Take Care Before Jumping Onto IBU-tec advanced materials AG (ETR:IBU) Even Though It's 28% Cheaper

The IBU-tec advanced materials AG (ETR:IBU) share price has fared very poorly over the last month, falling by a substantial 28%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

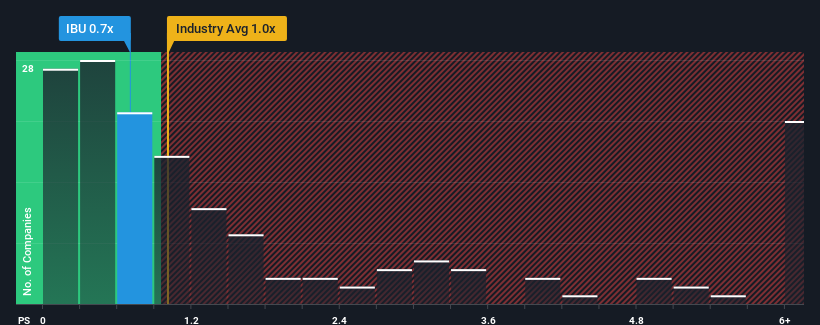

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about IBU-tec advanced materials' P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in Germany is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for IBU-tec advanced materials

How Has IBU-tec advanced materials Performed Recently?

Recent times have been more advantageous for IBU-tec advanced materials as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Want the full picture on analyst estimates for the company? Then our free report on IBU-tec advanced materials will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like IBU-tec advanced materials' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.5%. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 8.5% over the next year. With the industry only predicted to deliver 3.5%, the company is positioned for a stronger revenue result.

In light of this, it's curious that IBU-tec advanced materials' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On IBU-tec advanced materials' P/S

IBU-tec advanced materials' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, IBU-tec advanced materials' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for IBU-tec advanced materials (1 is a bit unpleasant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:IBU

IBU-tec advanced materials

Offers services and products for the chemical industry Germany, rest of Europe, and internationally.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives