- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

A Look at thyssenkrupp (XTRA:TKA) Valuation Following Major Steel Division Restructuring and Leadership Change

Reviewed by Simply Wall St

thyssenkrupp (XTRA:TKA) announced major changes to its steel division, revealing plans to significantly cut its workforce by 2030 and introducing Marie Jaroni as the new chief executive. These moves are intended to improve profitability in light of ongoing industry headwinds.

See our latest analysis for thyssenkrupp.

After a turbulent period marked by industry shocks and leadership changes, thyssenkrupp’s 1-year total shareholder return stands at a stellar 291.4%, with its year-to-date share price return surging 132%. This momentum reflects a market recognizing both the progress from the turnaround strategy and renewed optimism about profitability under new leadership.

If changes at thyssenkrupp have you curious what other companies could be on the move, now is a perfect time to broaden your view and discover fast growing stocks with high insider ownership

But with shares already up dramatically this year and trading close to analyst targets, the big question is whether thyssenkrupp is still undervalued or if the market is already factoring in its turnaround. Could this be a buying window, or is future growth already fully priced in?

Most Popular Narrative: 8.7% Undervalued

At €10.20, the narrative-driven fair value puts thyssenkrupp’s stock well above its recent close of €9.32, suggesting more upside if forecasts play out. The latest narrative combines optimism about margin turnarounds and strategic moves with caution about execution risk and sector trends.

Structural reforms, segment autonomy, and planned Marine Systems spin-off are expected to boost operational efficiency and unlock previously unrecognized value.

What key numbers justify that target? The narrative hinges on a massive jump in profitability, but it takes more than just cost cuts and optimism. Find out which future financial leaps and sector bets are built into this call. Don’t miss the story behind the surprising forecast.

Result: Fair Value of €10.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand or ongoing restructuring setbacks could quickly derail profit recovery and challenge assumptions behind the current valuation narrative.

Find out about the key risks to this thyssenkrupp narrative.

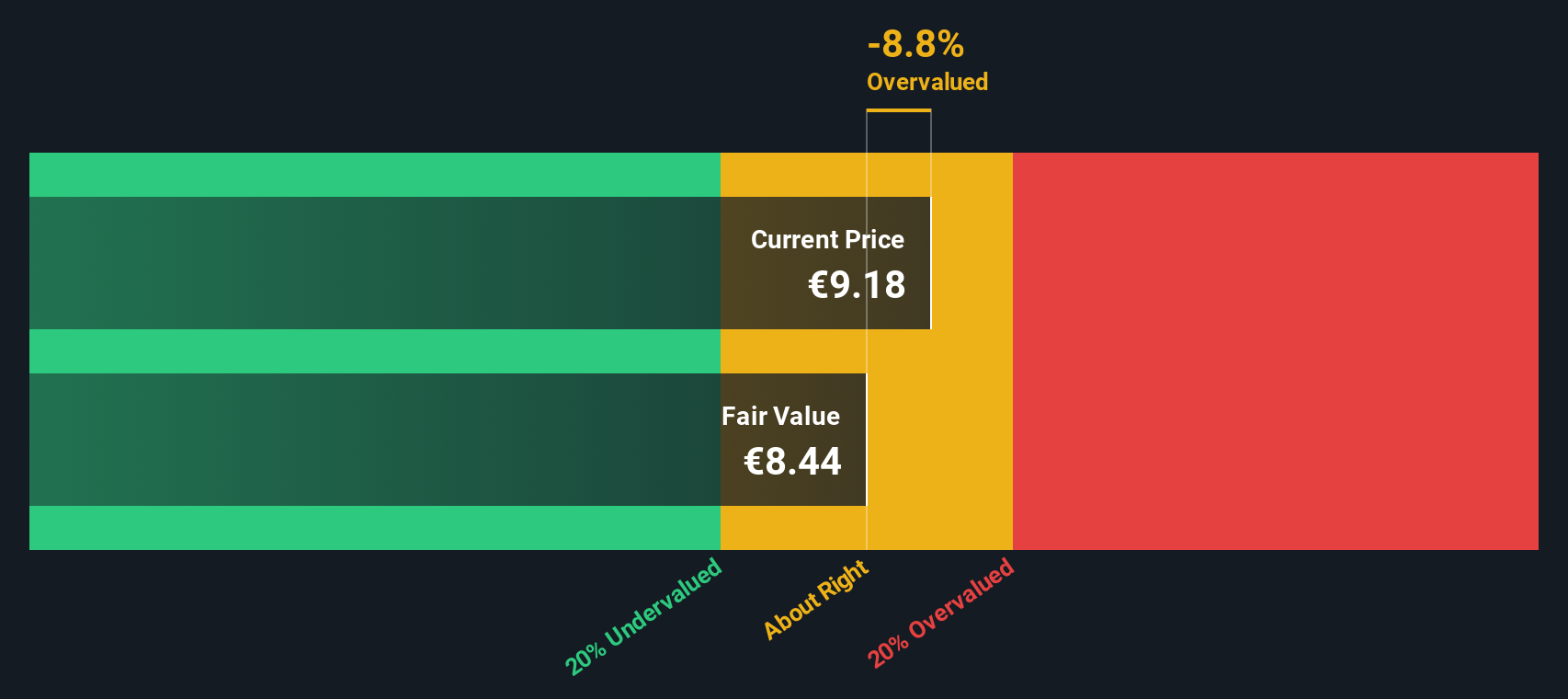

Another View: SWS DCF Model Signals Caution

Looking at thyssenkrupp through our DCF model offers a more conservative story. The SWS DCF model estimates a fair value of €8.11, meaning the current price sits above this mark. This result suggests less upside and challenges the optimism seen in the narrative-driven target. Which angle best fits your view of the company's future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out thyssenkrupp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own thyssenkrupp Narrative

If you see things differently or want to dig deeper into the numbers yourself, building your own view is quick and easy. You can make your own narrative in just minutes. Do it your way

A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Seize your investing edge with the latest smart stock picks using these powerful tools right now:

- Unlock hidden value by checking out these 862 undervalued stocks based on cash flows, filled with stocks trading below their intrinsic worth and positioned for strong returns.

- Accelerate your strategy by spotting potential innovators among these 26 AI penny stocks, where tomorrow’s AI breakthroughs could drive impressive growth.

- Boost your search for steady income with these 14 dividend stocks with yields > 3%, highlighting companies delivering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives