- Germany

- /

- Capital Markets

- /

- XTRA:JDC

Discovering Europe's Hidden Stock Gems July 2025

Reviewed by Simply Wall St

As Europe navigates through a landscape of tentative optimism surrounding trade deals and steady interest rates, the pan-European STOXX Europe 600 Index has seen a modest rise, reflecting cautious investor sentiment. Against this backdrop, identifying stocks that demonstrate resilience and potential for growth becomes crucial in uncovering hidden gems within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Equita Group (BIT:EQUI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equita Group S.p.A. is an Italian company that offers sales and trading, investment banking, and alternative asset management services to investors, financial institutions, corporates, and entrepreneurs both domestically and internationally with a market capitalization of €235.26 million.

Operations: Equita Group generates revenue primarily from its Global Markets (€46.17 million), Investment Banking (€31.18 million), and Asset Management (€8.36 million) segments. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Equita Group, a financial entity in Italy, stands out with its robust cash position exceeding total debt and a reduced debt-to-equity ratio from 271% to 154% over five years. The company's price-to-earnings ratio of 15x is attractive compared to the Italian market's 17.1x, suggesting potential value for investors. Despite significant insider selling recently, Equita boasts high-quality earnings and reported an increase in net income to €4.68 million for Q1 2025 from €3.06 million the previous year. However, its earnings growth of 2% last year lagged behind the capital markets industry's impressive growth rate of 32%.

- Navigate through the intricacies of Equita Group with our comprehensive health report here.

Assess Equita Group's past performance with our detailed historical performance reports.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

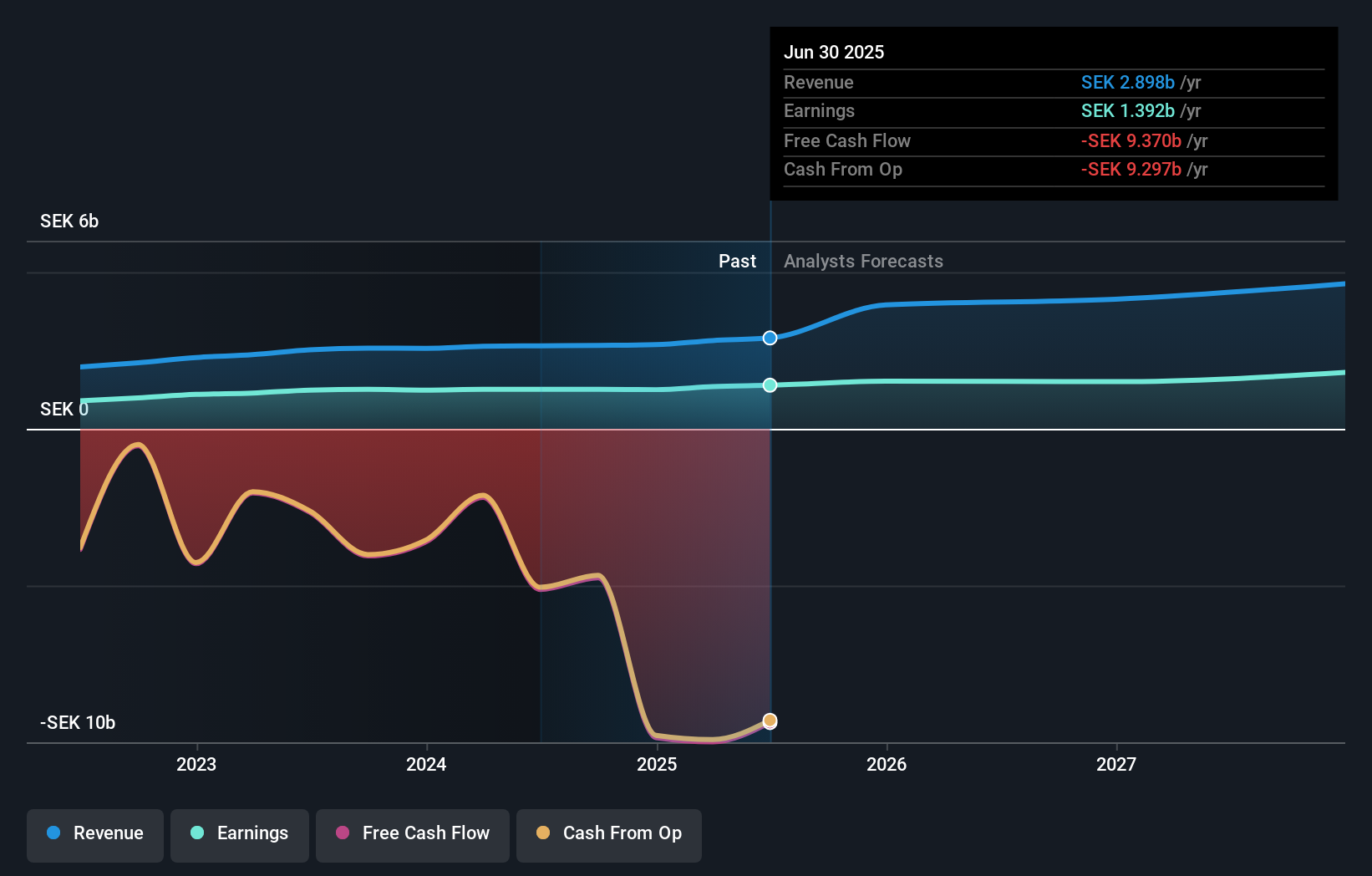

Overview: Norion Bank AB (publ) offers financial solutions to medium-sized corporates, real estate companies, merchants, and private individuals across Sweden, Germany, Norway, Denmark, Finland, and internationally with a market cap of approximately SEK12.49 billion.

Operations: Norion Bank generates revenue primarily from its Real Estate and Consumer segments, contributing SEK1.24 billion and SEK977 million, respectively. The Corporate segment also plays a significant role with SEK863 million in revenue. Payments add another SEK494 million to the overall income stream.

Norion Bank, with total assets of SEK70 billion and equity of SEK9.7 billion, is a standout in the European financial landscape. The bank's earnings growth over the past year was 10.7%, outpacing the industry average by a significant margin. However, it faces challenges with high non-performing loans at 20.2% and a low allowance for bad loans at 51%. Trading at 64.5% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent buybacks amounting to NOK90 million demonstrate proactive capital management aimed at enhancing shareholder value amidst these mixed dynamics.

- Take a closer look at Norion Bank's potential here in our health report.

Evaluate Norion Bank's historical performance by accessing our past performance report.

JDC Group (XTRA:JDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of approximately €365.08 million.

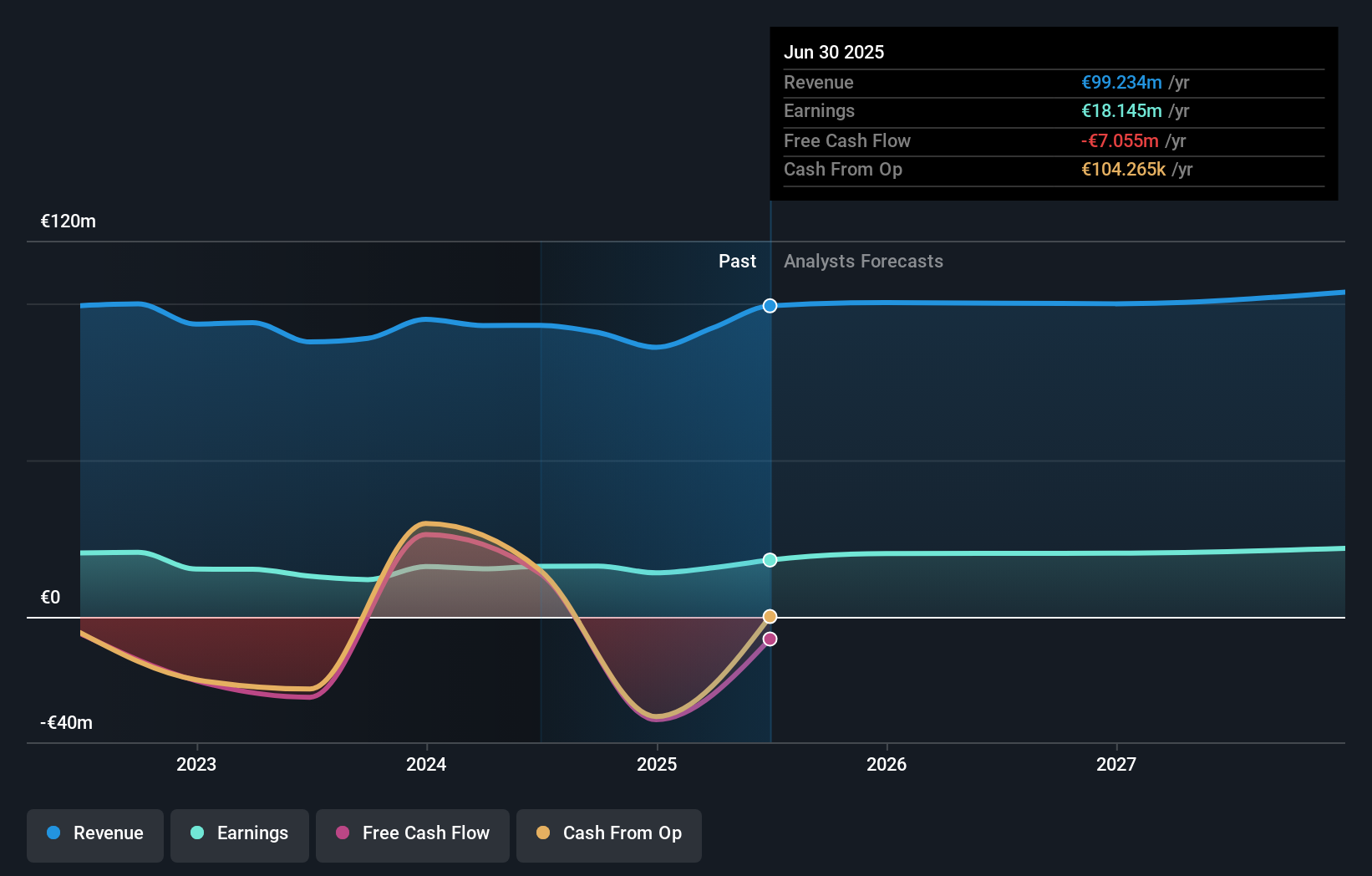

Operations: JDC Group AG generates revenue primarily through its Advisortech segment, which contributes €204.04 million, and the Advisory segment, with €43.71 million. The company also incurs a negative contribution from its Transfer segment amounting to -€19.78 million.

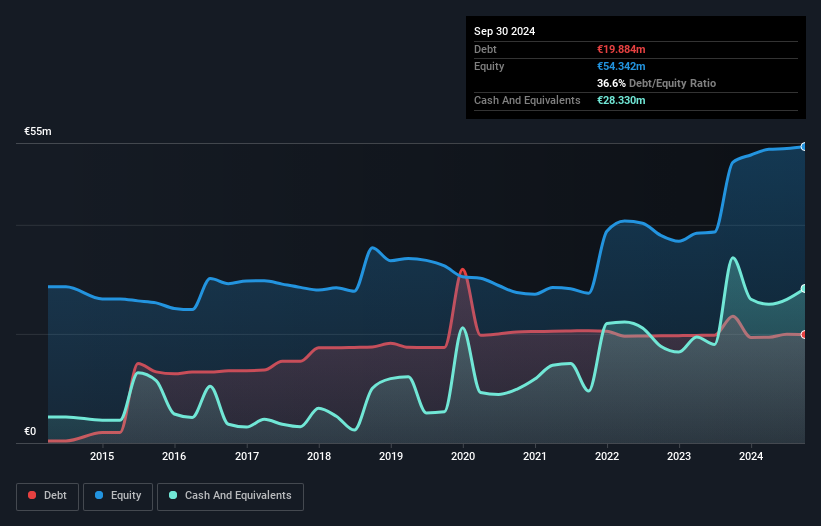

JDC Group is making waves in the financial services sector, particularly in Germany and Austria, with a strategic focus on digital transformation and AI-driven automation. The company recently reported a net income of €2.77 million for Q1 2025, up from €2.09 million the previous year, reflecting its robust earnings growth of 47.5% over the past year. JDC's debt to equity ratio has impressively reduced from 65% to 33% over five years, indicating sound financial management. With forecasts projecting annual revenue growth at 14%, JDC seems poised for continued expansion despite potential challenges like competitive pressures and technological hurdles.

Seize The Opportunity

- Embark on your investment journey to our 316 European Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JDC

JDC Group

Operates as a financial services company in Germany and Austria.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives