- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

There's Reason For Concern Over thyssenkrupp AG's (ETR:TKA) Massive 26% Price Jump

Despite an already strong run, thyssenkrupp AG (ETR:TKA) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 111% in the last year.

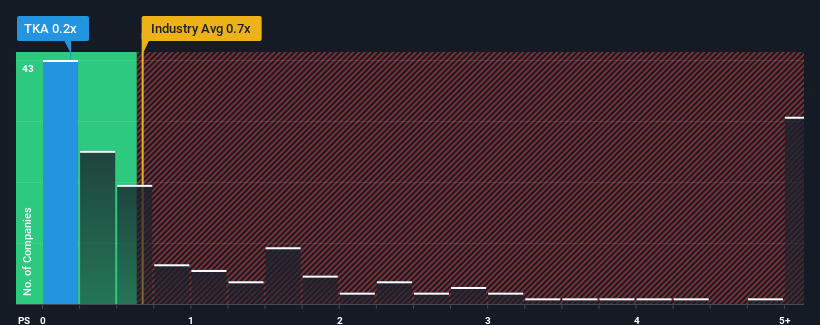

In spite of the firm bounce in price, there still wouldn't be many who think thyssenkrupp's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Germany's Metals and Mining industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Our free stock report includes 2 warning signs investors should be aware of before investing in thyssenkrupp. Read for free now.See our latest analysis for thyssenkrupp

What Does thyssenkrupp's Recent Performance Look Like?

While the industry has experienced revenue growth lately, thyssenkrupp's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on thyssenkrupp will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For thyssenkrupp?

The only time you'd be comfortable seeing a P/S like thyssenkrupp's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's top line. As a result, revenue from three years ago have also fallen 2.9% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 7.2% per annum as estimated by the seven analysts watching the company. With the industry predicted to deliver 17% growth per annum, that's a disappointing outcome.

In light of this, it's somewhat alarming that thyssenkrupp's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From thyssenkrupp's P/S?

thyssenkrupp's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that thyssenkrupp currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with thyssenkrupp, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026