- Germany

- /

- Basic Materials

- /

- XTRA:HEI

Heidelberg Materials (XTRA:HEI): Assessing Valuation After Barclays Upgrade and Renewed Sector Optimism

Reviewed by Simply Wall St

After Barclays upgraded Heidelberg Materials (XTRA:HEI) this week, attention is focusing on the company’s competitive EU CO2 positioning, possible volume recovery in key European construction markets, and steady infrastructure demand in the U.S.

See our latest analysis for Heidelberg Materials.

Heidelberg Materials has caught the market's eye this year, with a hefty 72% share price return year-to-date and a stellar 79% total shareholder return over the past 12 months. Barclays’ recent upgrade adds to the momentum that has been building since strong Q3 updates and optimism about a rebound in European construction. Long-term investors have been well rewarded, as the stock’s multi-year total returns continue to outperform sector averages.

If you’re watching construction and infrastructure plays, now is an ideal time to branch out and discover See the full list for free.

With shares having surged and further upgrades on the table, the question remains: does Heidelberg Materials still offer value for new investors, or has the market already priced in the expected recovery and future growth?

Most Popular Narrative: 1.1% Undervalued

The current fair value estimate in the most widely followed narrative stands slightly higher than the latest close price for Heidelberg Materials. Market watchers are closely examining the growth and margin assumptions driving this calculation.

The company's acceleration in sustainable product development, including world-first carbon capture projects, commercialization of low-carbon products like evoZero, and significant reductions in CO2 emissions, positions it to capture premium pricing and market share as customers and regulators shift toward green materials. This is likely to boost margins and support higher long-term earnings.

Want to see which breakthrough climate innovations could supercharge profits? The full narrative uncovers how the push into green tech and a new premium product strategy influence this fair value story. The next wave of industry transformation is woven into these numbers. Find out what sets this estimate apart.

Result: Fair Value of $210.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volume declines in Europe or lost public funding for green projects could undermine the optimism behind Heidelberg Materials' strong growth narrative.

Find out about the key risks to this Heidelberg Materials narrative.

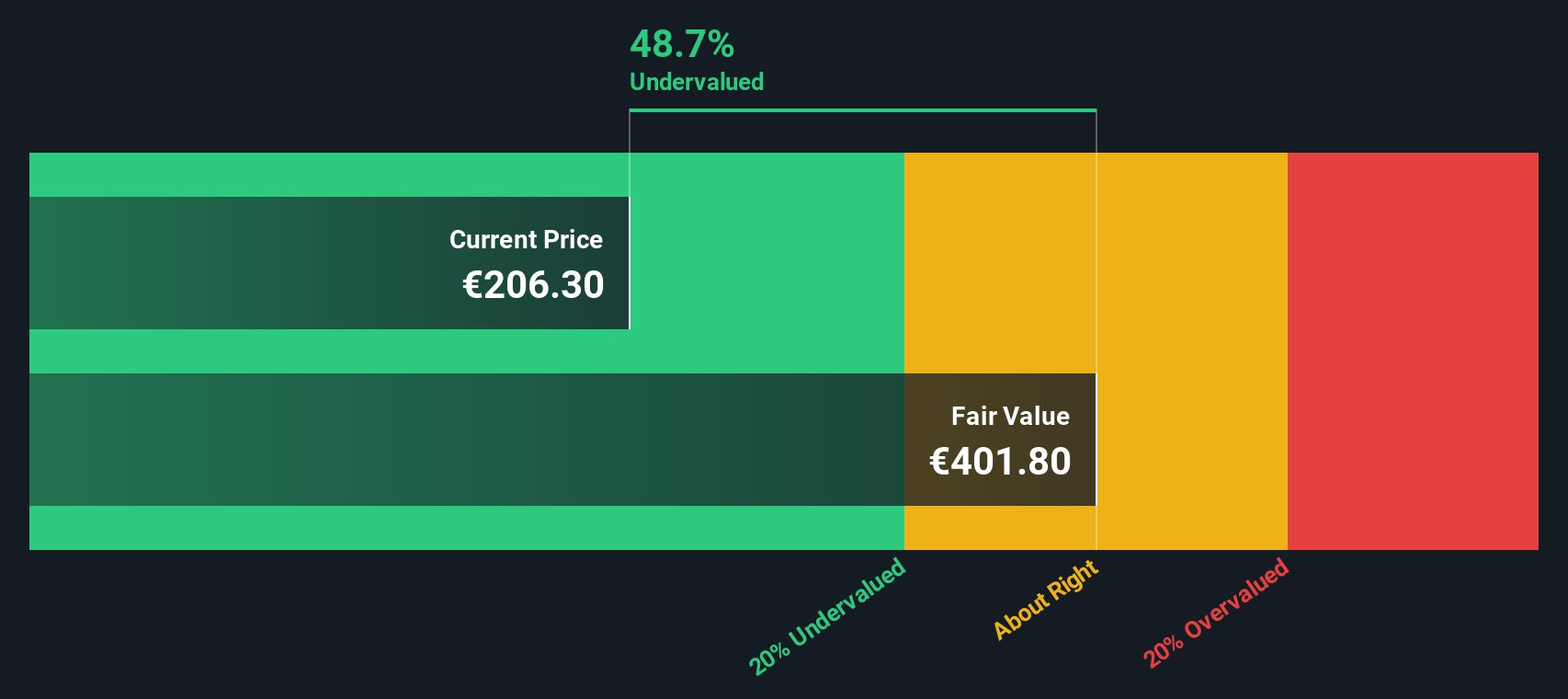

Another View: SWS DCF Model Signals a Much Deeper Discount

Looking at our DCF model, the result sharply contrasts with the market’s view. While price targets suggest Heidelberg Materials is close to fairly valued, the SWS DCF model sees the shares trading at a much steeper discount, almost half below its estimated fair value. Could the market be overlooking upside here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Heidelberg Materials Narrative

If you think there’s more to the story or want to dig into the numbers yourself, you can quickly craft your personal outlook in under three minutes with Do it your way.

A great starting point for your Heidelberg Materials research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors move fast to spot the next opportunity. Don’t limit yourself to one stock. Use these powerful screeners to hunt for your next portfolio winner:

- Accelerate your search for tech disruptors by targeting these 27 AI penny stocks and tapping into the booming artificial intelligence sector.

- Boost income potential instantly with these 18 dividend stocks with yields > 3% which offers consistent yields above 3% to reward patient investors.

- Unlock affordable growth with these 905 undervalued stocks based on cash flows to find stocks trading below their true cash flow-based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HEI

Heidelberg Materials

Produces and distributes cement, aggregates, ready-mixed concrete, and asphalt worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives