- Germany

- /

- Capital Markets

- /

- XTRA:O4B

OVB Holding (XTRA:O4B) Net Profit Margin Drops, Challenging Bullish Growth Narrative

Reviewed by Simply Wall St

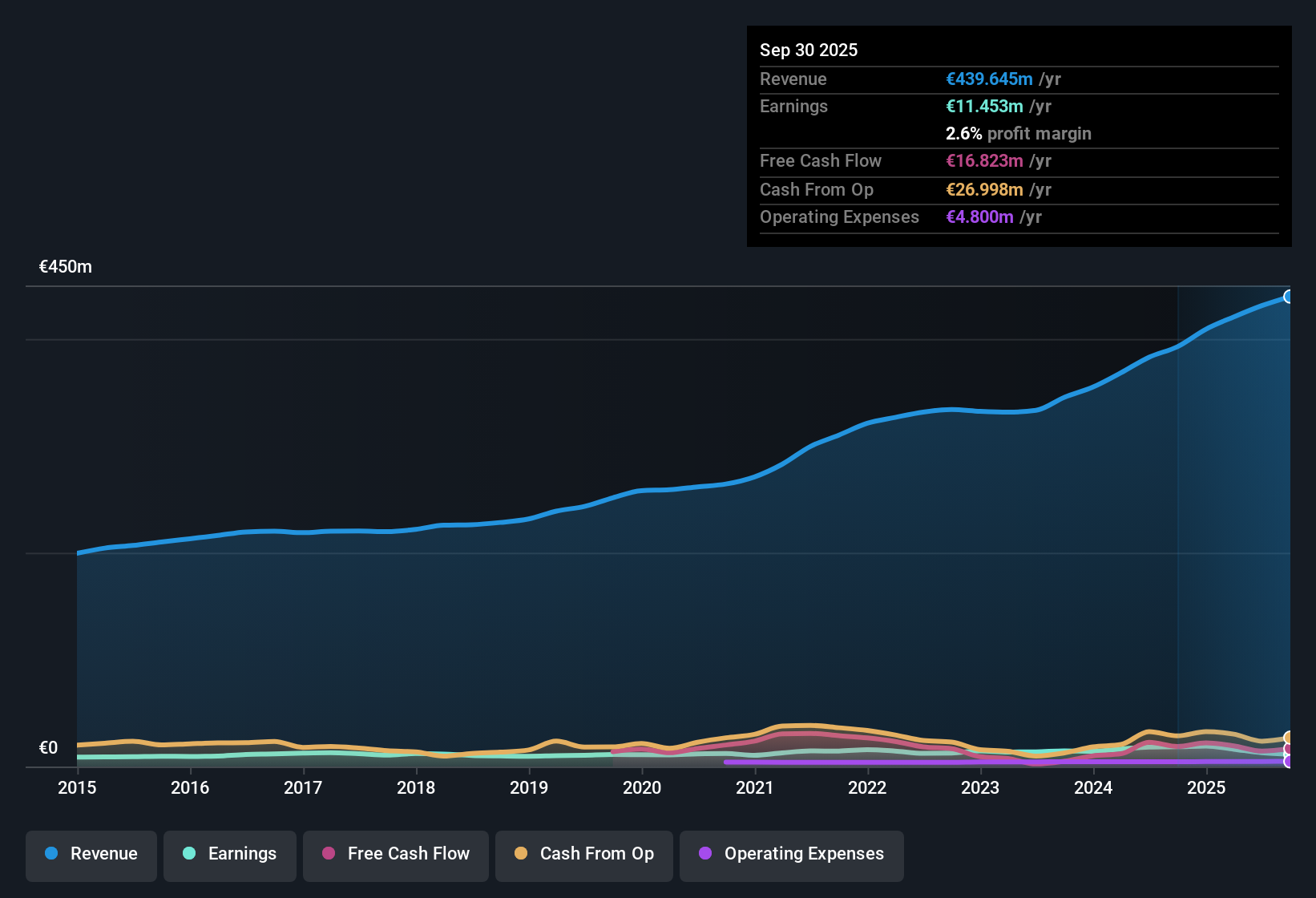

OVB Holding (XTRA:O4B) reported a 27.25% annual earnings growth forecast, comfortably outpacing the German market’s 16.7% forecast. Nevertheless, the company’s net profit margin slipped to 3%, down from 4.8% in the prior year, with recent earnings growth turning negative after averaging 6.6% per year over the past five years. Investors are tracking the robust growth outlook but balancing it against the current decline in profitability and OVB’s higher Price-To-Earnings ratio of 21.2x, which is above both its peer and industry averages.

See our full analysis for OVB Holding.Next up, we’ll see how the latest numbers match or diverge from the key narratives investors are following right now.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides as Growth Outlook Stays Strong

- Net profit margin came in at 3% for the most recent year, falling from 4.8% the year before. This is a notable drop even as forecasts call for average annual earnings growth of 27.25% moving forward.

- Despite a sharp growth forecast, the most recent margin slip challenges the idea that OVB's profitability will keep pace with its projected earnings expansion.

- While DCF fair value sits notably higher than the current share price at €24.70 compared to €19.20, the near-term weakness in profitability creates an unexpected hurdle for outright bullishness on operations.

- Investors expecting a clean growth story must now balance these margin pressures with anticipated top-line gains, which stands in contrast to the prevailing market's focus on uplift.

Premium Valuation Versus Peers Remains a Sticking Point

- OVB’s Price-To-Earnings ratio is 21.2x, significantly above both the peer average of 10.6x and the broader German Capital Markets industry average of 16x. This suggests investors are paying a premium compared to similar companies.

- The prevailing market view is quick to point out that, even with substantial growth forecasts, a premium valuation raises expectations for consistent outperformance. This P/E gap could also magnify volatility if forecast growth does not materialize as planned.

- Shareholders may have to contend with a higher "bar for success" than rivals, especially as profitability narrows in the latest year.

- Whether the projected 27.25% annual earnings growth is enough to justify the premium remains a central debate, with no additional narrative support currently swaying sentiment either way.

DCF Fair Value Signals Upside but Dividends Under Watch

- The current share price of €19.20 remains below the DCF fair value estimate of €24.70, suggesting potential upside for investors willing to take on present operational risks.

- From the prevailing market perspective, two clear rewards stand out: strong forecast earnings growth and valuation support from discounted cash flow analysis. These are partially overshadowed by flagged risks around dividend sustainability and the fall in net profit margin.

- This valuation gap will only matter if OVB can keep its dividend stable and return margins to previous levels.

- Investors with a focus on total return and income need to watch for concrete dividend updates and margin improvement before leaning into the upside case.

To see how these developments fit into a broader investment story, read the full OVB Holding Consensus Narrative.

📊 Read the full OVB Holding Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on OVB Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite upbeat growth forecasts, OVB faces immediate challenges from falling margins, negative recent earnings momentum, and uncertainty around dividend stability. If you want to sidestep those risk factors, try these 2009 dividend stocks with yields > 3% to discover companies offering more reliable and sustainable income streams for investors seeking dependable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:O4B

OVB Holding

Through its subsidiaries, provides advisory and brokerage services to private households in Europe.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives