LANXESS (XTRA:LXS) Is Down 16.8% After Deeper Losses and Weaker Demand in Q3 2025 Results

Reviewed by Sasha Jovanovic

- Earlier this month, LANXESS reported third-quarter 2025 results showing sales of €1.34 billion, down from €1.60 billion the previous year, along with a net loss of €77 million compared to a small net profit in Q3 2024.

- The company highlighted persistent weak demand across construction, automotive, and agro-chemical sectors while announcing additional cost-saving measures to counter ongoing economic pressures.

- We’ll explore how LANXESS’s deeper quarterly losses and cautious guidance may impact its outlook for operational resilience and recovery.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

LANXESS Investment Narrative Recap

To be an investor in LANXESS right now, you need to believe the company can emerge from weak demand cycles in core markets and position itself to benefit when industrial and construction activity rebounds in Europe. The latest earnings release confirmed another steep quarterly loss and management’s expectation of 2025 profits at the lower end of guidance, keeping operational recovery tied to a still uncertain demand environment, which remains the most important catalyst and risk for the stock after this news. Short-term, the impact on these drivers is material as ongoing demand softness directly affects margins and profitability.

Of the company’s recent announcements, the Q3 results and related cost-saving measures are most relevant. LANXESS outlined a plan to deliver €100 million in additional annual savings in 2026, supplementing existing restructuring efforts. While this could help protect margins, sustained demand weakness in end markets remains a crucial concern for investors watching for early signs of a turnaround.

By contrast, investors should be aware that even with cost cuts, the risk of prolonged underutilization and weak demand in construction and automotive remains a significant consideration...

Read the full narrative on LANXESS (it's free!)

LANXESS' outlook anticipates €6.4 billion in revenue and €10.2 million in earnings by 2028. This is based on a 1.4% annual revenue growth rate and a €175.2 million improvement in earnings from the current €-165.0 million.

Uncover how LANXESS' forecasts yield a €24.55 fair value, a 43% upside to its current price.

Exploring Other Perspectives

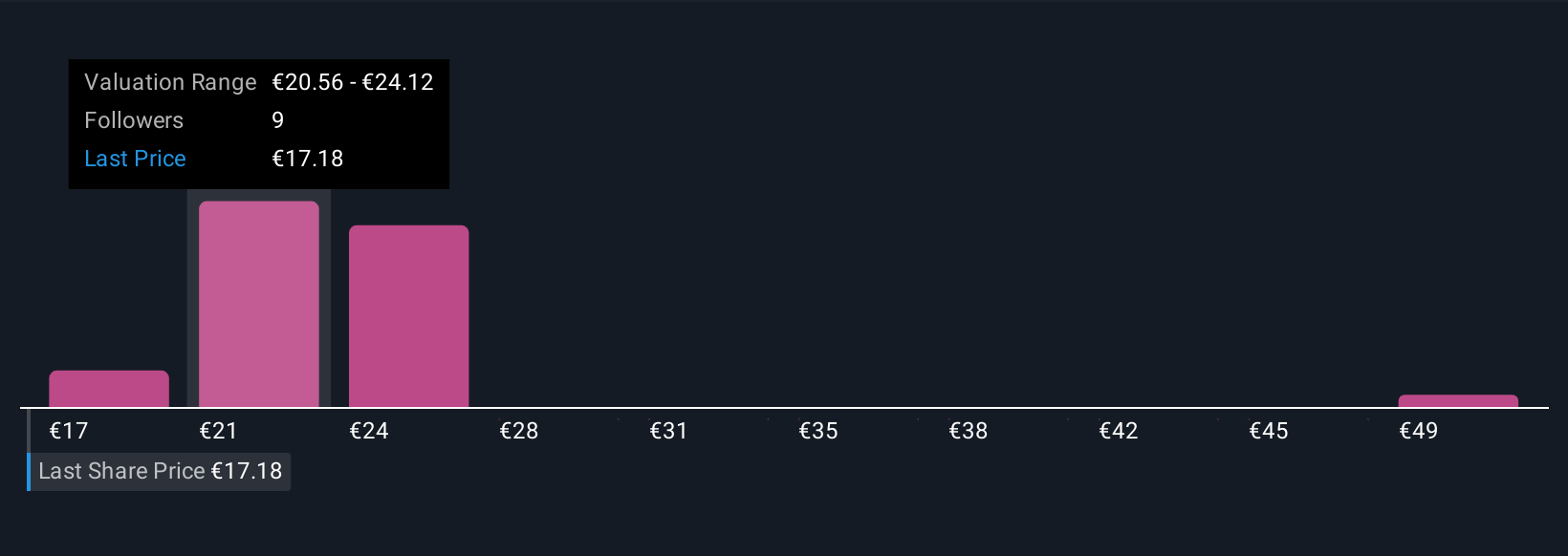

Estimates from five Simply Wall St Community participants value LANXESS between €17 and €52.61 per share, reflecting varied views on recovery potential. With persistent end-market weakness now confirmed by management, be sure to explore a range of perspectives on what could shape the company’s performance.

Explore 5 other fair value estimates on LANXESS - why the stock might be worth just €17.00!

Build Your Own LANXESS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LANXESS research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LANXESS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LANXESS' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LXS

LANXESS

A specialty chemicals company, engages in the development, manufacture, and marketing of chemical intermediates, additives, and consumer protection products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives