- Germany

- /

- Healthcare Services

- /

- XTRA:ILM1

The Medios (ETR:ILM1) Share Price Is Up 128% And Shareholders Are Boasting About It

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the Medios AG (ETR:ILM1) share price is 128% higher than it was three years ago. How nice for those who held the stock! On top of that, the share price is up 35% in about a quarter.

View our latest analysis for Medios

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

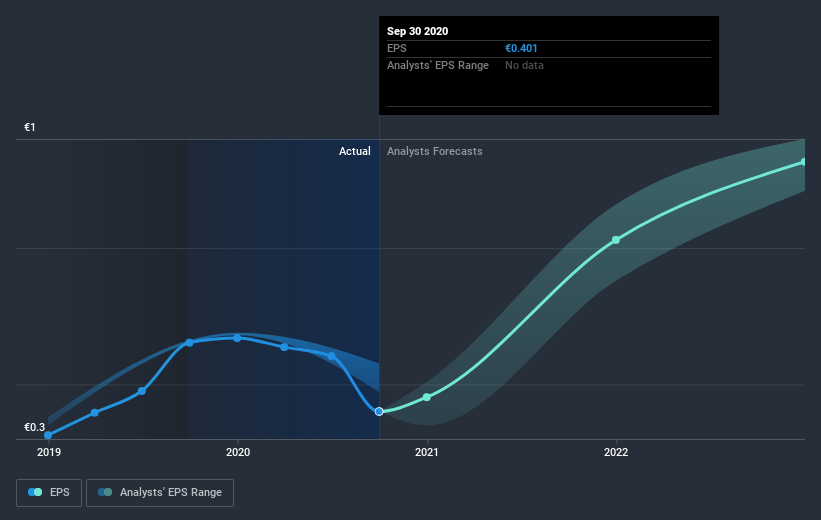

During three years of share price growth, Medios achieved compound earnings per share growth of 63% per year. This EPS growth is higher than the 32% average annual increase in the share price. So it seems investors have become more cautious about the company, over time. Of course, with a P/E ratio of 91.57, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Medios' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Medios' total shareholder return last year was 48%. That gain actually surpasses the 32% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Medios on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Medios .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade Medios, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:ILM1

Undervalued with excellent balance sheet.

Market Insights

Community Narratives