- Germany

- /

- Metals and Mining

- /

- XTRA:NDA

Aurubis (XTRA:NDA) Valuation in Focus After €200M EIB Loan for Expansion and Sustainability Initiatives

Reviewed by Simply Wall St

If you’re watching Aurubis (XTRA:NDA) right now, the latest move could have you wondering if it’s time to reconsider your stance on the stock. On September 11, the company announced a significant €200 million investment loan from the European Investment Bank (EIB) aimed at scaling up copper refining in Bulgaria and boosting metal recycling and environmental measures in Hamburg. This financing marks the first support for the sector under the EIB’s new raw materials strategy and positions Aurubis at the center of Europe’s push for secure, sustainable supply chains.

The news appears to have piqued market interest, with Aurubis showing consistent momentum over the past year. The stock rose 39% over twelve months and 20% in the past three months. Management has indicated ambitious production capacity targets, with copper output set to increase and serve Europe’s rising demand for critical metals spanning the energy, technology, and security sectors. However, the company’s most recent annual results highlighted a dip in net income even as sales have edged higher, underscoring that growth initiatives can come with operational challenges.

With the share price trending higher leading into this announcement, the real question for investors is whether the market is already factoring in future upside, or if Aurubis presents a new opportunity at these levels.

Most Popular Narrative: 16.8% Overvalued

According to the most widely followed narrative, Aurubis is currently trading above what analysts consider its fair value. Cautious sector sentiment and concerns over long-term earnings power are weighing on the company's valuation outlook, even as the share price has climbed considerably in recent months.

Ongoing substantial investments in automation, digitalization, and advanced processing technologies at key sites (for example, Pirdop and Hamburg) are improving operational efficiency, production stability, and cost structure. These efforts could elevate net margins and long-term earnings. Expansion into the U.S. through the commissioning of the Richmond recycling facility positions Aurubis advantageously in a market with high copper demand and supportive policy shifts that favor domestic recycling, potentially supporting higher segment earnings and diversified revenue streams.

Why do analysts think the fair value is so much lower than the current share price? There are bold projections underpinning this target, including dramatic changes to both revenue and profit margins, and a financial multiple that sets a high bar for future growth. What happens if market realities shift just a little? If you want to understand the assumptions driving this eye-catching valuation, and see what could really change the story for Aurubis, you'll want to dig deeper into the narrative's figures.

Result: Fair Value of €81.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued strong copper demand or significant gains from upcoming strategic investments could quickly shift Aurubis’s outlook beyond current analyst expectations.

Find out about the key risks to this Aurubis narrative.Another View: What About Our DCF Model?

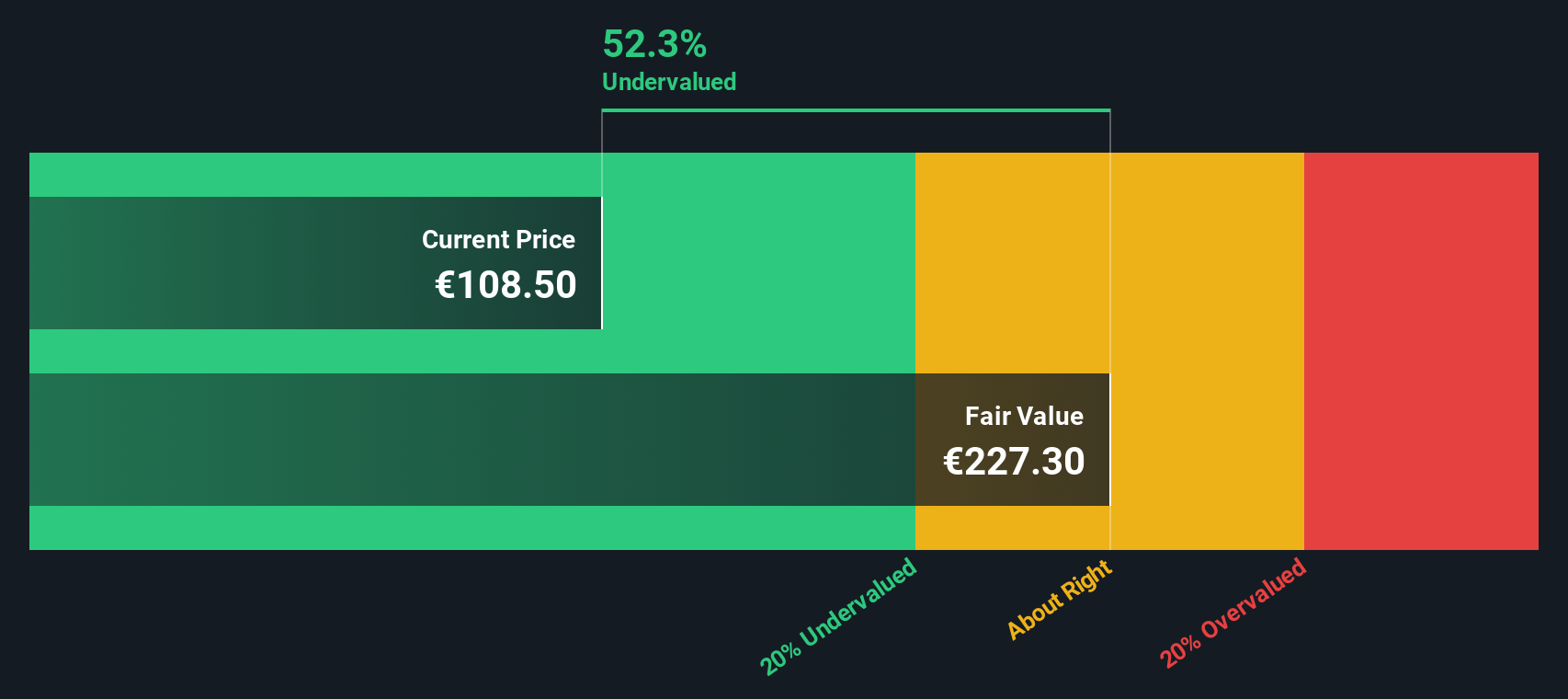

While analysts argue that Aurubis is overvalued right now, our SWS DCF model paints a very different picture. The model suggests the stock could actually be undervalued. Is the market missing something, or is the caution justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aurubis Narrative

If you see the story differently or want to dig into the data for yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Aurubis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You never want to miss the companies making big moves in today’s markets. The right screener can help you find standouts and new opportunities other investors overlook.

- Power up your portfolio with companies offering exceptional yields by checking out dividend stocks with yields > 3% and see which stocks are exceeding expectations on income potential.

- Spot the next wave of tech breakthroughs by tapping into AI penny stocks to find businesses harnessing advanced artificial intelligence for rapid growth.

- Get ahead of the crowd searching for hidden gems by using undervalued stocks based on cash flows to uncover quality stocks trading for less than their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NDA

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives