- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

With A 25% Price Drop For Stratec SE (ETR:SBS) You'll Still Get What You Pay For

Stratec SE (ETR:SBS) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

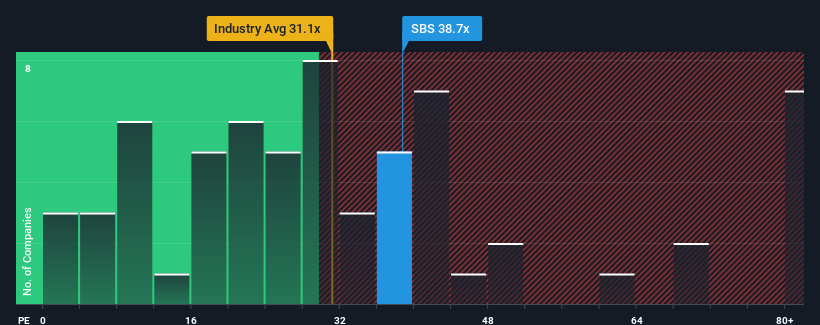

In spite of the heavy fall in price, Stratec's price-to-earnings (or "P/E") ratio of 38.7x might still make it look like a strong sell right now compared to the market in Germany, where around half of the companies have P/E ratios below 15x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Stratec hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Stratec

What Are Growth Metrics Telling Us About The High P/E?

Stratec's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 78% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 41% each year during the coming three years according to the six analysts following the company. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Stratec is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Stratec's P/E

Stratec's shares may have retreated, but its P/E is still flying high. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Stratec's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Stratec is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SBS

Stratec

Designs and manufactures automation and instrumentation solutions in the fields of in-vitro diagnostics and life sciences in Germany, the European Union, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives