As global markets react to China's robust stimulus measures, Germany's DAX index has notably surged by 4.03%, reflecting a positive sentiment across European equities. Despite mixed signals in business activity and consumer confidence, the German market remains a focal point for investors seeking stability through dividend-paying stocks. In this environment, identifying strong dividend stocks becomes crucial as they offer potential income and resilience amidst economic fluctuations.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.26% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.17% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.52% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.70% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.22% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.35% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.20% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.66% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

MVV Energie (XTRA:MVV1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MVV Energie AG, with a market cap of €2.07 billion, operates in Germany providing electricity, heat, gas, water, and waste treatment and disposal products through its subsidiaries.

Operations: MVV Energie AG generates revenue through its primary segments of electricity, heat, gas, water, and waste treatment and disposal products.

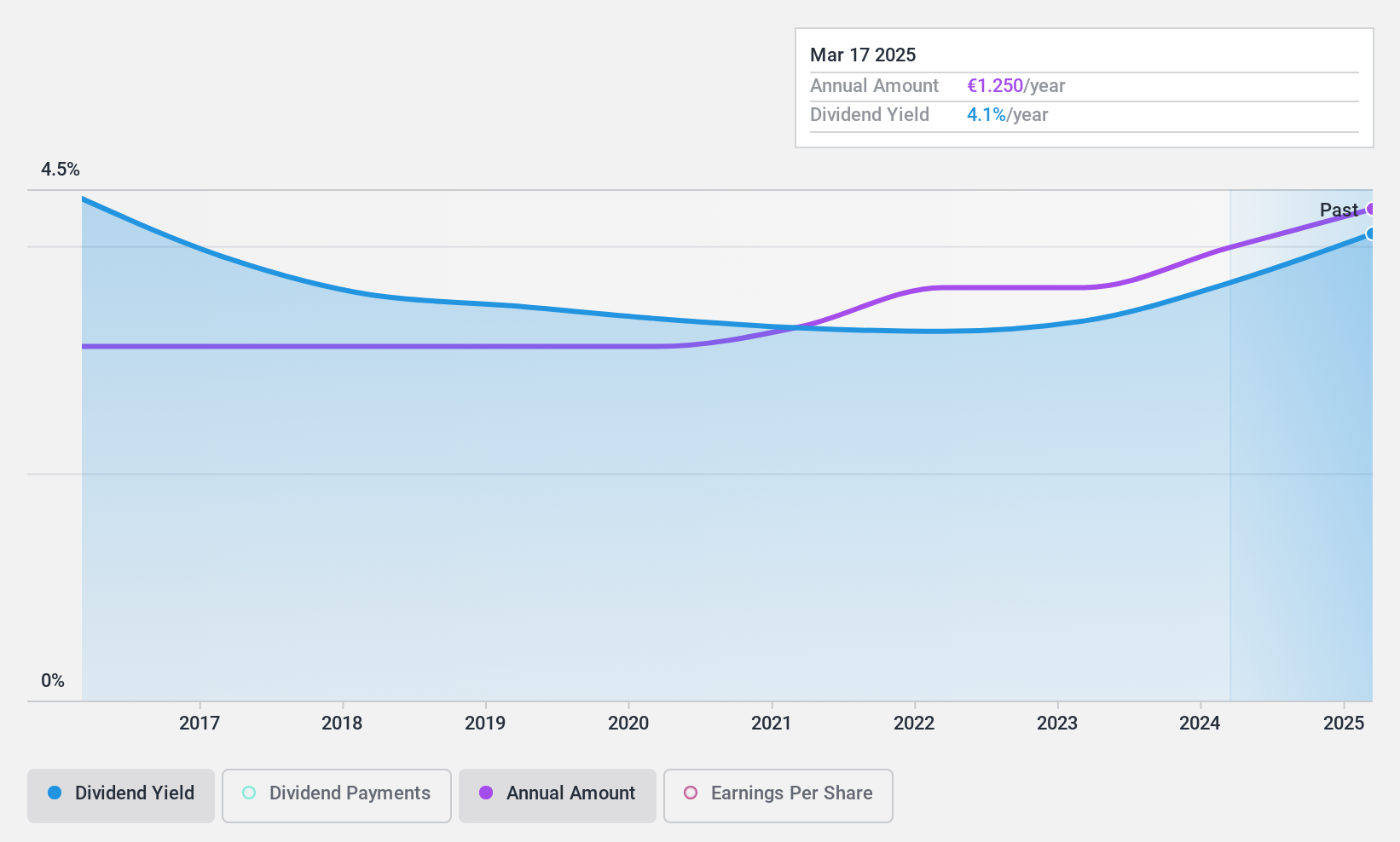

Dividend Yield: 3.7%

MVV Energie AG's recent earnings report showed a decline in net income and profit margins, with third-quarter net income falling to €24.79 million from €112.64 million a year ago. Despite this, the company maintains a reasonably low payout ratio of 47.1%, ensuring dividends are well-covered by earnings and cash flows (59.9%). MVV Energie has consistently paid stable dividends over the past decade and offers a reliable yield of 3.66%, though it's lower than top-tier German dividend payers.

- Unlock comprehensive insights into our analysis of MVV Energie stock in this dividend report.

- Upon reviewing our latest valuation report, MVV Energie's share price might be too optimistic.

K+S (XTRA:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: K+S Aktiengesellschaft, with a market cap of €2.06 billion, operates as a global supplier of mineral products for the agricultural, industrial, consumer, and community sectors.

Operations: K+S Aktiengesellschaft generates €3.72 billion in revenue from its Operating Unit Europe+.

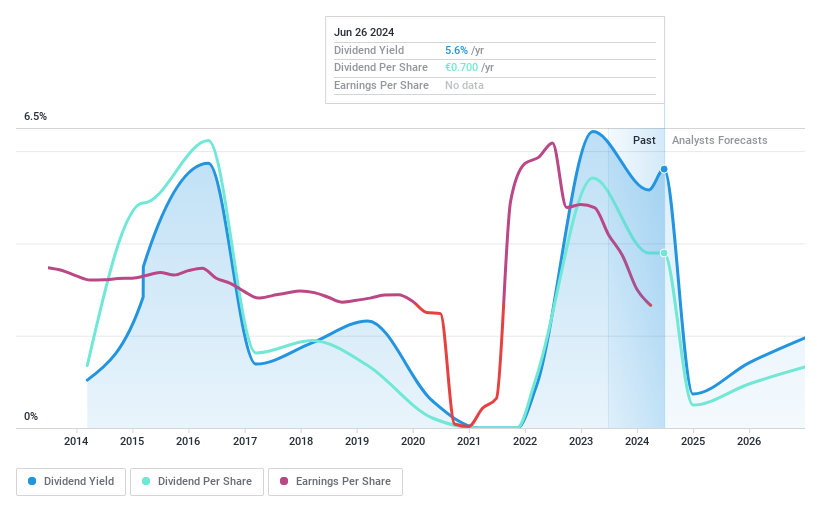

Dividend Yield: 6.1%

K+S Aktiengesellschaft's dividend yield of 6.09% is among the top 25% in the German market, but its high payout ratio (2952.2%) indicates dividends are not well covered by earnings, though they are covered by cash flows (82.2%). The company's dividend payments have been volatile and unreliable over the past decade. Recent financial results show a net loss of €6.1 million for Q2 2024, despite an increase in sales to €873.8 million from €825.8 million a year ago.

- Click to explore a detailed breakdown of our findings in K+S' dividend report.

- Upon reviewing our latest valuation report, K+S' share price might be too pessimistic.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG produces and distributes sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €125.14 million.

Operations: Schloss Wachenheim AG generates €441.51 million from its alcoholic beverages segment.

Dividend Yield: 3.8%

Schloss Wachenheim's dividend payments are covered by earnings with a payout ratio of 50.2%, and the dividends have been stable and growing over the past decade. However, the current dividend yield of 3.8% is lower than the top 25% of German dividend payers and is not well covered by free cash flows. Recent earnings results show sales increased to €441.51 million, but net income dropped to €9.47 million, impacting basic earnings per share from €1.38 to €1.2 year-over-year.

- Get an in-depth perspective on Schloss Wachenheim's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Schloss Wachenheim shares in the market.

Key Takeaways

- Reveal the 33 hidden gems among our Top German Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K+S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SDF

K+S

Operates as a supplier of mineral products for the agricultural, industrial, consumer, and community sectors worldwide.

Flawless balance sheet average dividend payer.