Is ad pepper media International N.V.'s(ETR:APM) Recent Stock Performance Tethered To Its Strong Fundamentals?

Most readers would already be aware that ad pepper media International's (ETR:APM) stock increased significantly by 33% over the past three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to ad pepper media International's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for ad pepper media International

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ad pepper media International is:

20% = €4.0m ÷ €21m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every €1 worth of shareholders' equity, the company generated €0.20 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of ad pepper media International's Earnings Growth And 20% ROE

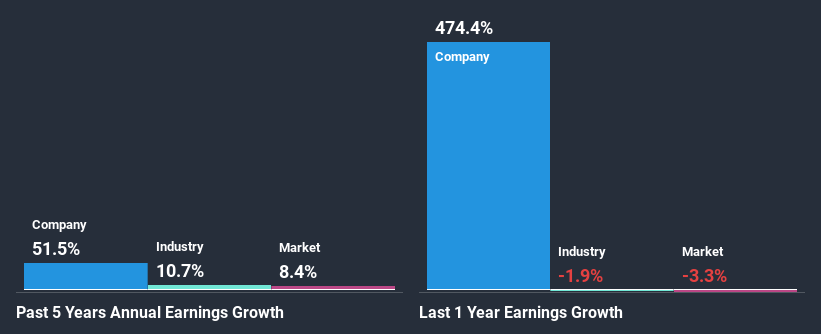

To begin with, ad pepper media International seems to have a respectable ROE. On comparing with the average industry ROE of 13% the company's ROE looks pretty remarkable. Probably as a result of this, ad pepper media International was able to see an impressive net income growth of 51% over the last five years. However, there could also be other causes behind this growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that ad pepper media International's growth is quite high when compared to the industry average growth of 11% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is APM fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is ad pepper media International Efficiently Re-investing Its Profits?

Summary

Overall, we are quite pleased with ad pepper media International's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading ad pepper media International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:APM

ad pepper media International

Provides performance marketing services in Germany, the United Kingdom, Spain, Switzerland, France, Italy, and the Netherlands.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth