Stock Analysis

- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

Bayerische Motoren Werke Leads Three Key German Dividend Stocks

Reviewed by Simply Wall St

Amid a backdrop of mixed performances across major European stock indexes, with Germany's DAX experiencing a slight downturn, investors continue to seek stable returns in uncertain times. Dividend stocks, such as those from established German companies, offer potential for steady income, making them an appealing option in the current economic climate where cautious optimism and strategic investment choices prevail.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.23% | ★★★★★★ |

| Edel SE KGaA (XTRA:EDL) | 6.41% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.79% | ★★★★★★ |

| Südzucker (XTRA:SZU) | 6.52% | ★★★★★☆ |

| MLP (XTRA:MLP) | 4.76% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.54% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.10% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.96% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.07% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.36% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft (BMW) operates globally, focusing on the development, manufacture, and sale of automobiles and motorcycles, along with spare parts and accessories, boasting a market capitalization of approximately €58.40 billion.

Operations: Bayerische Motoren Werke Aktiengesellschaft (BMW) generates revenue primarily through its Automotive and Financial Services segments, with €131.95 billion and €36.93 billion respectively, complemented by a smaller contribution of €3.15 billion from its Motorcycles segment.

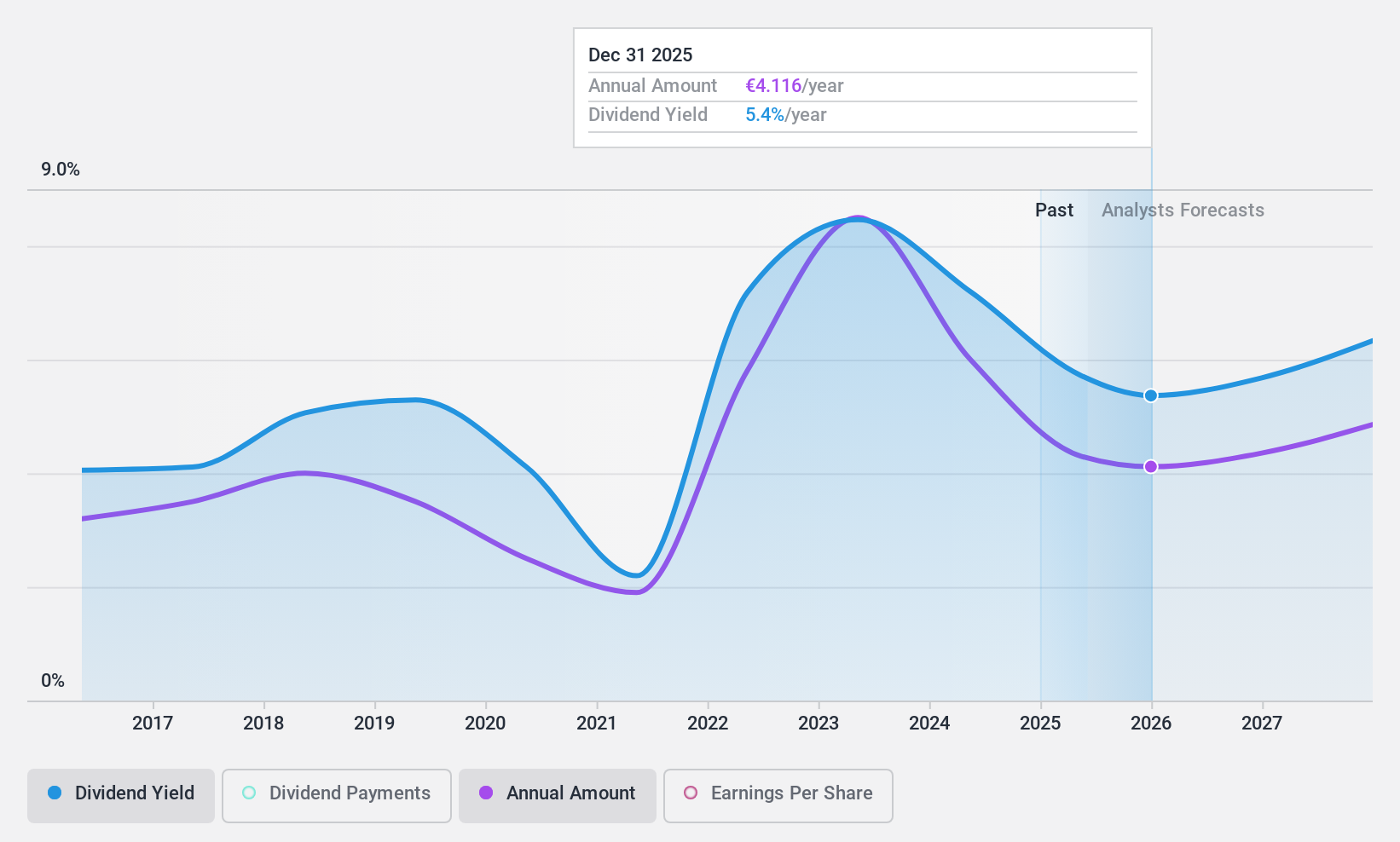

Dividend Yield: 6.5%

Bayerische Motoren Werke (BMW) presents a complex picture for dividend investors. Despite a high dividend yield of 6.47%, placing it in the top 25% of German dividend payers, its sustainability is questionable as dividends are not well covered by cash flows, with a cash payout ratio of 168.2%. Additionally, BMW's dividend history has been volatile and unreliable over the past decade, reflecting inconsistency in payments. However, the stock is currently trading at 16.6% below its estimated fair value and analysts predict a potential price increase of 22.7%. Recent leadership changes within the company might influence future strategic directions but have no immediate bearing on its financial stability or dividend policies.

- Unlock comprehensive insights into our analysis of Bayerische Motoren Werke stock in this dividend report.

- Upon reviewing our latest valuation report, Bayerische Motoren Werke's share price might be too pessimistic.

Deutsche Lufthansa (XTRA:LHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Lufthansa AG is a global aviation company with a market capitalization of approximately €7.73 billion.

Operations: Deutsche Lufthansa AG generates its revenue primarily from three segments: Passenger Airlines (€28.69 billion), Maintenance, Repair and Overhaul Services (€6.78 billion), and Logistics (€2.85 billion).

