- Germany

- /

- Specialty Stores

- /

- XTRA:ZAL

Top German Growth Stocks With High Insider Ownership In August 2024

Reviewed by Simply Wall St

As the German DAX index climbs 3.38% amid hopes for interest rate cuts, investors are increasingly looking toward growth companies with high insider ownership as potential opportunities. In this favorable market environment, stocks with substantial insider stakes can be particularly appealing due to the alignment of interests between company management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| Stemmer Imaging (XTRA:S9I) | 26.1% | 23.2% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.4% | 63.5% |

| Exasol (XTRA:EXL) | 25.3% | 124.6% |

| NAGA Group (XTRA:N4G) | 14.1% | 78.3% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 50.1% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 23.3% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

Here's a peek at a few of the choices from the screener.

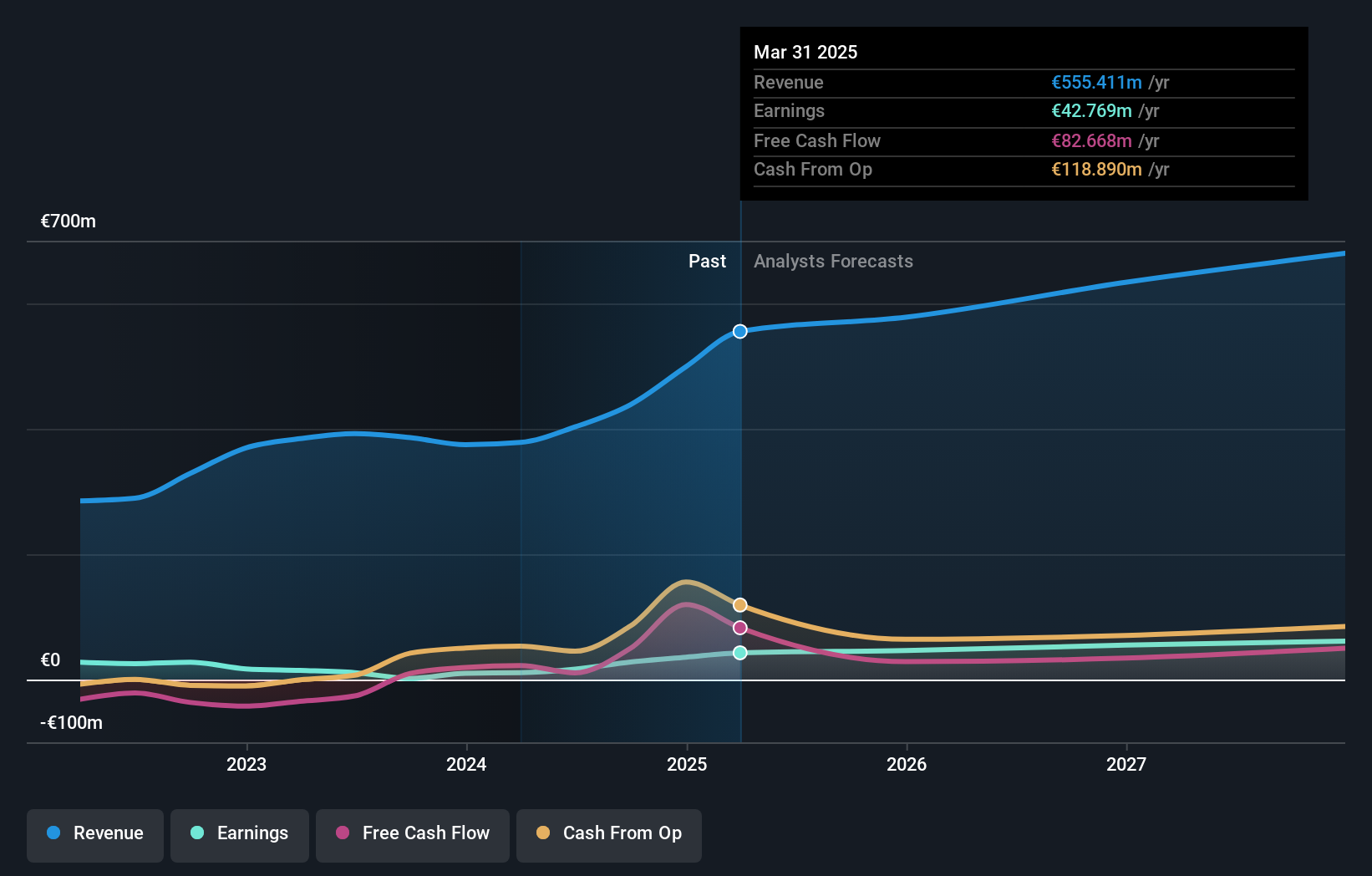

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €509.69 million.

Operations: Revenue segments are comprised of €51.53 million from Demand Side Platforms (DSP) and €318.35 million from Supply Side Platforms (SSP).

Insider Ownership: 25.1%

Earnings Growth Forecast: 20.5% p.a.

Verve Group SE, with strong insider ownership and significant recent developments, has raised its 2024 earnings guidance to €400 million - €420 million. The company recently appointed Alex Stil as Chief Commercial Officer to enhance its demand-side business and streamline product offerings. Verve's profitability is expected to grow significantly at 20.52% annually, outpacing the German market. Despite high volatility in share price and past shareholder dilution, it trades at good value compared to peers.

- Get an in-depth perspective on Verve Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates Verve Group may be undervalued.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE offers solutions for energy transformation and transportation in Germany and Europe, with a market cap of €422 million.

Operations: The company's revenue segments include €100 million from Energy Networks, €200 million from Gas Networks, and €300 million from Technical Services.

Insider Ownership: 18%

Earnings Growth Forecast: 23.3% p.a.

Friedrich Vorwerk Group SE, marked by high insider ownership, has shown robust growth with earnings rising 48.6% over the past year and a forecasted annual profit growth of 23.28%. Recent Q2 results reported sales of €117.41 million and net income of €7.96 million, both significantly higher than the previous year. Despite slower revenue growth at 7.6% annually compared to market expectations, its profitability trajectory remains strong against the German market backdrop.

- Delve into the full analysis future growth report here for a deeper understanding of Friedrich Vorwerk Group.

- Upon reviewing our latest valuation report, Friedrich Vorwerk Group's share price might be too optimistic.

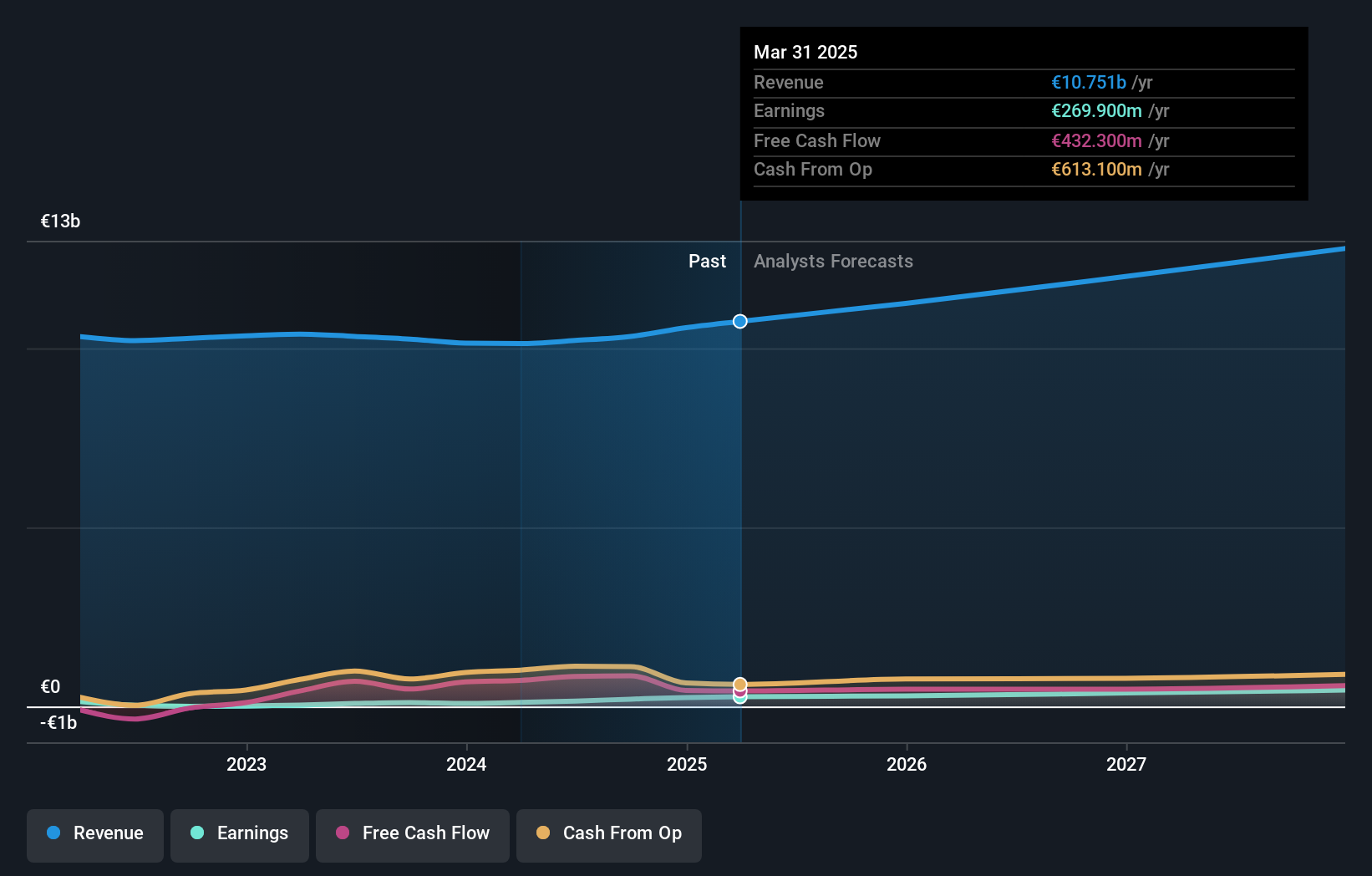

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products and has a market cap of approximately €5.96 billion.

Operations: Zalando SE generates revenue primarily from its online platform for fashion and lifestyle products, with segment adjustments amounting to €10.49 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 24.6% p.a.

Zalando SE, with high insider ownership, reported Q2 2024 sales of €2.64 billion and net income of €95.7 million, both up from the previous year. Earnings grew 84.3% over the past year and are forecasted to grow at 24.6% annually, outpacing the German market's 20%. Despite slower revenue growth at 5.6% per year compared to market expectations, Zalando trades significantly below its estimated fair value and shows a promising profitability trajectory.

- Navigate through the intricacies of Zalando with our comprehensive analyst estimates report here.

- The analysis detailed in our Zalando valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Delve into our full catalog of 22 Fast Growing German Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zalando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ZAL

Excellent balance sheet with reasonable growth potential.