- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

Introducing thyssenkrupp (ETR:TKA), The Stock That Dropped 49% In The Last Year

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the thyssenkrupp AG (ETR:TKA) share price slid 49% over twelve months. That falls noticeably short of the market return of around -9.0%. We note that it has not been easy for shareholders over three years, either; the share price is down 32% in that time. The silver lining is that the stock is up 4.2% in about a week.

Check out our latest analysis for thyssenkrupp

Because thyssenkrupp is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year thyssenkrupp saw its revenue grow by 5.3%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 49% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

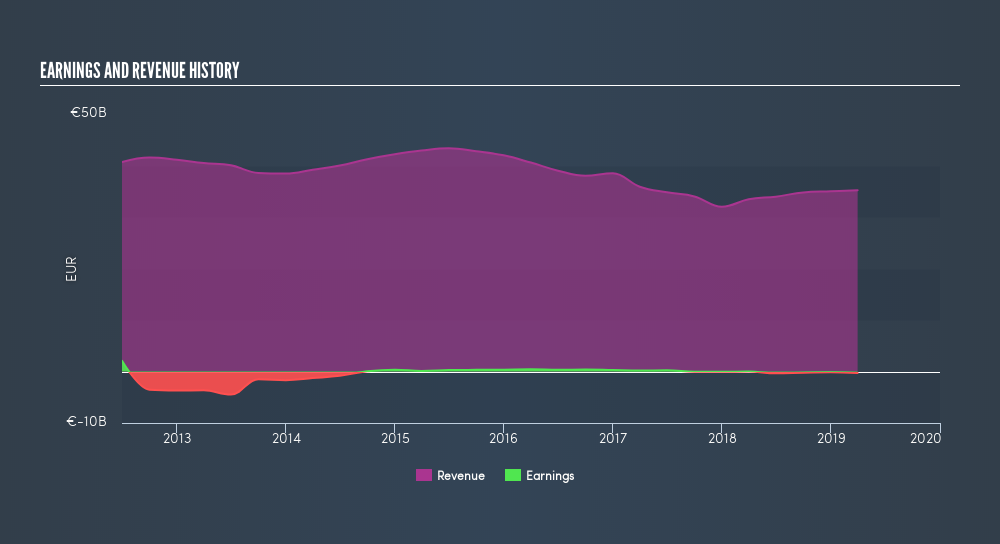

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

thyssenkrupp is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between thyssenkrupp's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. thyssenkrupp's TSR of was a loss of 49% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 9.0% in the twelve months, thyssenkrupp shareholders did even worse, losing 49% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives