- Sweden

- /

- Hospitality

- /

- OM:NREST

Undiscovered Gems in Europe to Explore This November 2025

Reviewed by Simply Wall St

As European markets face a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns about overvaluation in AI-related stocks, investors are increasingly looking towards small-cap companies for potential opportunities. In this environment, identifying stocks that combine solid fundamentals with growth potential can be particularly rewarding as they may offer resilience and upside in uncertain market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 6.17% | 5.42% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is engaged in the development, manufacturing, and assembly of components and systems for industrial clients across various countries including Sweden, Finland, and the USA, with a market capitalization of approximately SEK16.85 billion.

Operations: AQ Group generates revenue primarily from two segments: Component, contributing SEK8.12 billion, and System, accounting for SEK1.42 billion.

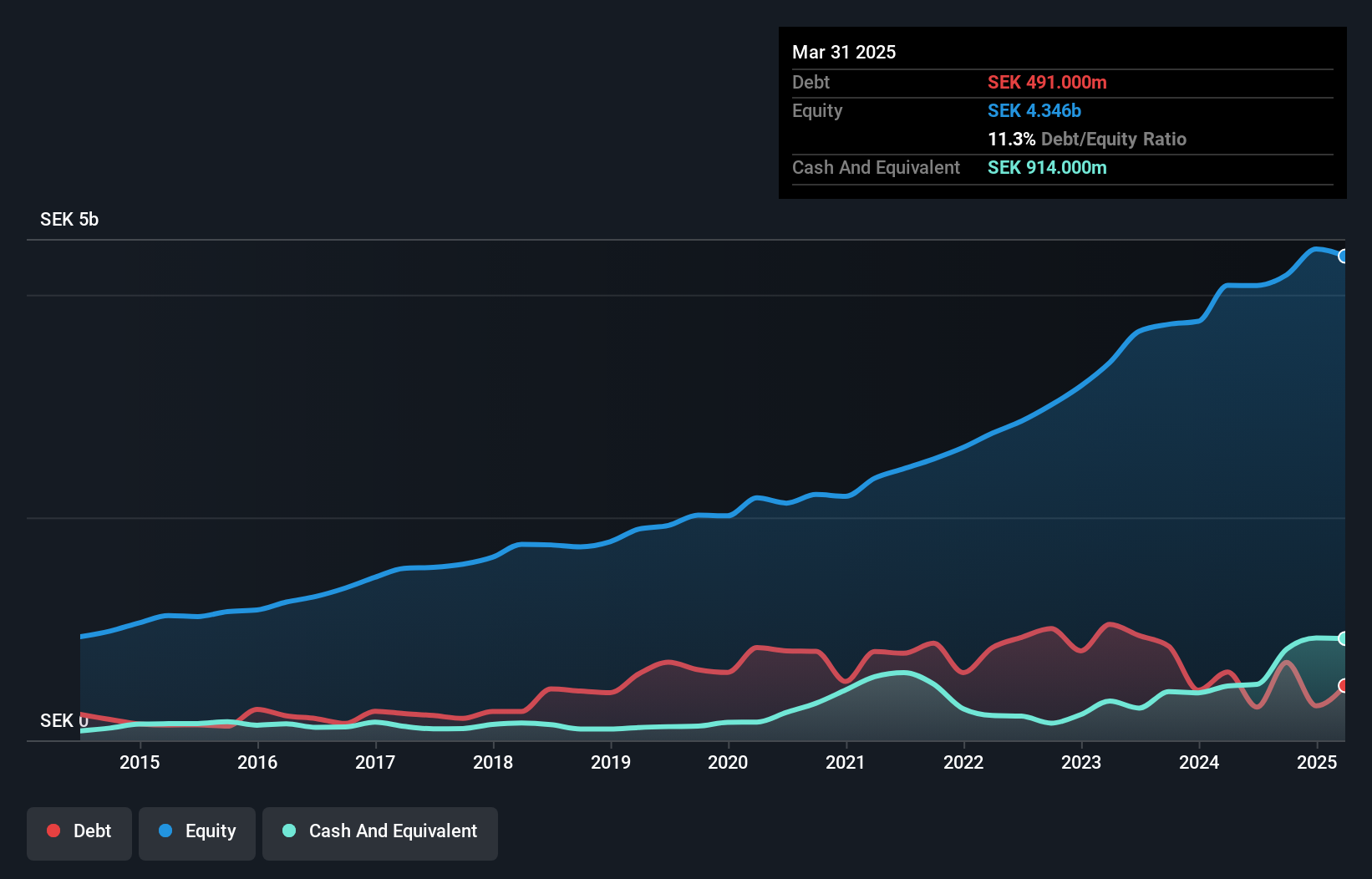

AQ Group's financial health is solid, with a debt-to-equity ratio dropping from 36.2% to 3.2% over five years and interest payments covered 119 times by EBIT. Recent earnings show a slight increase in net income to SEK 154 million for Q3, up from SEK 146 million the previous year, with revenue at SEK 2,141 million. Despite challenges like declining demand and integration risks, AQ Group's strategic focus on electrification and railway sectors could drive growth, supported by its plan to acquire multiple factories annually. The current share price of SEK 183 aligns closely with the target of SEK 190.

Nordrest Holding (OM:NREST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nordrest Holding AB (publ) is a foodservice company operating in Sweden and internationally, with a market capitalization of SEK3.03 billion.

Operations: Nordrest generates its revenue primarily from foodservice operations in Sweden and internationally. The company has a market capitalization of SEK3.03 billion.

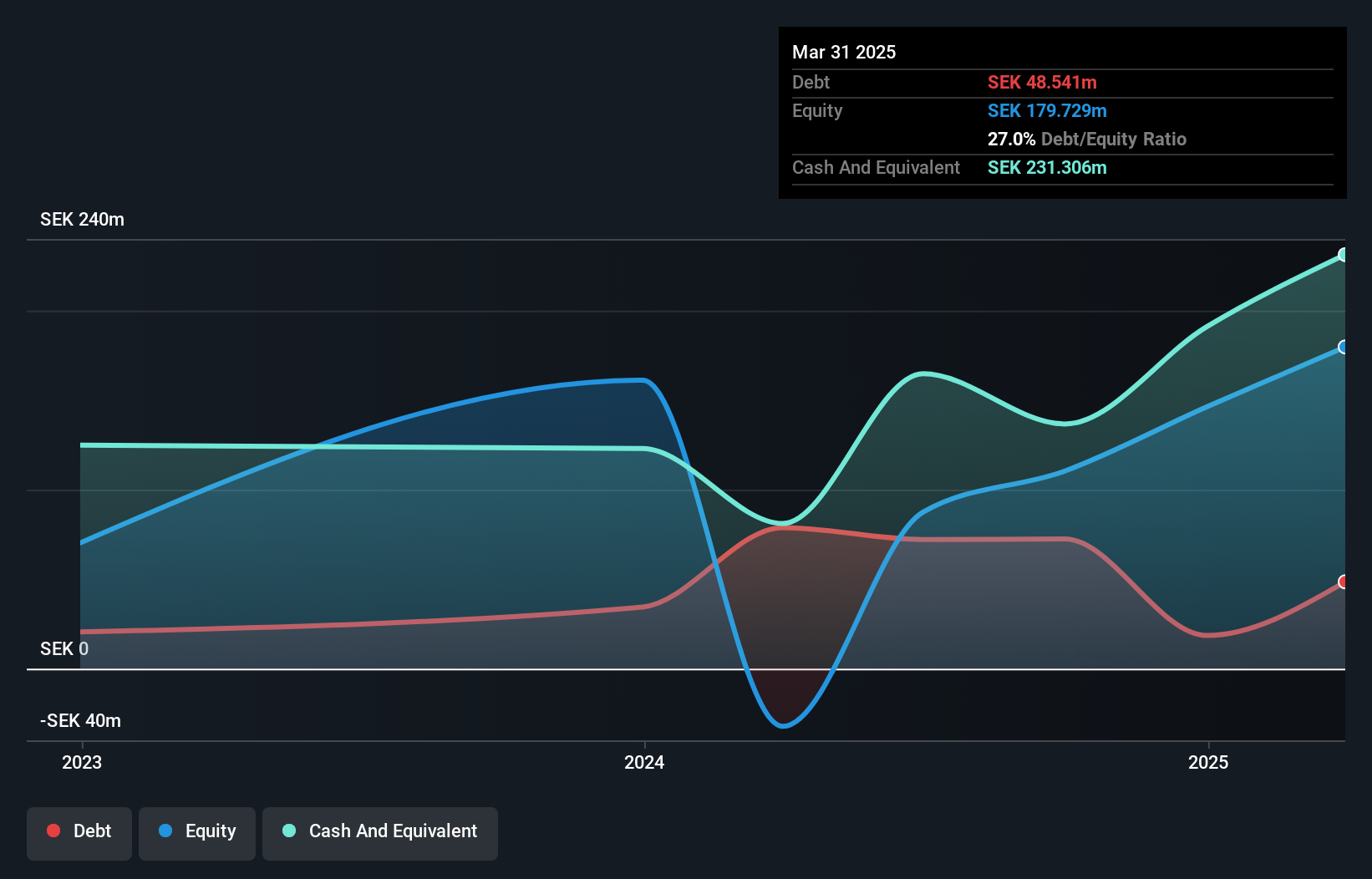

Nordrest Holding, a small company in the hospitality sector, has been making waves with its impressive financial performance. Over the past year, earnings grew by 25.9%, outpacing the industry growth of 21.3%. The firm reported third-quarter sales of SEK 578 million and net income of SEK 29 million, both up from last year’s figures. Trading at a significant discount to its estimated fair value by 62.7%, Nordrest seems undervalued given its robust earnings quality and strong cash position relative to debt levels. With EBIT covering interest payments over eleven times, financial stability appears solid for future growth prospects.

- Click to explore a detailed breakdown of our findings in Nordrest Holding's health report.

Assess Nordrest Holding's past performance with our detailed historical performance reports.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Eckert & Ziegler SE is a company that manufactures and sells isotope technology components globally, with a market capitalization of approximately €1.05 billion.

Operations: Eckert & Ziegler generates revenue primarily from its Medical segment (€159.33 million) and Isotopes Products segment (€150.29 million). The company experiences a negative impact from eliminations amounting to €10.39 million.

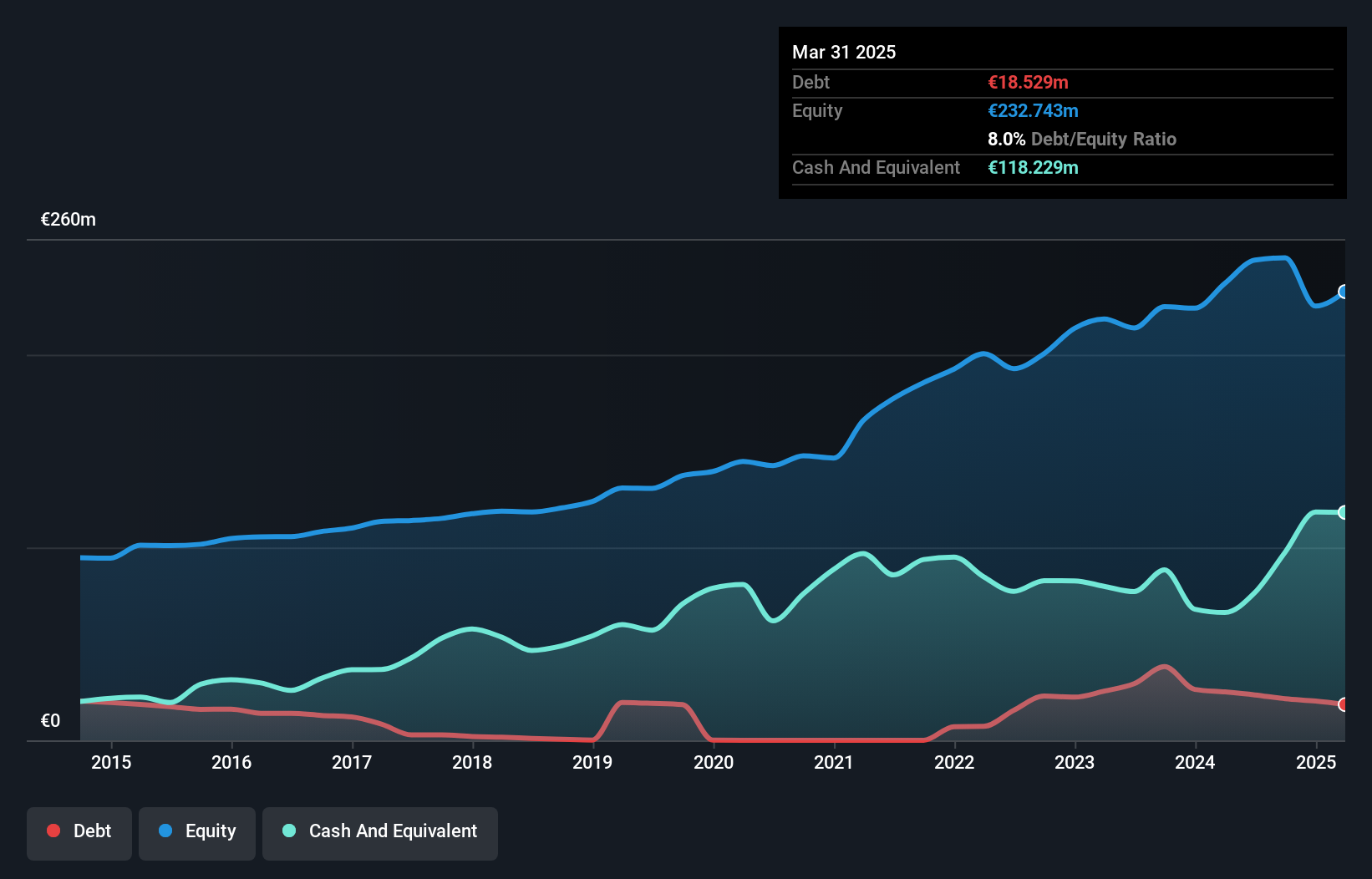

Eckert & Ziegler, a nimble player in the radiopharmaceuticals sector, is carving its niche with robust production capabilities and strategic alliances. The company enjoys high-quality earnings and has seen a 10.3% annual growth in earnings over the past five years. With interest payments covered 67 times by EBIT, financial health appears solid despite a rising debt-to-equity ratio of 7.4%. Trading at €16.75, it sits well below its estimated fair value, offering potential upside to the consensus price target of €21.67 amid expected revenue growth and expanding profit margins from 13.9% to 15.2%.

Key Takeaways

- Click through to start exploring the rest of the 322 European Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordrest Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NREST

Nordrest Holding

Operates as a foodservice company in Sweden and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives