The Bull Case For KWS SAAT SE KGaA (XTRA:KWS) Could Change Following Divestment-Driven EBITDA Improvement

Reviewed by Sasha Jovanovic

- KWS SAAT SE & Co. KGaA recently reported its first quarter 2025/2026 results, with revenue of €228.2 million and a net loss of €9.8 million, alongside confirming its outlook for the fiscal year.

- The strong performance in the winter crop seed segment, particularly oilseed rape, and a positive impact from the North American corn business sale were key contributors to improved EBITDA despite softer sugarbeet sales.

- Given the positive EBITDA effect from the divestment, we will explore how this development could influence KWS's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

KWS SAAT SE KGaA Investment Narrative Recap

To be a shareholder in KWS SAAT SE & Co. KGaA, you need to believe in its ability to deliver steady growth by focusing on high-margin segments, sustainable innovations and optimizing its portfolio. The recent Q1 results saw a notable improvement in net loss due to the one-off gain from the North American corn business sale, though core revenue slipped. This divestment is significant, but ongoing pressures in other segments suggest that short-term catalysts and risks remain largely unchanged.

A particularly relevant announcement to this quarter’s update is KWS’s expectation of roughly 3% organic net sales growth for the 2025/2026 fiscal year. While this signals confidence in underlying business fundamentals despite a muted agricultural market environment, performance across key segments like cereals and vegetables will be critical to meeting these targets and driving further upside.

By contrast, investors should be aware that the sugarbeet segment’s future revenue stability may face challenges if sugar prices remain volatile or if acreage is reduced...

Read the full narrative on KWS SAAT SE KGaA (it's free!)

KWS SAAT SE KGaA's outlook suggests €1.8 billion in revenue and €209.9 million in earnings by 2028. This scenario assumes annual revenue growth of 3.5% and a €51.6 million earnings increase from the current €158.3 million.

Uncover how KWS SAAT SE KGaA's forecasts yield a €79.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

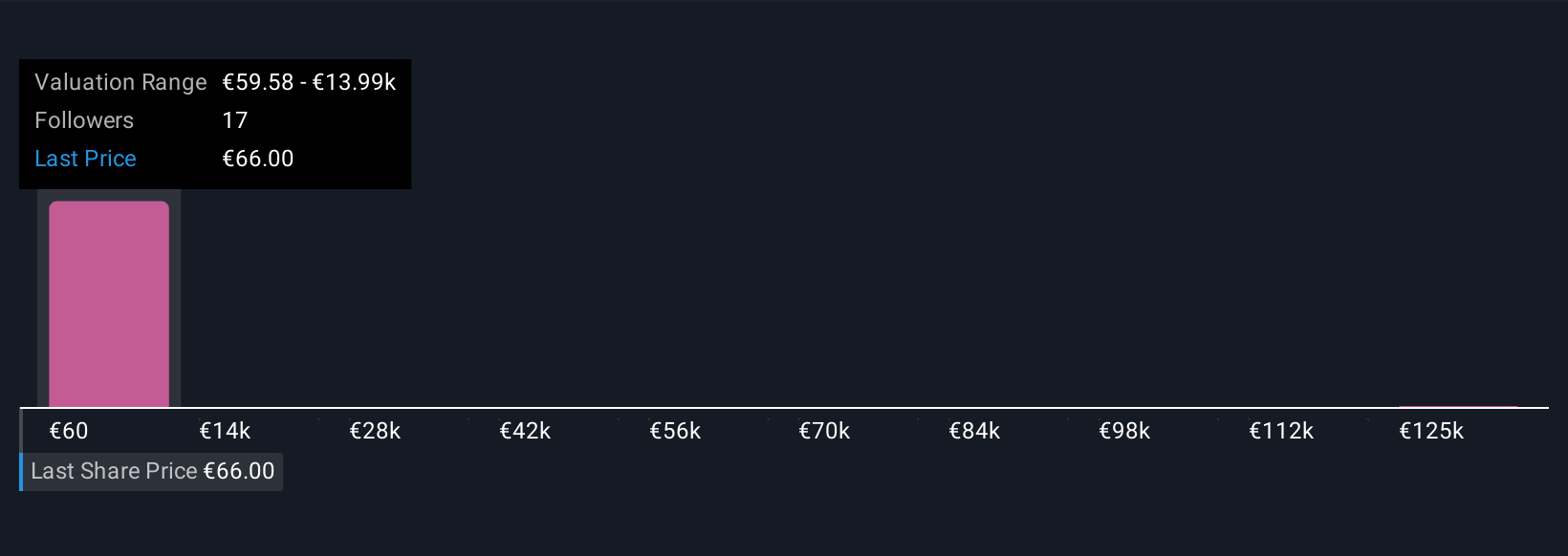

Fair value estimates from the Simply Wall St Community range from €59.58 to an outlier of €139,362.81 based on four individual analyses. Looking ahead, expansion in sustainable products and the impact of recent divestments highlight why opinions can vary so widely, take this as your cue to explore several viewpoints.

Explore 4 other fair value estimates on KWS SAAT SE KGaA - why the stock might be worth 9% less than the current price!

Build Your Own KWS SAAT SE KGaA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KWS SAAT SE KGaA research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free KWS SAAT SE KGaA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KWS SAAT SE KGaA's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KWS SAAT SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KWS

KWS SAAT SE KGaA

KWS SAAT SE & Co. KGaA breeds, produces, and distributes seeds for agriculture.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives