- Germany

- /

- Oil and Gas

- /

- XTRA:VBK

Verbio SE (ETR:VBK) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Verbio SE (ETR:VBK) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

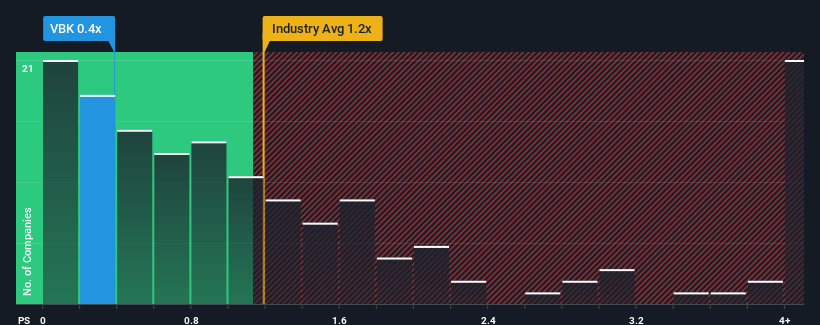

Following the heavy fall in price, Verbio's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Oil and Gas industry in Germany, where around half of the companies have P/S ratios above 1.3x and even P/S above 235x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Verbio

What Does Verbio's P/S Mean For Shareholders?

Verbio has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Verbio will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Verbio would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. Still, the latest three year period has seen an excellent 37% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 9.0% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 0.3% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Verbio's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Verbio's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Verbio's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Verbio you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VBK

Verbio

Engages in the production and distribution of fuels and finished products in Germany, Europe, North America, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives