- Germany

- /

- Medical Equipment

- /

- XTRA:GME

The Market Lifts Geratherm Medical AG (ETR:GME) Shares 28% But It Can Do More

Geratherm Medical AG (ETR:GME) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

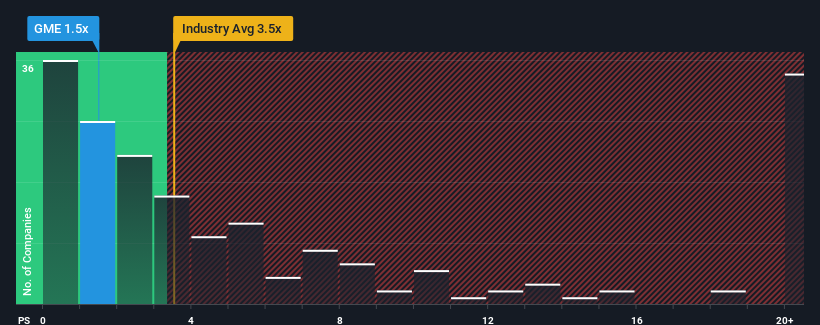

Even after such a large jump in price, given about half the companies operating in Germany's Medical Equipment industry have price-to-sales ratios (or "P/S") above 2.3x, you may still consider Geratherm Medical as an attractive investment with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Geratherm Medical

What Does Geratherm Medical's P/S Mean For Shareholders?

Geratherm Medical could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Geratherm Medical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Geratherm Medical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 30%. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 8.7% as estimated by the one analyst watching the company. With the industry predicted to deliver 7.1% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Geratherm Medical's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Geratherm Medical's P/S?

Geratherm Medical's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Geratherm Medical's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Geratherm Medical, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:GME

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives