Stock Analysis

- Germany

- /

- Auto Components

- /

- XTRA:PWO

Three German Dividend Stocks Offering Yields From 3.7% To 5.6%

Reviewed by Simply Wall St

As the German DAX index shows relative stability amidst a mixed performance in European markets, investors may find reassurance in the consistency of dividend stocks. In times when market volatility is evident and interest rate cuts are anticipated, dividend-yielding stocks can offer a semblance of predictability and income generation, making them an appealing option for those seeking to balance risk and reward in their investment portfolios.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.19% | ★★★★★★ |

| Edel SE KGaA (XTRA:EDL) | 6.70% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.82% | ★★★★★★ |

| Südzucker (XTRA:SZU) | 6.46% | ★★★★★☆ |

| MLP (XTRA:MLP) | 4.67% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.50% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 5.92% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.96% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.04% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

MVV Energie (XTRA:MVV1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MVV Energie AG operates mainly in Germany, offering services including electricity, heat, gas, water, and waste treatment and disposal with a market capitalization of approximately €2.03 billion.

Operations: MVV Energie AG generates revenue primarily through its Customer Solutions segment (€7.54 billion), followed by Generation and Infrastructure (€1.75 billion), and New Energies (€0.96 billion).

Dividend Yield: 3.7%

MVV Energie AG's recent earnings show a decline with Q2 sales at €1.99 billion and net income at €69.37 million, significantly lower than the previous year. Despite this, the company maintains a stable dividend history over the past decade, although its current yield of 3.73% is below the top German dividend payers' average. Notably, dividends are not well supported by free cash flow or earnings, with a payout ratio of 30.5%, indicating potential sustainability issues if financial performance doesn't improve.

- Unlock comprehensive insights into our analysis of MVV Energie stock in this dividend report.

- According our valuation report, there's an indication that MVV Energie's share price might be on the cheaper side.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG specializes in producing lightweight construction components from aluminum and steel for the mobility industry, operating across Germany, Czechia, Canada, Mexico, Serbia, and China with a market capitalization of €97.50 million.

Operations: PWO AG generates €562.18 million from its auto parts and accessories segment.

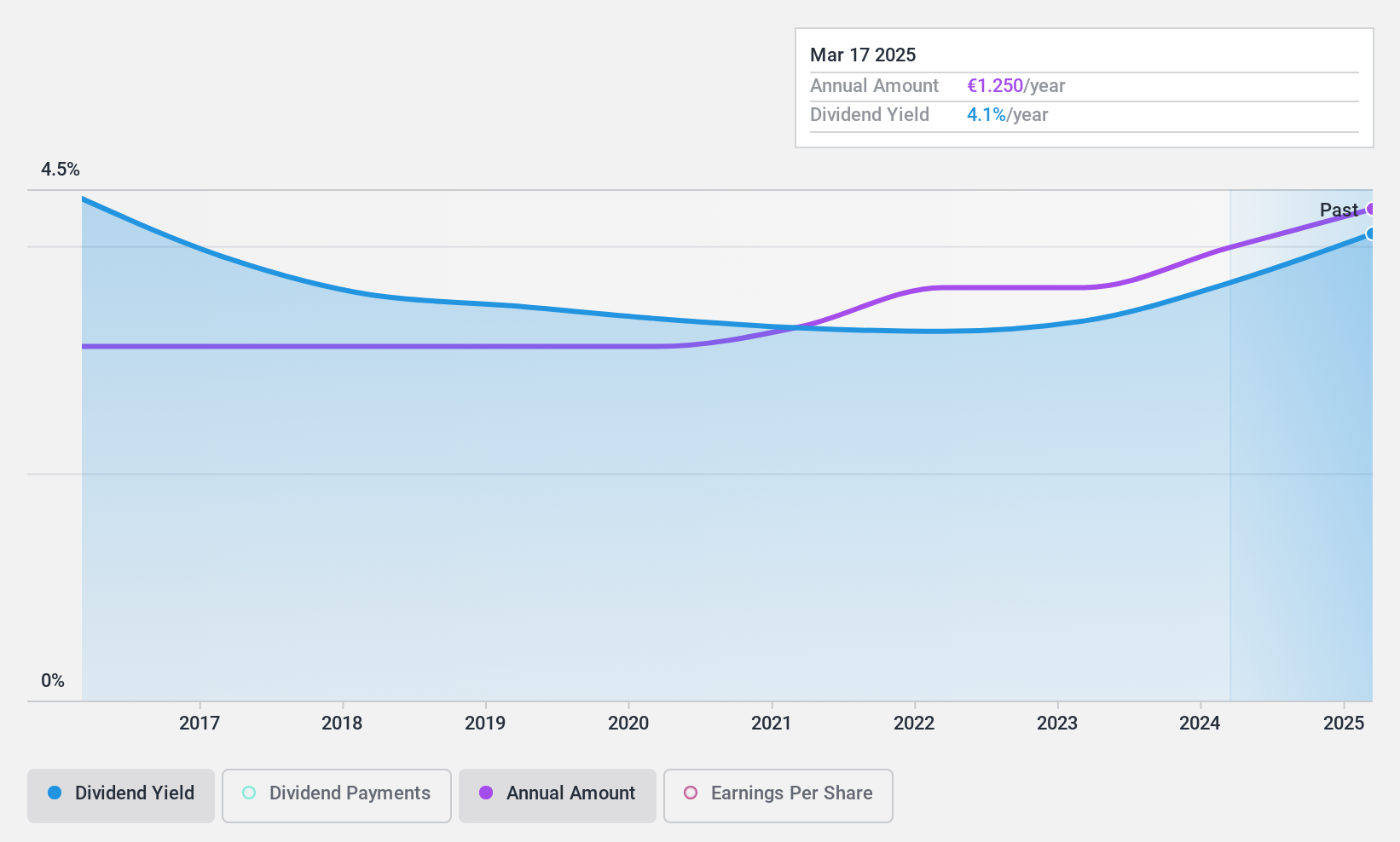

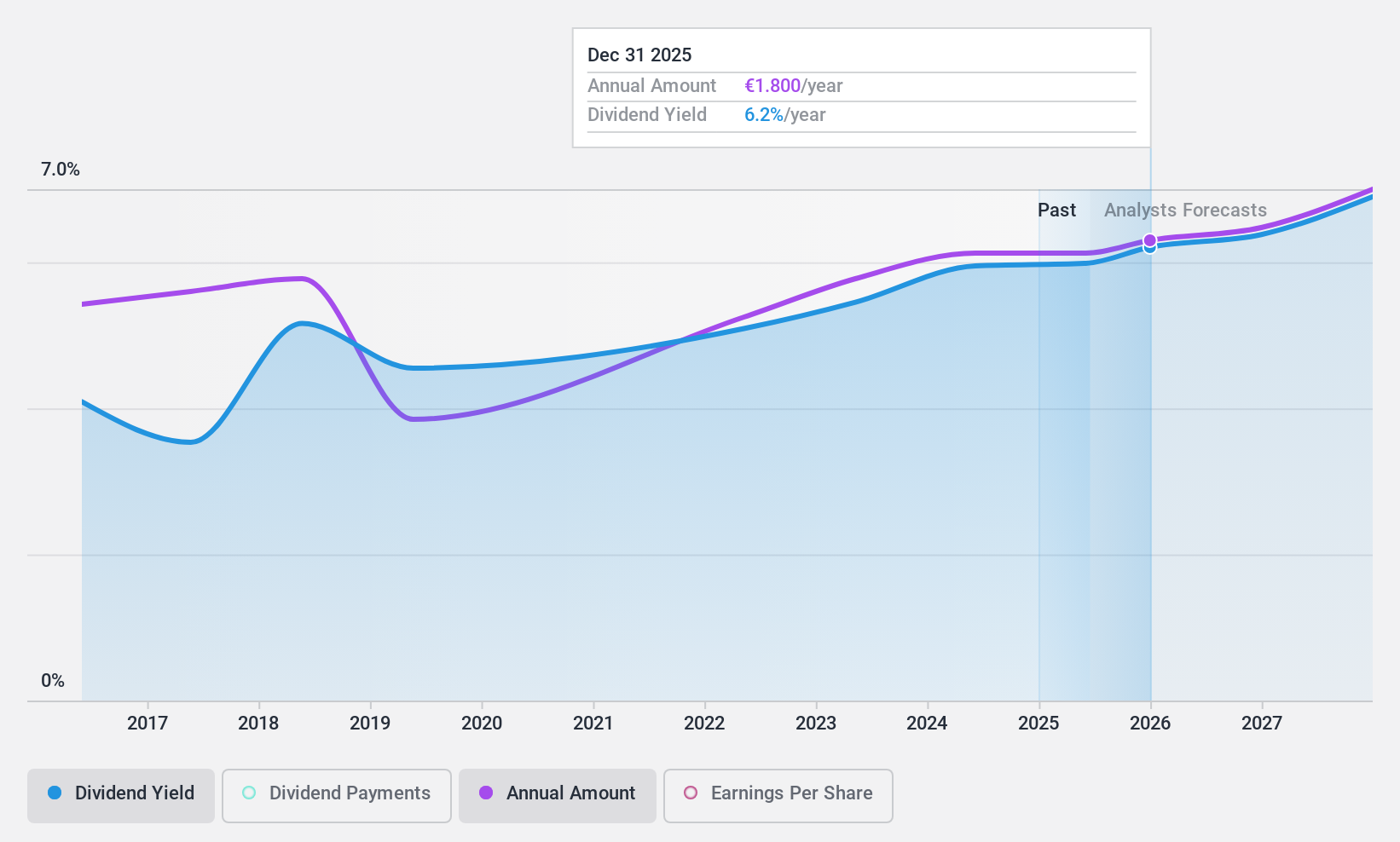

Dividend Yield: 5.6%

PWO AG, a German company, reported an increase in annual sales to €556.31 million and net income to €16.22 million for 2023, with earnings per share rising to €5.19. Despite its top-tier dividend yield of 5.61%, PWO's dividend history has been marked by instability over the past decade, with payments experiencing significant fluctuations. However, dividends are currently well-covered by both earnings and cash flow, with payout ratios of 33.3% and 23% respectively, suggesting improved sustainability in the near term.

- Click here to discover the nuances of PWO with our detailed analytical dividend report.

- The analysis detailed in our PWO valuation report hints at an deflated share price compared to its estimated value.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is a company that produces and distributes sparkling and semi-sparkling wines across Europe and internationally, with a market capitalization of approximately €123.55 million.

Operations: Schloss Wachenheim AG generates €441.16 million in revenue from its alcoholic beverages segment.

Dividend Yield: 3.8%

Schloss Wachenheim AG's recent financial performance shows a downturn, with sales up slightly to €337.91 million but net income falling to €6.15 million over nine months. Its dividend yield of 3.85% trails behind the top German dividend payers, and both earnings and cash flows currently do not cover its dividend payments, evidenced by a high cash payout ratio of 113.1%. Despite this, the company has maintained stable dividends for the past decade and is seen as undervalued by analysts, suggesting potential price increases ahead.

- Click here and access our complete dividend analysis report to understand the dynamics of Schloss Wachenheim.

- Upon reviewing our latest valuation report, Schloss Wachenheim's share price might be too pessimistic.

Where To Now?

- Explore the 30 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether PWO is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PWO

PWO

Engages in the manufacture and sale of light weight construction aluminum sheet components made of steel for mobility industry in Germany, Czechia, Canada, Mexico, Serbia, and China.

Excellent balance sheet, good value and pays a dividend.