- Switzerland

- /

- Building

- /

- SWX:MTG

Undiscovered European Gems To Explore This November 2025

Reviewed by Simply Wall St

As European markets grapple with concerns over artificial intelligence-related stock valuations and a dip in major indexes, investors are keenly observing the evolving landscape for opportunities. In this environment, identifying promising stocks involves focusing on companies that demonstrate resilience and adaptability amid broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Deutsche Balaton (HMSE:BBHK)

Simply Wall St Value Rating: ★★★★★☆

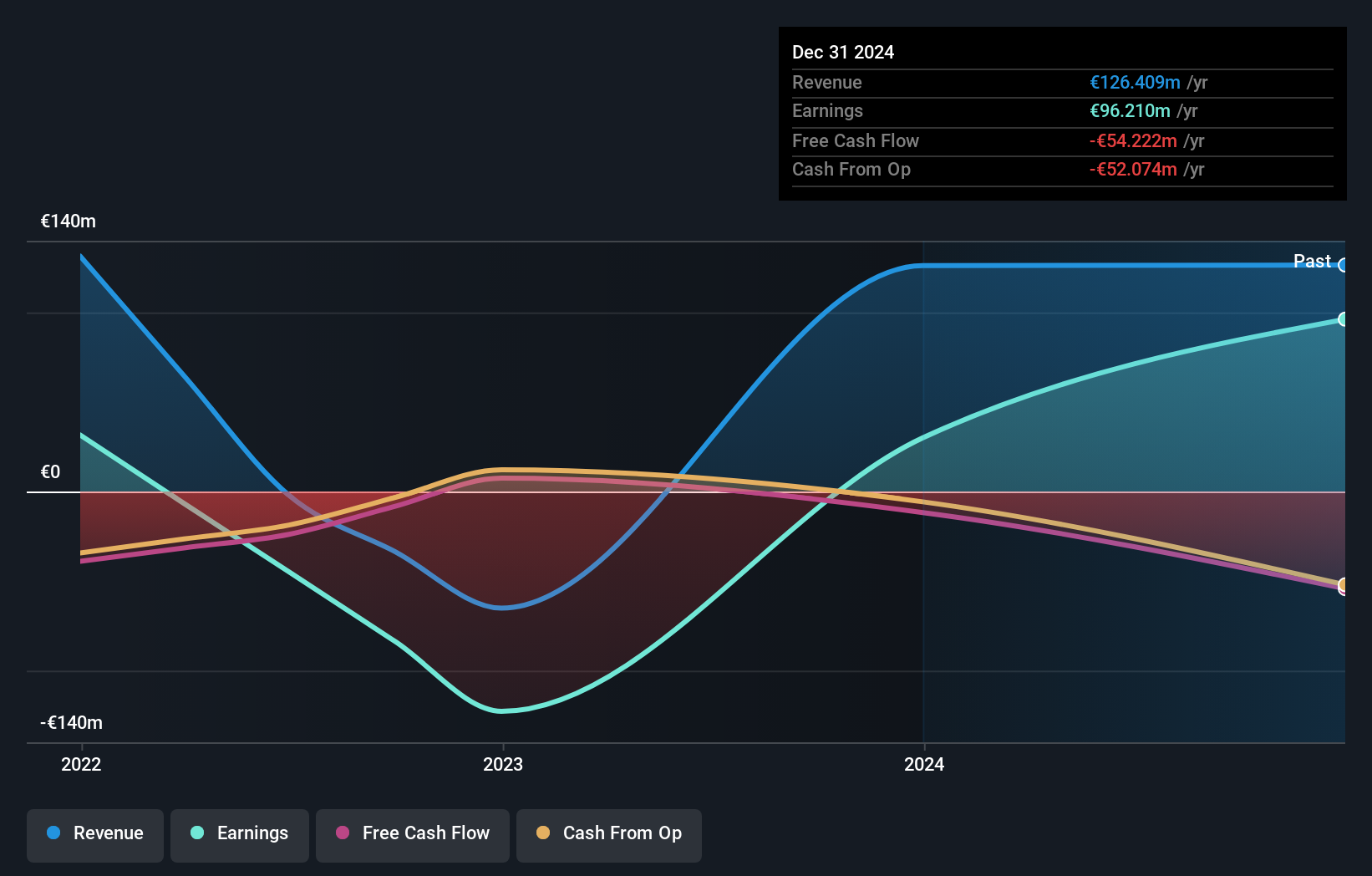

Overview: Deutsche Balaton AG is a private equity firm specializing in investments in both listed and unlisted companies, real estate, and other assets, with a market capitalization of approximately €229.72 million.

Operations: Deutsche Balaton AG generates revenue primarily through its Beta Systems segment, contributing €80.55 million, and its Asset Management segment, adding €45.86 million. The company has a market capitalization of approximately €229.72 million.

Deutsche Balaton, a small player in the European market, stands out with its impressive earnings growth of 221.2% over the past year, surpassing the Capital Markets industry average of 27.5%. Its price-to-earnings ratio at 2.6x is significantly lower than Germany's market average of 17.8x, suggesting potential undervaluation. The company has also successfully reduced its debt-to-equity ratio from 38.1% to just 4.6% over five years, indicating effective debt management strategies and financial prudence that could bolster investor confidence moving forward.

- Click to explore a detailed breakdown of our findings in Deutsche Balaton's health report.

Evaluate Deutsche Balaton's historical performance by accessing our past performance report.

Arendals Fossekompani (OB:AFK)

Simply Wall St Value Rating: ★★★★★★

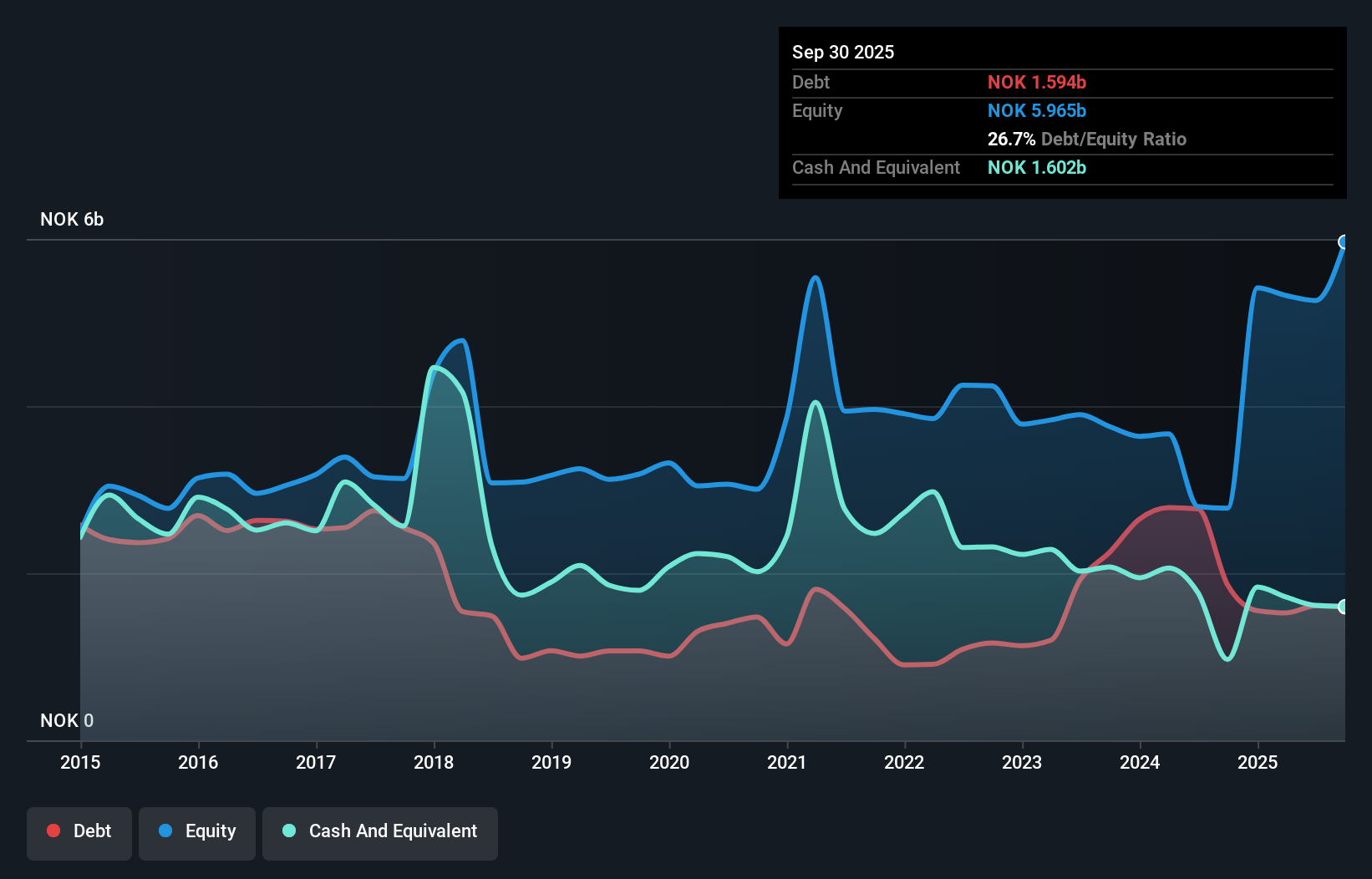

Overview: Arendals Fossekompani ASA is an industrial investment company that offers cyber secure satellite and mobile communications across Norway, Europe, Asia, and North America with a market capitalization of NOK7.42 billion.

Operations: The company's revenue is derived from providing cyber secure satellite and mobile communications services across multiple regions. It operates with a market capitalization of NOK7.42 billion, focusing on diverse geographical markets including Norway, Europe, Asia, and North America.

Arendals Fossekompani, a compact player in the European market, has shown notable financial resilience. Over the past year, earnings surged by 26%, outpacing the Industrials industry average of 0.6%. The company's debt-to-equity ratio impressively decreased from 49.1% to 26.7% over five years, indicating prudent financial management. Despite a dip in third-quarter sales to NOK 853 million from NOK 911 million last year, net income skyrocketed to NOK 734 million compared to just NOK 1 million previously. With a P/E ratio of 17.7x below the industry average and high-quality earnings reported, AFK seems well-positioned for future opportunities.

Meier Tobler Group (SWX:MTG)

