- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

3 Top German Growth Stocks With Insider Ownership Up To 30%

Reviewed by Simply Wall St

As global markets grapple with volatility and mixed economic signals, Germany's DAX has shown resilience with a modest gain. In this uncertain environment, identifying growth stocks with substantial insider ownership can provide investors with confidence that company leaders are committed to long-term success.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| Stemmer Imaging (XTRA:S9I) | 26.1% | 23.2% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.4% | 63.5% |

| Exasol (XTRA:EXL) | 25.3% | 115.1% |

| NAGA Group (XTRA:N4G) | 14.1% | 78.3% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 20.3% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 50.1% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

Here we highlight a subset of our preferred stocks from the screener.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €515.28 million.

Operations: Verve Group SE generates revenue from two primary segments: Demand Side Platforms (DSP) at €51.53 million and Supply Side Platforms (SSP) at €318.35 million.

Insider Ownership: 25.1%

Verve Group SE, with high insider ownership and recent substantial insider buying, is positioned for significant growth. The company raised its 2024 revenue guidance to €400 million - €420 million and expects earnings to grow at 20.5% annually, outpacing the German market. Despite a volatile share price and past shareholder dilution, Verve's acquisition of Jun Group and new leadership under Alex Stil enhance its market presence. Recent bond refinancing also reduces financing costs by €10 million annually.

- Click here to discover the nuances of Verve Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Verve Group's current price could be quite moderate.

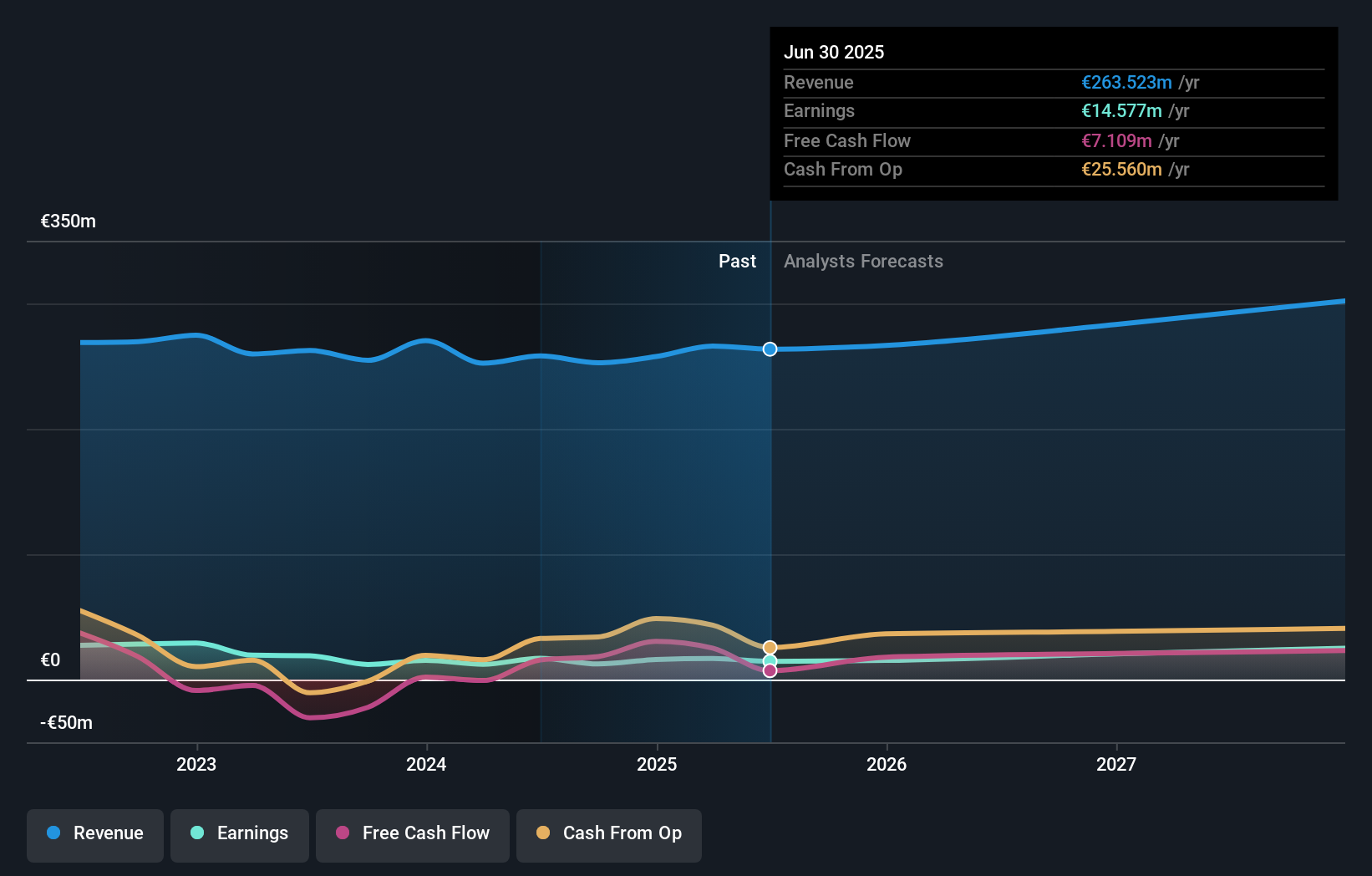

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE, with a market cap of €525.74 million, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences across Germany, the European Union, and internationally.

Operations: Stratec's revenue segments include automation and instrumentation solutions for in-vitro diagnostics and life sciences, serving markets in Germany, the European Union, and globally.

Insider Ownership: 30.9%

Stratec SE, with notable insider ownership, reported Q2 2024 sales of €68.21 million and net income of €3.48 million, both up from the previous year. Despite a slight decline in H1 sales to €119.08 million, net income rose to €3.92 million. Forecasts suggest annual revenue growth of 7.9% and earnings growth of 20.32%, outpacing the German market's average earnings growth rate but with a low return on equity forecast at 10.8%.

- Unlock comprehensive insights into our analysis of Stratec stock in this growth report.

- According our valuation report, there's an indication that Stratec's share price might be on the expensive side.

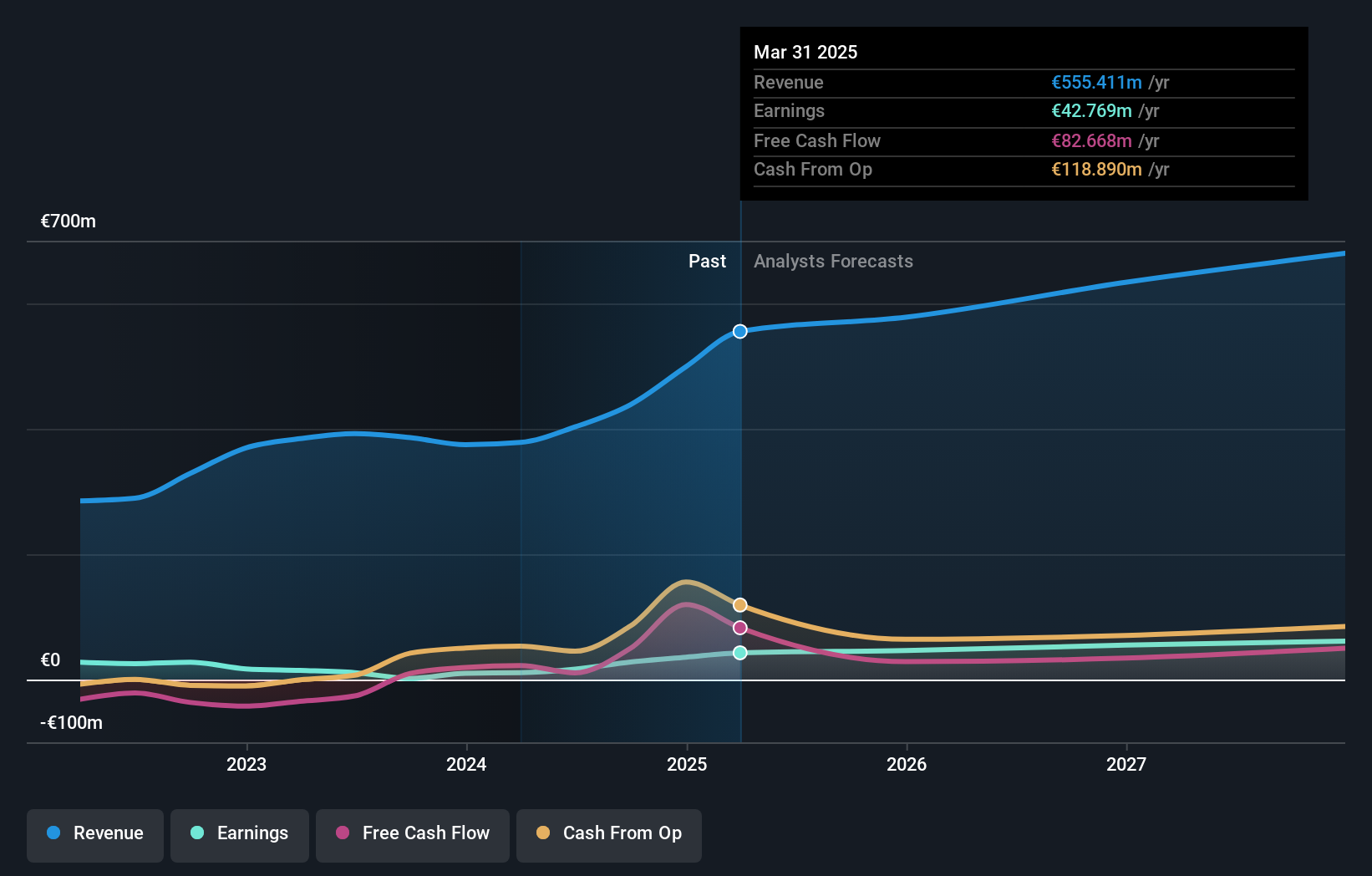

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE offers diverse solutions for energy transformation and transportation across Germany and Europe, with a market cap of €426 million.

Operations: The company's revenue segments include €72.07 million from Electricity, €157.60 million from Natural Gas, €28.59 million from Clean Hydrogen, and €118.73 million from Adjacent Opportunities.

Insider Ownership: 18%

Friedrich Vorwerk Group, with significant insider ownership, is forecasted to achieve annual revenue growth of 9%, outpacing the German market's 5.3% but below the 20% high-growth threshold. Earnings are expected to grow significantly at 31.64% annually, surpassing the market average of 19.7%. Despite robust earnings projections, return on equity is anticipated to be relatively low at 11.5% in three years. Recent H1 2024 earnings call highlighted continued positive financial performance trends.

- Click here and access our complete growth analysis report to understand the dynamics of Friedrich Vorwerk Group.

- Our expertly prepared valuation report Friedrich Vorwerk Group implies its share price may be too high.

Key Takeaways

- Unlock our comprehensive list of 20 Fast Growing German Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SBS

Stratec

Designs and manufactures automation and instrumentation solutions in the fields of in-vitro diagnostics and life sciences in Germany, European Union, and internationally.

Flawless balance sheet with reasonable growth potential.