As Germany's DAX Index reaches new highs amid a backdrop of slowing inflation, investors are increasingly looking towards stable dividend stocks as a reliable source of income. In this environment, selecting stocks with strong fundamentals and consistent dividend payouts can be particularly advantageous.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 4.89% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.28% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.74% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.04% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.70% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.41% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.19% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.36% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.81% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.42% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Allianz SE, with a market cap of €109.24 billion, operates globally through its subsidiaries offering property-casualty insurance, life/health insurance, and asset management products and services.

Operations: Allianz SE generates revenue from three main segments: property-casualty insurance (€74.95 billion), life/health insurance (€45.52 billion), and asset management (€3.34 billion).

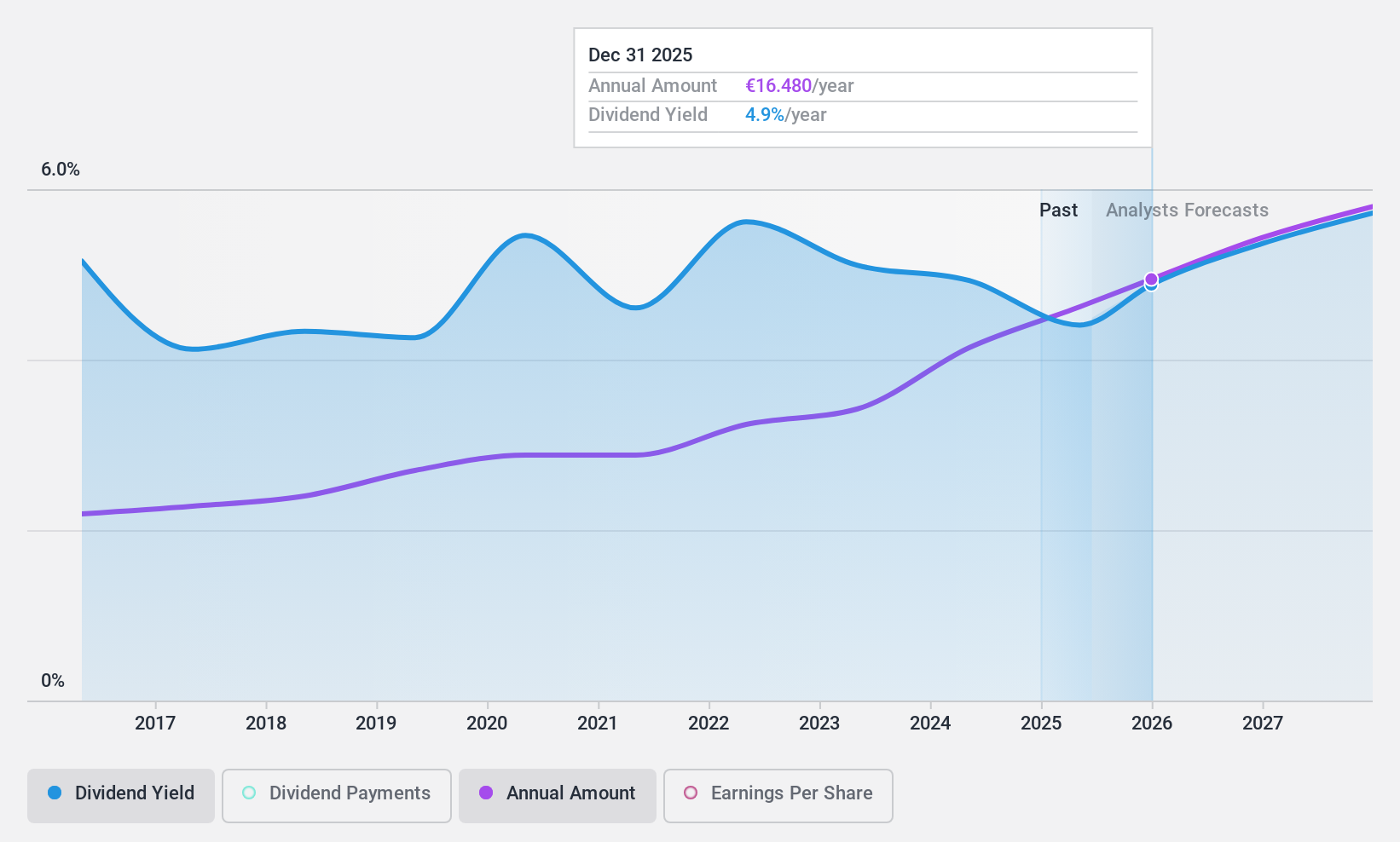

Dividend Yield: 4.9%

Allianz's dividend payments are well-covered by both earnings (60% payout ratio) and cash flows (23.1% cash payout ratio), ensuring sustainability. The company has a reliable dividend history over the past decade, with stable and growing payouts. Recent buybacks (€1 billion completed, additional €500 million authorized) and strategic partnerships, such as with Jetty, bolster its financial position. Earnings for H1 2024 were €4.99 billion, up from €4.37 billion last year, supporting continued dividend reliability.

- Take a closer look at Allianz's potential here in our dividend report.

- Our expertly prepared valuation report Allianz implies its share price may be lower than expected.

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE provides IT solutions in Germany and internationally, with a market cap of €331.18 million.

Operations: DATAGROUP SE's revenue segments include €456.25 million from Services and €77.59 million from Solutions & Consulting.

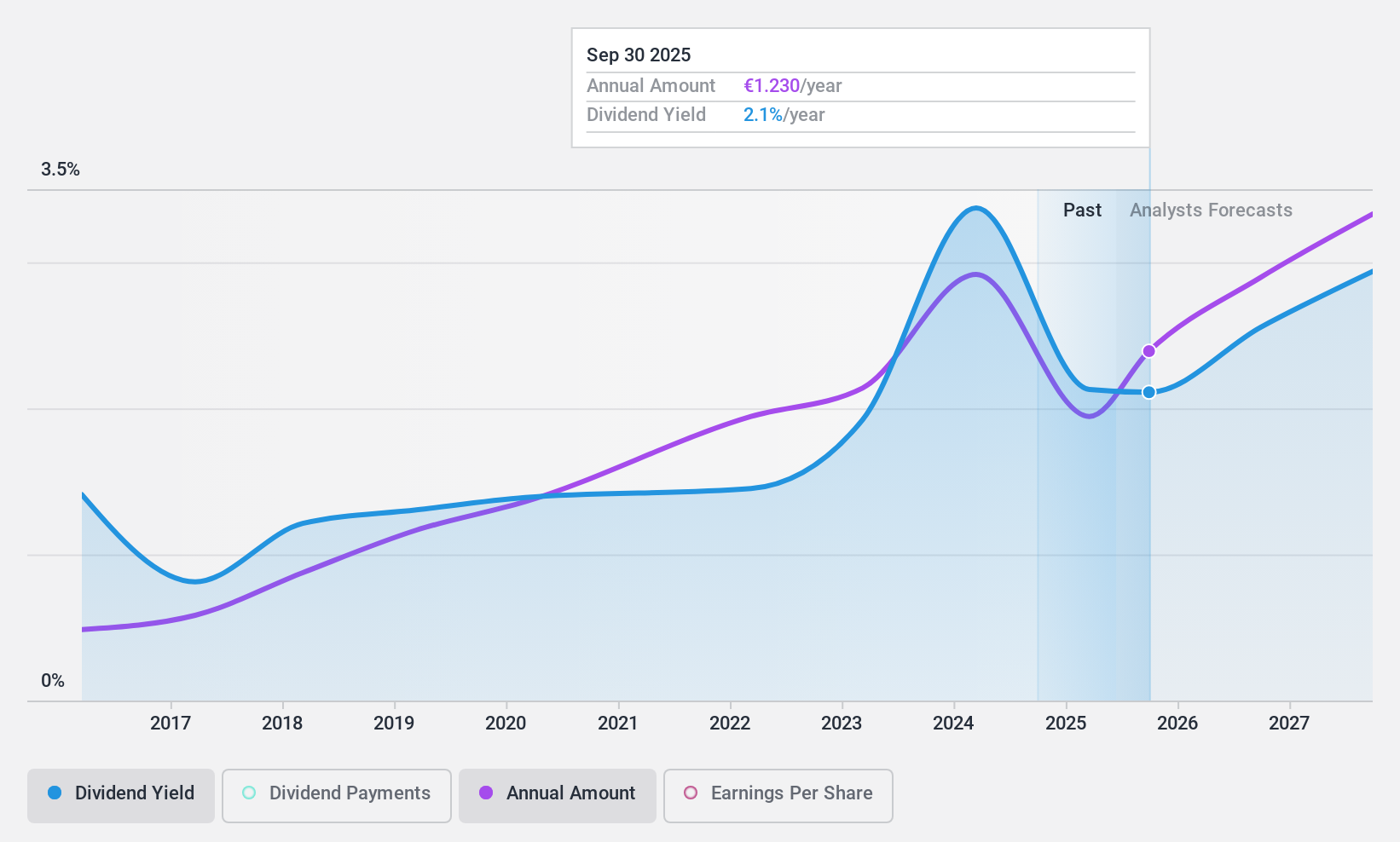

Dividend Yield: 3.8%

DATAGROUP's dividend payments are well-covered by earnings (48.1% payout ratio) and cash flows (28.2% cash payout ratio), indicating sustainability despite a volatile track record over the past decade. The company reported earnings for the nine months ended June 30, 2024, with sales of €383.75 million, up from €367.52 million last year, though net income decreased to €18.34 million from €21.12 million previously. Trading at good value compared to peers and industry estimates, DATAGROUP shows potential for future growth but has a lower-than-top-tier dividend yield at 3.77%.

- Get an in-depth perspective on DATAGROUP's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, DATAGROUP's share price might be too pessimistic.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, with a market cap of €1.07 billion, manufactures and supplies pumps, valves, and related services globally through its subsidiaries.

Operations: KSB SE & Co. KGaA generates revenue from three primary segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

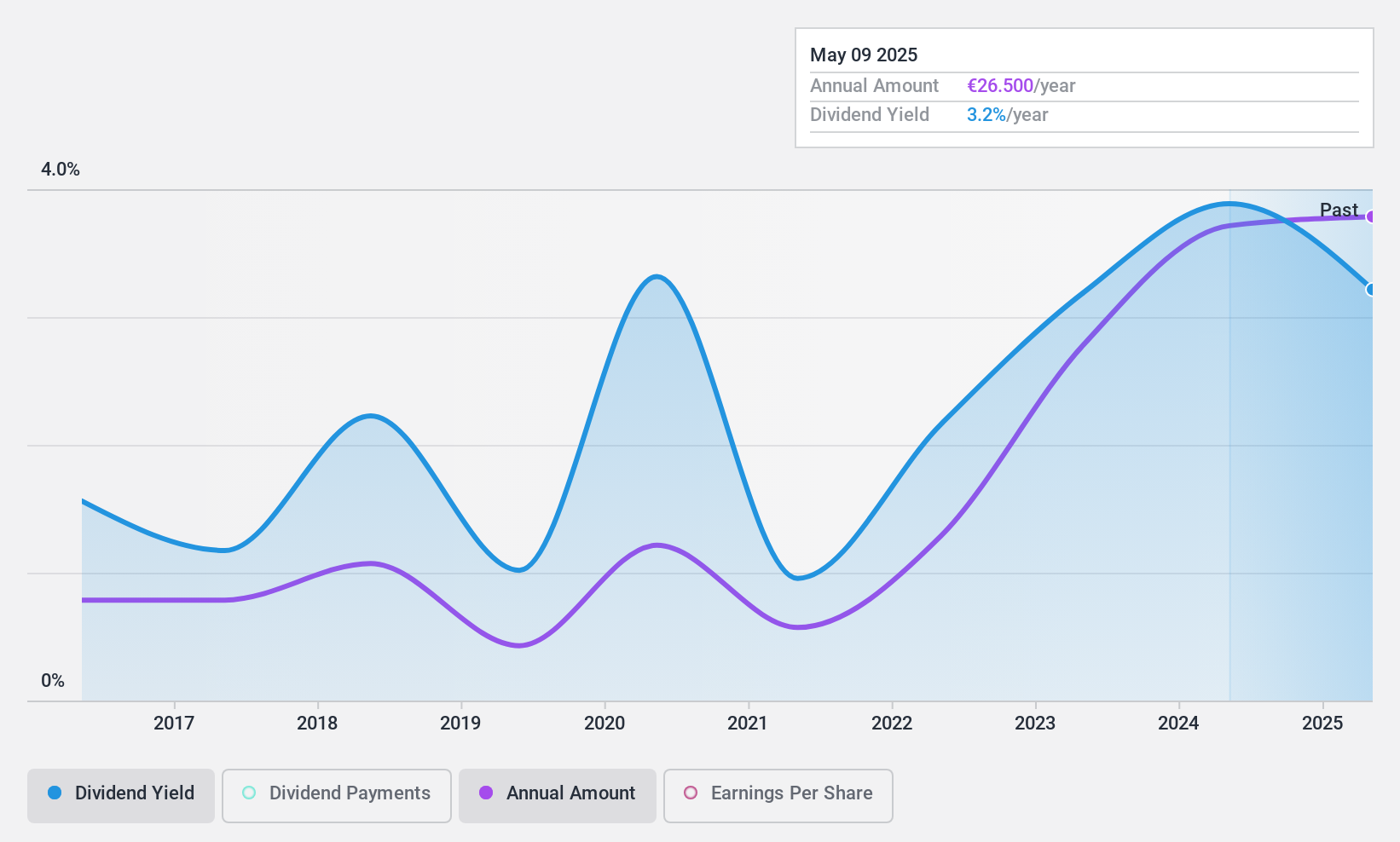

Dividend Yield: 4.1%

KSB SE & Co. KGaA's dividend yield (4.06%) is lower than the top 25% of German dividend payers but is well-covered by both earnings (29.9% payout ratio) and cash flows (24.2% cash payout ratio). Despite a volatile dividend history, payments have increased over the past decade. Recent earnings for H1 2024 show sales of €1.44 billion, up from €1.39 billion last year, though net income slightly decreased to €58.2 million from €62 million previously.

- Navigate through the intricacies of KSB SE KGaA with our comprehensive dividend report here.

- The analysis detailed in our KSB SE KGaA valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Unlock more gems! Our Top German Dividend Stocks screener has unearthed 28 more companies for you to explore.Click here to unveil our expertly curated list of 31 Top German Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.