- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

3 German Growth Stocks With High Insider Ownership Growing Earnings At 54%

Reviewed by Simply Wall St

As the German economy faces a forecasted contraction in 2024, with factory orders experiencing a significant decline, investors are increasingly focused on identifying resilient opportunities within the market. In this context, growth companies with high insider ownership can be particularly appealing, as they often demonstrate strong alignment between management and shareholder interests and have the potential to capitalize on any economic rebound.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| Stemmer Imaging (XTRA:S9I) | 25.1% | 23.2% |

| Multitude (XTRA:E4I) | 31% | 20.7% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.6% | 54.1% |

| pferdewetten.de (XTRA:EMH) | 20.6% | 97.9% |

| adidas (XTRA:ADS) | 16.6% | 40.4% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| R. STAHL (XTRA:RSL2) | 37.9% | 59.3% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18.8% | 24.6% |

| Redcare Pharmacy (XTRA:RDC) | 17.4% | 54.3% |

Underneath we present a selection of stocks filtered out by our screen.

Deutsche Beteiligungs (XTRA:DBAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm that focuses on direct and fund of fund investments, with a market cap of €461.42 million.

Operations: The company's revenue is derived from Fund Investment Services, generating €48.00 million, and Private Equity Investments, contributing €27.01 million.

Insider Ownership: 39.6%

Earnings Growth Forecast: 54.1% p.a.

Deutsche Beteiligungs AG shows potential for growth with earnings forecasted to increase by 54.07% annually, outpacing the German market. Despite a significant drop in recent earnings and revenue, the company is trading at 62% below its estimated fair value, suggesting possible undervaluation. Revenue growth expectations are strong at 41.7% per year, though profit margins have decreased significantly from last year. The dividend yield of 3.98% is not well covered by current earnings or free cash flows.

- Click to explore a detailed breakdown of our findings in Deutsche Beteiligungs' earnings growth report.

- The analysis detailed in our Deutsche Beteiligungs valuation report hints at an deflated share price compared to its estimated value.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates as an online pharmacy in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of approximately €2.95 billion.

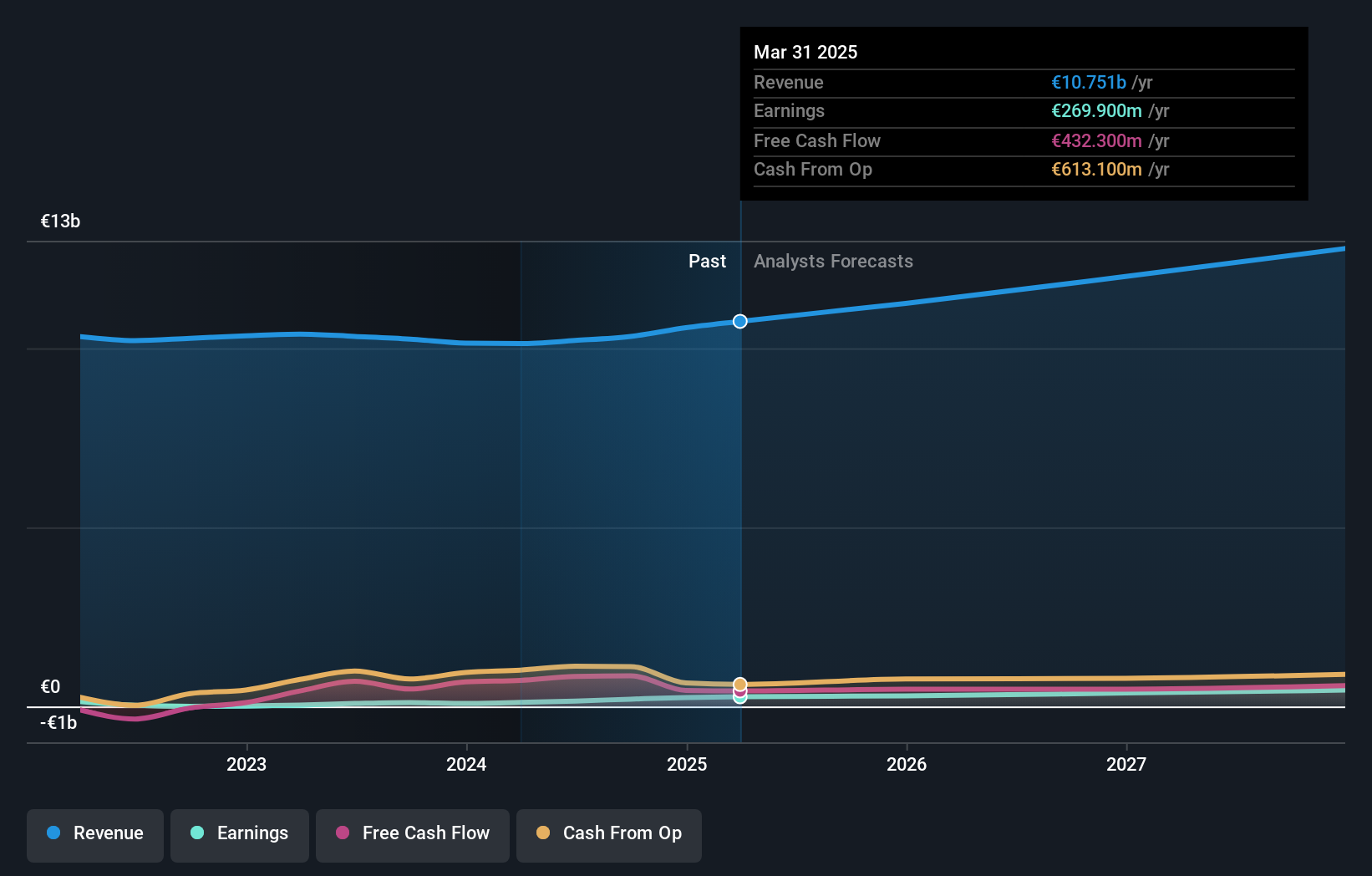

Operations: The company generates revenue from its DACH segment, amounting to €1.74 billion, and its International segment, contributing €391 million.

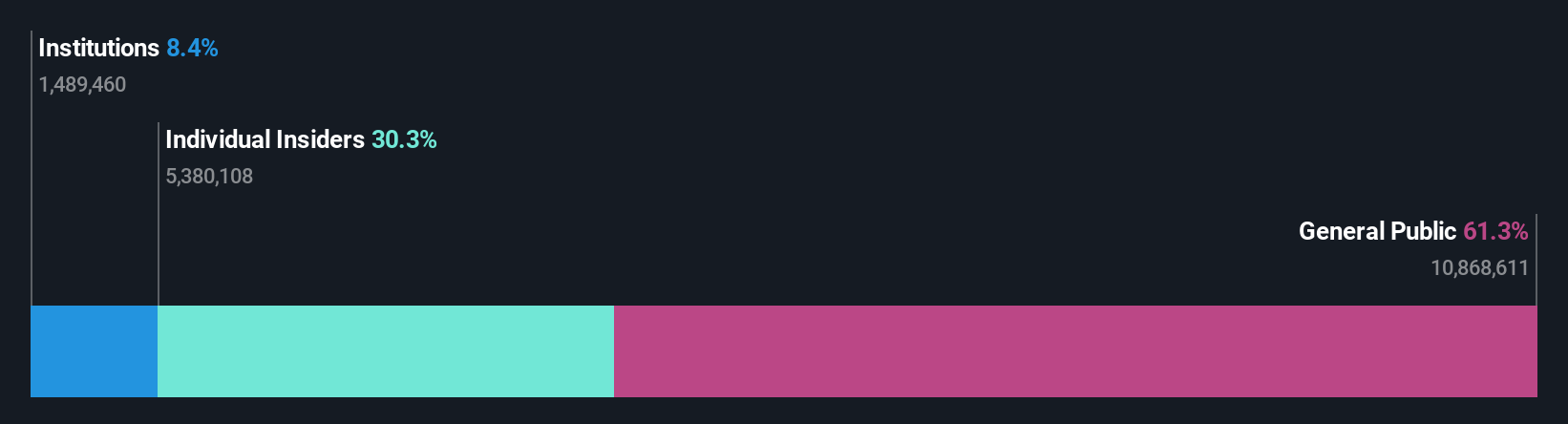

Insider Ownership: 17.4%

Earnings Growth Forecast: 54.3% p.a.

Redcare Pharmacy is poised for growth, with revenue forecasted to increase by 17.5% annually, surpassing the German market average of 5.4%. The company recently raised its sales guidance for 2024 to between €2.35 billion and €2.5 billion. Despite a net loss reduction in the first half of 2024, insider ownership remains high with more shares bought than sold recently, indicating confidence in future profitability expected within three years.

- Get an in-depth perspective on Redcare Pharmacy's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Redcare Pharmacy's shares may be trading at a premium.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products with a market cap of €7.82 billion.

Operations: The company's revenue segments include a segment adjustment of €10.49 billion.

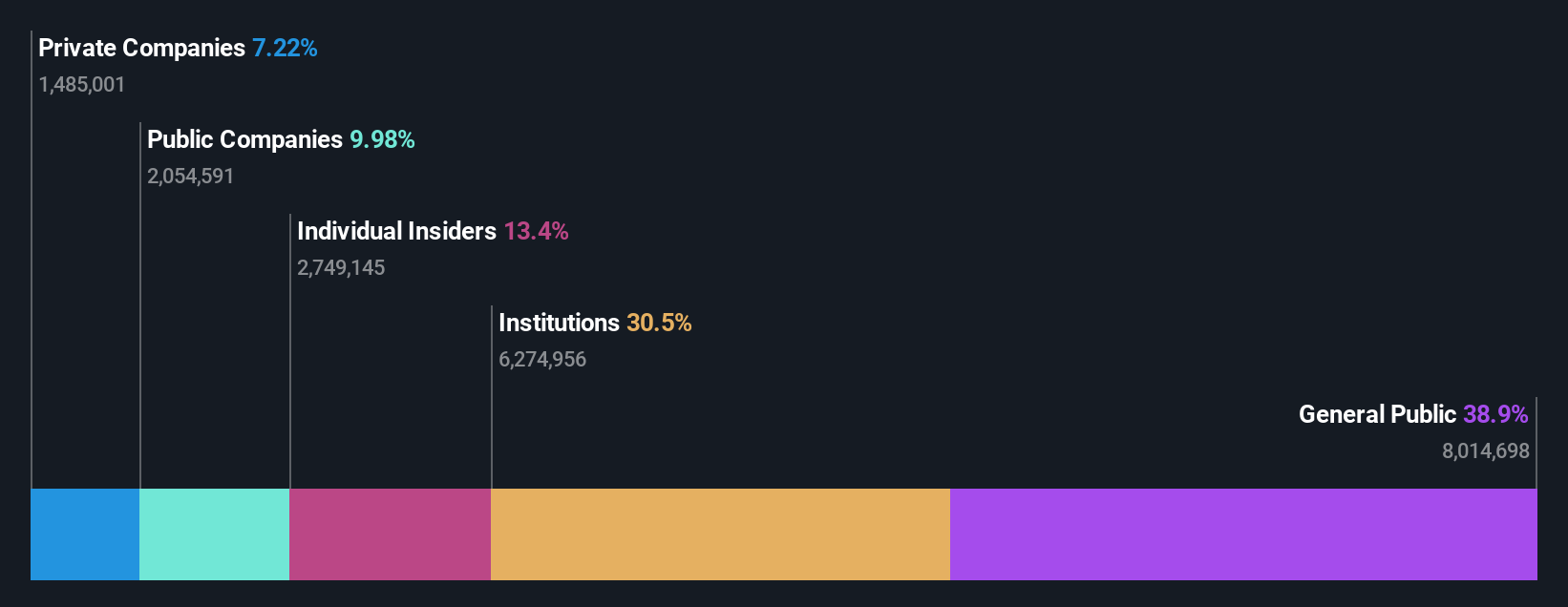

Insider Ownership: 10.4%

Earnings Growth Forecast: 24.4% p.a.

Zalando's earnings are projected to grow significantly at 24.4% annually, outpacing the German market average of 19.8%. Despite trading at a substantial discount to its estimated fair value, the company's revenue growth is modest at 5.5% per year. Recent executive changes include CFO Dr. Sandra Dembeck's upcoming departure in early 2025, which may influence strategic direction. The company reported strong earnings growth for Q2 2024 with net income rising to €95.7 million from €56.6 million a year ago.

- Click here to discover the nuances of Zalando with our detailed analytical future growth report.

- Our expertly prepared valuation report Zalando implies its share price may be too high.

Turning Ideas Into Actions

- Reveal the 22 hidden gems among our Fast Growing German Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Excellent balance sheet with reasonable growth potential.