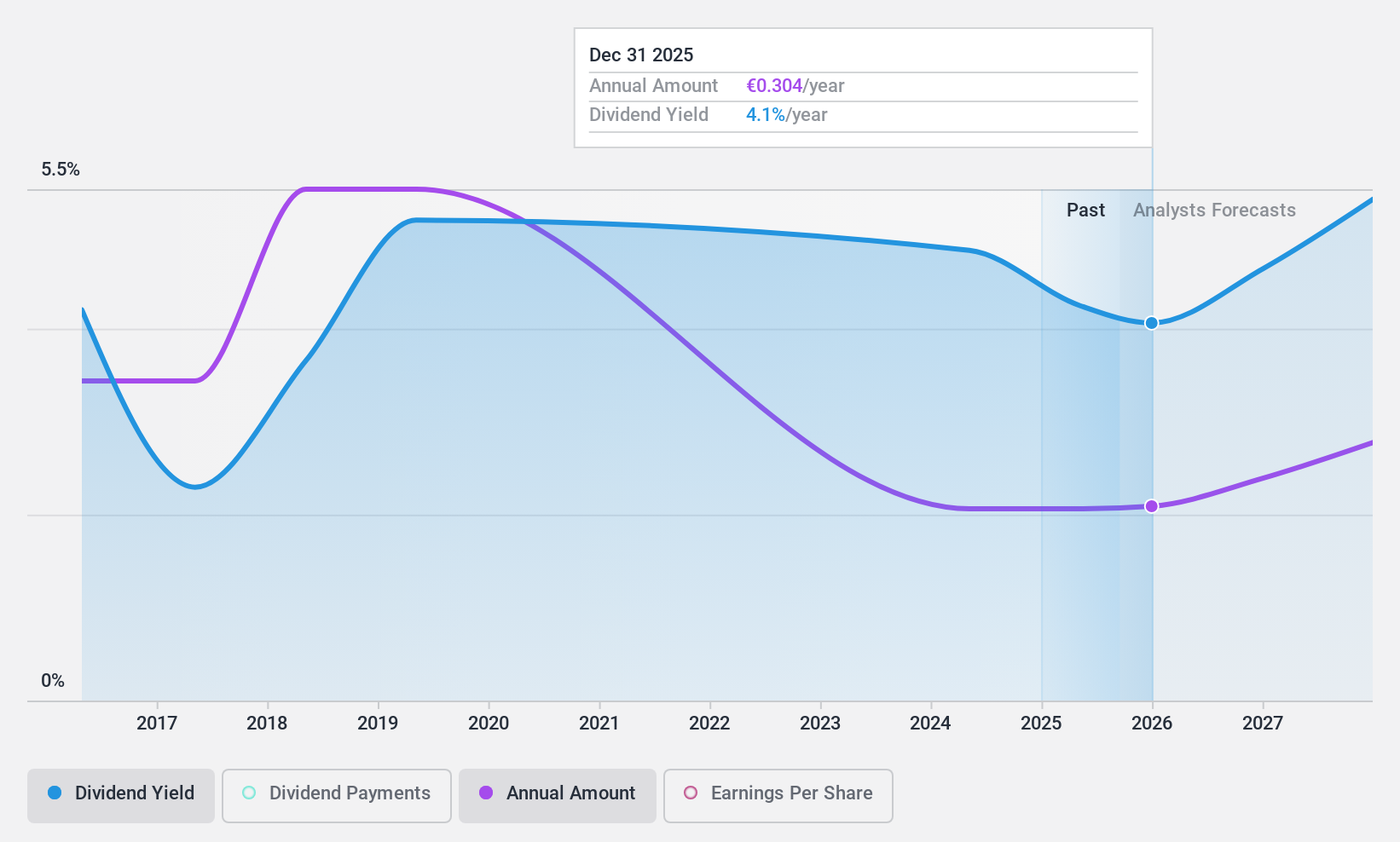

Dividend Yield: 4.6%

Deutsche Lufthansa AG offers a dividend of €0.30 per share, with a payout ratio of 22.3%, indicating dividends are well-covered by earnings. However, the company's dividend history is marked by instability and reductions over the past decade, reflecting inconsistent payments to shareholders. Despite this, Lufthansa trades at a significant discount relative to its fair value and peers within the industry. Recent executive changes and fixed-income offerings could impact future financial strategies but have yet to stabilize the dividend payouts.

- Click to explore a detailed breakdown of our findings in Deutsche Lufthansa's dividend report.

- The analysis detailed in our Deutsche Lufthansa valuation report hints at an deflated share price compared to its estimated value.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG operates as a publicly owned investment manager, with a market capitalization of approximately €143.11 million.

Operations: MPC Münchmeyer Petersen Capital AG's revenue segments are not specified in the provided text.

Dividend Yield: 6.7%

MPC Münchmeyer Petersen Capital AG, with a dividend yield of 6.65%, stands out in the German market. The company's dividends are well-supported by earnings and cash flows, with payout ratios at 72.6% and 73.6% respectively. Despite this, MPCK has a short dividend history of only two years and lacks stability in its dividend track record. Recent financials show strong growth, with net income rising to €5.88 million from €3.72 million year-over-year, suggesting potential for continued support of dividend payments amidst leadership changes set for June 2024.

- Navigate through the intricacies of MPC Münchmeyer Petersen Capital with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that MPC Münchmeyer Petersen Capital is priced lower than what may be justified by its financials.

Seize The Opportunity

- Embark on your investment journey to our 29 Top Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether MPC Münchmeyer Petersen Capital is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MPCK

Flawless balance sheet, undervalued and pays a dividend.