- Switzerland

- /

- Medical Equipment

- /

- SWX:MED

Renta 4 Banco And 2 Other Undiscovered European Gems For Your Portfolio

Reviewed by Simply Wall St

As the European market experiences a positive shift with the pan-European STOXX Europe 600 Index climbing 0.90% amid easing inflation and supportive monetary policies from the European Central Bank, investors are increasingly on the lookout for promising opportunities in lesser-known stocks. In this environment, identifying stocks that demonstrate resilience and growth potential can be particularly rewarding, making Renta 4 Banco and two other undiscovered European gems intriguing considerations for a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A. operates in wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €606.33 million.

Operations: Renta 4 Banco generates revenue primarily through wealth management, brokerage, and corporate advisory services. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency and cost management.

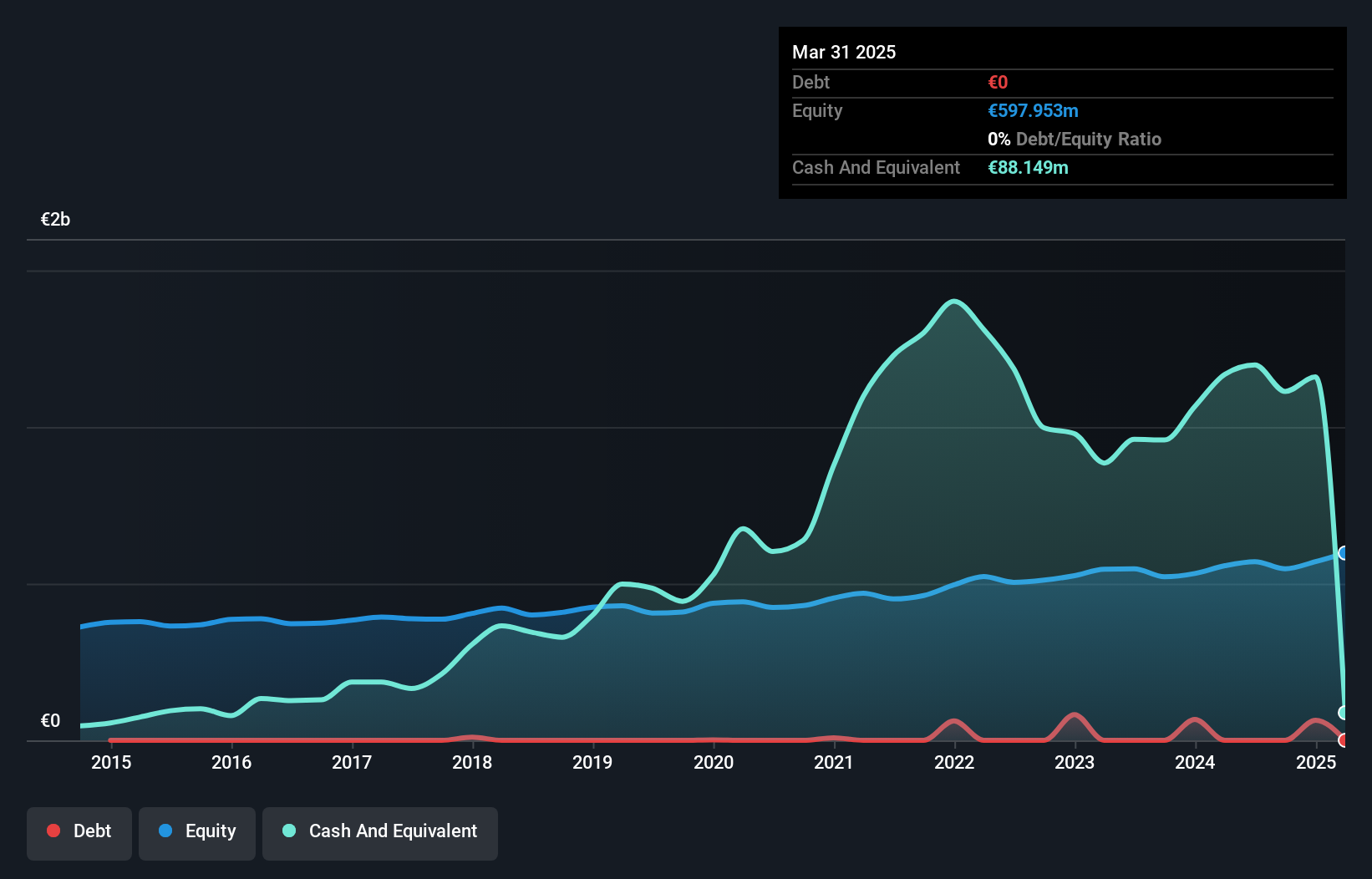

Renta 4 Banco, a financial entity with no debt and a reduced debt-to-equity ratio from 9.4% five years ago, showcases impressive growth. The bank's earnings surged by 23% last year, outpacing the Capital Markets industry's growth of 13.9%. With high-quality earnings and a favorable price-to-earnings ratio of 18.9x compared to the Spanish market's 19.2x, Renta seems undervalued in its sector. Additionally, it recently declared a cash dividend of €0.13 per share in April 2025, reflecting its commitment to shareholder value despite fluctuations in free cash flow over recent years.

- Click to explore a detailed breakdown of our findings in Renta 4 Banco's health report.

Explore historical data to track Renta 4 Banco's performance over time in our Past section.

Medartis Holding (SWX:MED)

Simply Wall St Value Rating: ★★★★★☆

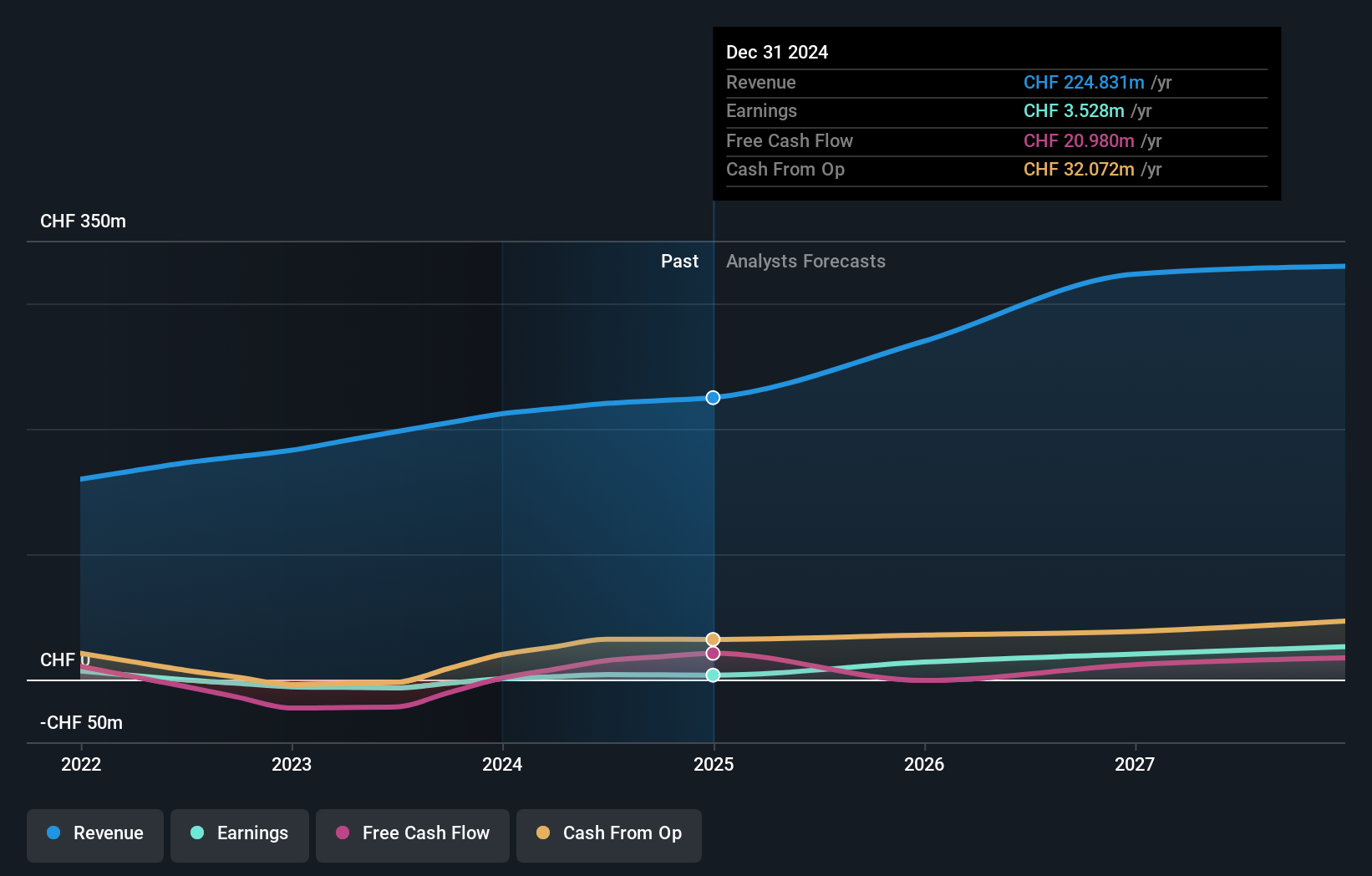

Overview: Medartis Holding AG is a medical device company focused on developing, manufacturing, and selling implant solutions globally, with a market capitalization of CHF959.52 million.

Operations: Medartis primarily generates revenue from its medical products segment, amounting to CHF224.83 million. The company's financial performance is reflected in its net profit margin trend over recent periods.

Medartis Holding, known for its implant solutions, has been making waves with a stunning 470% earnings growth over the past year, outpacing the industry average of 34%. The company reported sales of CHF224.83 million and net income of CHF3.53 million for 2024, showcasing a substantial leap from CHF0.619 million the previous year. Despite a one-off loss of CHF5.6 million impacting recent results, Medartis remains financially sound with more cash than debt and plans to bolster its U.S., Japan, and Australia presence in 2025 with expected organic core sales growth between 13%-15%.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE, with a market cap of €951.48 million, operates as a financial services provider catering to private, corporate, and institutional clients in Germany through its various subsidiaries.

Operations: MLP SE generates revenue primarily from Financial Consulting (€450.39 million), FERI (€265.89 million), and Banking (€226.45 million) segments, with additional contributions from DOMCURA and Deutschland.Immobilien. The company's financial performance is impacted by segment adjustments and consolidation effects, which total €-82.06 million in the reported period.

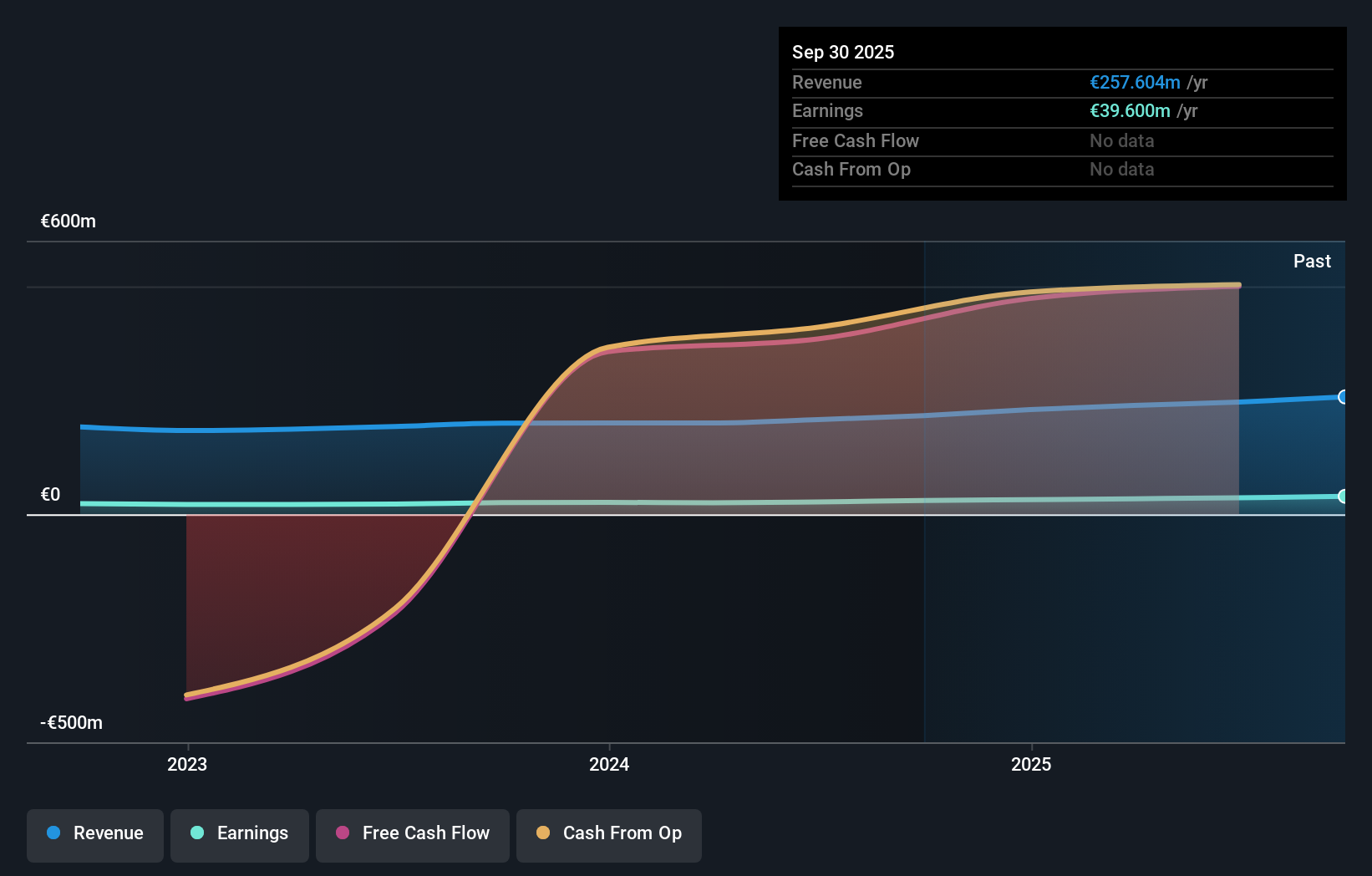

MLP, a nimble player in the European market, is making waves with its strategic growth initiatives. The company recently reported earnings growth of 30.8%, outpacing the Capital Markets industry's 25.4%. With no debt on its books, MLP stands out for its financial prudence and high-quality earnings. Recent results show revenue at €300.63 million for Q1 2025, up from €284.11 million last year, while net income was steady at €27.58 million compared to €27.76 million previously. A proposed dividend increase to 36 cents per share reflects confidence in future prospects despite challenges like margin pressures and demographic shifts impacting profitability.

Where To Now?

- Dive into all 329 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MED

Medartis Holding

A medical device company, engages in the development, manufacturing, and sales of implant solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives