A Quick Analysis On Wüstenrot & Württembergische's (ETR:WUW) CEO Compensation

Jürgen Junker has been the CEO of Wüstenrot & Württembergische AG (ETR:WUW) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Wüstenrot & Württembergische.

View our latest analysis for Wüstenrot & Württembergische

Comparing Wüstenrot & Württembergische AG's CEO Compensation With the industry

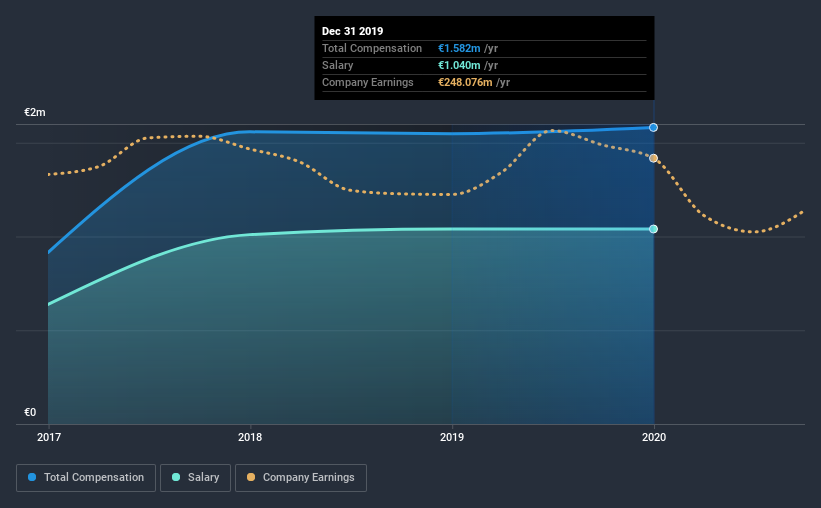

At the time of writing, our data shows that Wüstenrot & Württembergische AG has a market capitalization of €1.6b, and reported total annual CEO compensation of €1.6m for the year to December 2019. That's mostly flat as compared to the prior year's compensation. In particular, the salary of €1.04m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from €824m to €2.6b, the reported median CEO total compensation was €1.6m. So it looks like Wüstenrot & Württembergische compensates Jürgen Junker in line with the median for the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €1.0m | €1.0m | 66% |

| Other | €542k | €508k | 34% |

| Total Compensation | €1.6m | €1.5m | 100% |

Talking in terms of the industry, salary represented approximately 40% of total compensation out of all the companies we analyzed, while other remuneration made up 60% of the pie. According to our research, Wüstenrot & Württembergische has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Wüstenrot & Württembergische AG's Growth Numbers

Over the last three years, Wüstenrot & Württembergische AG has shrunk its earnings per share by 9.6% per year. It saw its revenue drop 4.8% over the last year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Wüstenrot & Württembergische AG Been A Good Investment?

With a three year total loss of 19% for the shareholders, Wüstenrot & Württembergische AG would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Wüstenrot & Württembergische pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, EPS growth and total shareholder return have been negative for the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is potentially serious) in Wüstenrot & Württembergische we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Wüstenrot & Württembergische, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wüstenrot & Württembergische might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:WUW

Wüstenrot & Württembergische

Provides insurance products and services in Germany.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026