Simply Wall St Value Rating: ★★★★★★

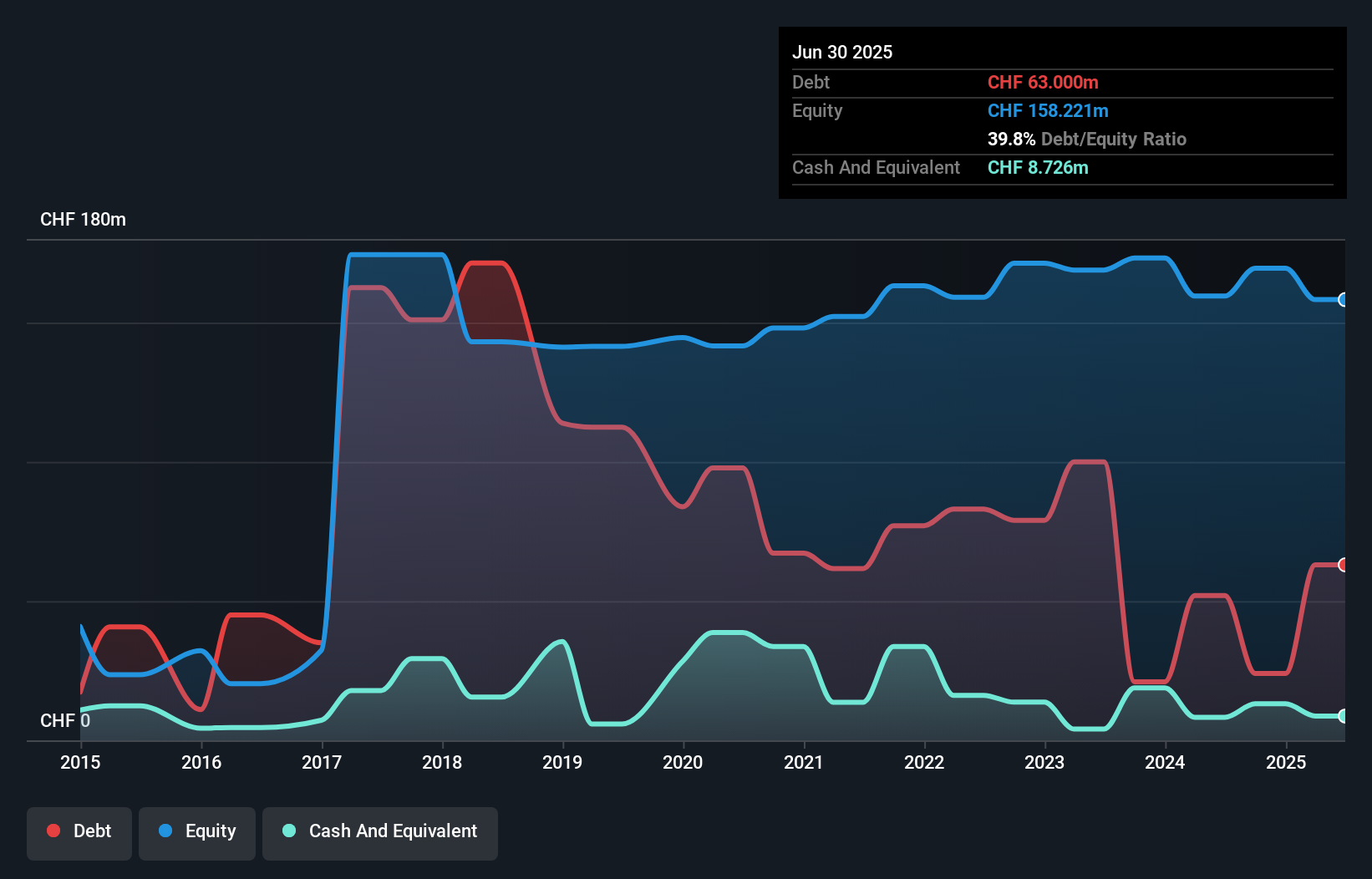

Overview: Meier Tobler Group AG is a trading and services company specializing in heat generation and air conditioning systems, with a market capitalization of CHF 423.19 million.

Operations: Meier Tobler Group AG generates revenue primarily through its Distribution segment, contributing CHF 395.31 million, and the Service segment, adding CHF 96.89 million.

Meier Tobler Group, a notable player in the building sector, has demonstrated robust performance with earnings growth of 7.1% over the past year, outpacing the industry average of -1.7%. The company's net debt to equity ratio stands at a satisfactory 34.3%, reflecting prudent financial management. Despite a significant one-off loss of CHF9.9M impacting recent results, MTG's interest payments are well covered by EBIT at 40.2 times coverage, indicating strong operational efficiency. With a price-to-earnings ratio of 20.6x below the industry norm and positive free cash flow, MTG presents an intriguing opportunity for investors seeking value in this space.

- Take a closer look at Meier Tobler Group's potential here in our health report.

Explore historical data to track Meier Tobler Group's performance over time in our Past section.

Where To Now?

- Get an in-depth perspective on all 321 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MTG

Meier Tobler Group

Operates as a trading and services company in heat generation and air conditioning systems.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives