bastei Lübbe

Bastei Lübbe's Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Based on the last payment, Bastei Lübbe was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share is forecast to fall by 29.5% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 74%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Bastei Lübbe's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 8 years was €0.28 in 2014, and the most recent fiscal year payment was €0.40. This works out to be a compound annual growth rate (CAGR) of approximately 4.6% a year over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Bastei Lübbe has been growing its earnings per share at 70% a year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

Bastei Lübbe Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 3 warning signs for Bastei Lübbe (of which 1 can't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bastei Lübbe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BST

Bastei Lübbe

A media company, publishes books, audio books, e-books, and related digital products in the genres of fiction and popular science content in European Union, Germany, Austria, Luxembourg, Czech Republic, and Switzerland.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success