Stock Analysis

Symrise (ETR:SY1) jumps 3.2% this week, though earnings growth is still tracking behind five-year shareholder returns

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Symrise AG (ETR:SY1) share price is up 28% in the last 5 years, clearly besting the market return of around 7.8% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 6.9%, including dividends.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Symrise

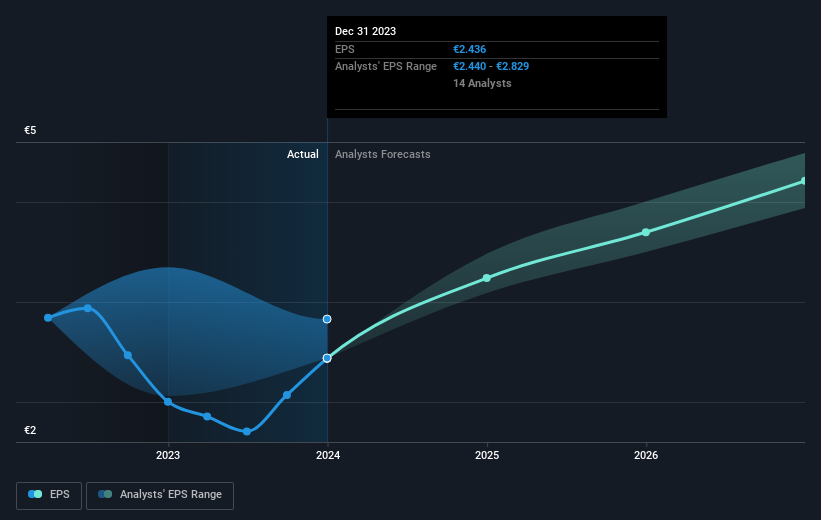

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Symrise managed to grow its earnings per share at 2.8% a year. This EPS growth is slower than the share price growth of 5% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Symrise the TSR over the last 5 years was 34%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Symrise provided a TSR of 6.9% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 6% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Symrise is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Symrise is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SY1

Symrise

Supplies fragrances, flavorings, cosmetic active ingredients and raw materials, and functional ingredients in Europe, Africa, the Middle East, North America, the Asia Pacific, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.