Upward Earnings Guidance Could Be a Game Changer for Hannover Rück (XTRA:HNR1)

Reviewed by Sasha Jovanovic

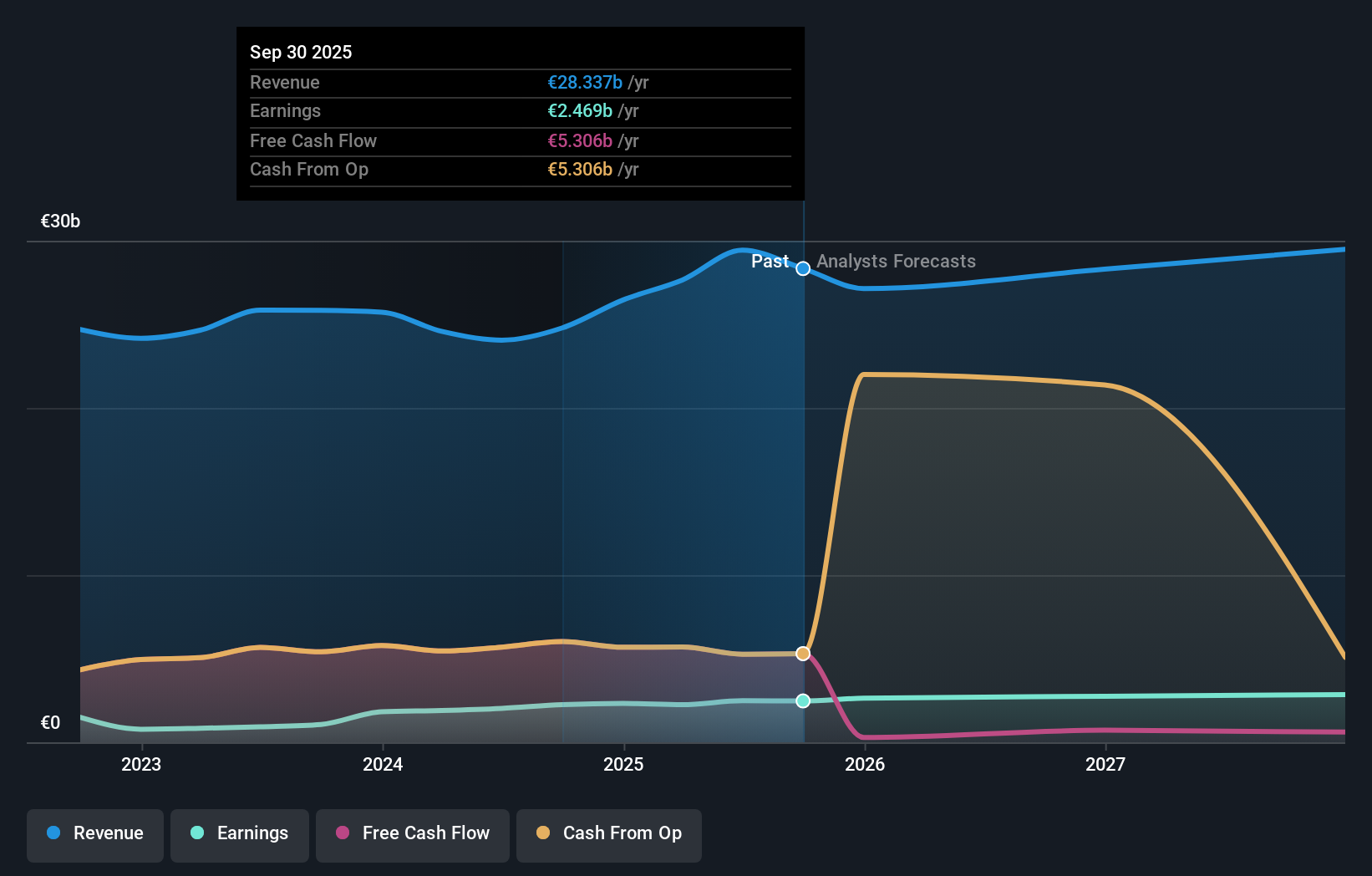

- Earlier this week, Hannover Rück SE raised its 2025 earnings guidance to around €2.6 billion and projected at least €2.7 billion in group net income for 2026, coinciding with the release of its Q3 2025 results showing nine-month net income of €1.96 billion.

- This upward revision to forecasts, paired with continued year-over-year earnings growth, highlights management's confidence in the company’s outlook despite industry headwinds.

- We'll examine how Hannover Rück's increased profitability targets could affect analyst assumptions around future margin expansion and earnings growth.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hannover Rück Investment Narrative Recap

To be a shareholder in Hannover Rück, you need to believe in the company's ability to maintain profitable premium growth and margin resilience, even as reinsurance markets become more competitive. The recent upgrade in 2025 and 2026 earnings guidance appears unlikely to immediately offset the biggest risk facing the business: persistent downward pressure on risk-adjusted premium rates from increased competition and capital inflows, particularly in property catastrophe. For now, the most important short-term catalyst, strong demand for both traditional and structured reinsurance, remains intact, as management’s updated guidance reinforces confidence in forward earnings potential, but margin compression risk persists.

Of the recent company announcements, the Q3 2025 results are particularly relevant in the context of the revised guidance. Nine-month net income rose to €1.96 billion from €1.82 billion a year earlier, indicating continued earnings growth despite quarterly volatility; this backdrop supports management's optimism but also sets a high bar for sustaining performance as competitive pressures mount.

However, investors should also be aware that even with stronger guidance, the sustained influx of capital and softening pricing in core reinsurance lines could...

Read the full narrative on Hannover Rück (it's free!)

Hannover Rück's narrative projects €30.2 billion revenue and €2.9 billion earnings by 2028. This requires a 0.9% yearly revenue decline and a €0.4 billion earnings increase from €2.5 billion today.

Uncover how Hannover Rück's forecasts yield a €283.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members supplied six fair value estimates for Hannover Rück ranging from €136.76 up to €2,585.88. While management's upgraded earnings targets may influence sentiment, ongoing pressure on risk-adjusted pricing keeps the debate open, see how your view compares with others.

Explore 6 other fair value estimates on Hannover Rück - why the stock might be worth over 9x more than the current price!

Build Your Own Hannover Rück Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hannover Rück research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Hannover Rück research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hannover Rück's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hannover Rück might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HNR1

Hannover Rück

Provides reinsurance products and services in Germany, the United Kingdom, France, Europe, the United States, Asia, Australia, Africa, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives