- Germany

- /

- Personal Products

- /

- XTRA:BEI

Will Beiersdorf’s (XTRA:BEI) Leadership Shift and Sports Partnerships Reshape Its Global Brand Strategy?

Reviewed by Sasha Jovanovic

- Beiersdorf has appointed Burcu Andreae-Nehlsen as President Derma & Health Care with global oversight of key brands such as Eucerin and Aquaphor, and Real Madrid has extended its partnership with Nivea Men to strengthen brand presence in sports and global markets.

- These leadership and partnership moves illustrate Beiersdorf’s commitment to expanding its derma and health businesses, deepening North American reach, and leveraging high-profile collaborations to enhance international brand visibility and consumer engagement.

- We’ll examine how Burcu Andreae-Nehlsen’s appointment and the Real Madrid renewal could influence Beiersdorf’s longer-term growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Beiersdorf Investment Narrative Recap

To be a Beiersdorf shareholder, you need to believe in its ability to drive consistent growth by expanding derma and healthcare segments, successfully executing in Europe and North America, and reinvigorating global brands. The appointment of Burcu Andreae-Nehlsen to lead the Derma & Health Care business and the Real Madrid-Nivea Men partnership are positives for long-term positioning, but the most important short-term catalyst, a rebound in European sales volumes, remains largely unaffected. Persistent retailer pressure in Europe continues to be the biggest near-term risk.

Among recent announcements, Beiersdorf’s share buyback program, up to €500 million through 2025, stands out, providing support for the stock at a time of tepid revenue and net income performance. While this initiative can have short-term benefits for shareholder value, it does not address challenges tied to pricing negotiations or shelf space loss in Europe.

However, investors should also recognize that ongoing retailer pressure could limit sales growth if shelf presence continues to be impacted...

Read the full narrative on Beiersdorf (it's free!)

Beiersdorf's outlook projects €11.0 billion in revenue and €1.2 billion in earnings by 2028. This scenario depends on annual revenue growth of 3.8% and an earnings increase of €318 million from the current €882.0 million.

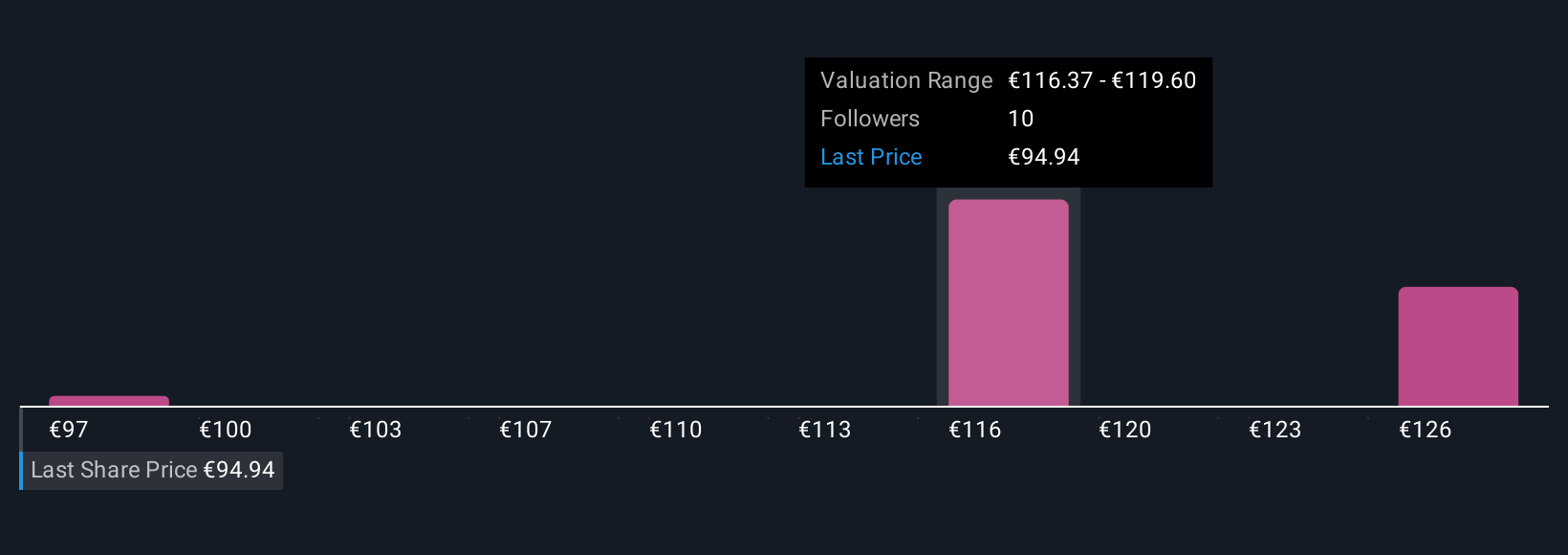

Uncover how Beiersdorf's forecasts yield a €120.53 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Two retail investors in the Simply Wall St Community valued Beiersdorf between €120.53 and €129.02. Many market participants see the potential rebound in European retail relationships as critical for driving returns, so exploring multiple outlooks is key.

Explore 2 other fair value estimates on Beiersdorf - why the stock might be worth just €120.53!

Build Your Own Beiersdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beiersdorf research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Beiersdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beiersdorf's overall financial health at a glance.

No Opportunity In Beiersdorf?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beiersdorf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BEI

Beiersdorf

Manufactures and distributes consumer goods in Europe, the United States, Africa, Asia, and Australia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives