Stock Analysis

- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

3 Leading German Growth Stocks With Insider Ownership Exceeding 26%

Reviewed by Simply Wall St

Amidst a mixed performance in major European stock indexes, with Germany's DAX experiencing a slight decline, investors continue to seek stable growth opportunities. High insider ownership can be an indicator of confidence in a company’s future prospects, making such stocks potentially attractive in the current economic environment.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 73.5% |

| Deutsche Beteiligungs (XTRA:DBAN) | 35.3% | 31.4% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| NAGA Group (XTRA:N4G) | 14.1% | 58.1% |

| Exasol (XTRA:EXL) | 25.3% | 107.4% |

| Beyond Frames Entertainment (DB:8WP) | 10.9% | 81.9% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 22% |

| elumeo (XTRA:ELB) | 25.8% | 99.1% |

| Redcare Pharmacy (XTRA:RDC) | 18.3% | 46.9% |

Let's dive into some prime choices out of from the screener.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

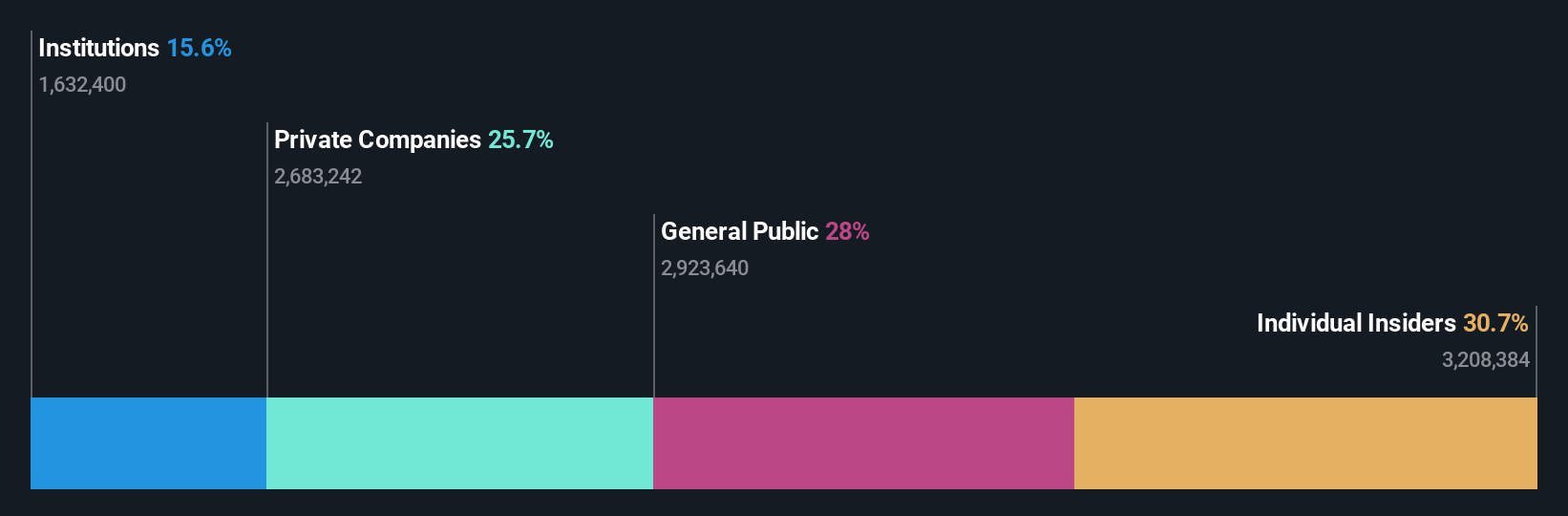

Overview: Brockhaus Technologies AG operates as a private equity firm with a market capitalization of approximately €250.74 million.

Operations: The firm functions with a market capitalization of around €250.74 million.

Insider Ownership: 26.6%

Brockhaus Technologies AG, a German growth company with high insider ownership, reported a significant revenue increase to €39.97 million in Q1 2024 from €33.89 million the previous year, despite a growing net loss of €1.38 million. The firm forecasts robust revenue growth for 2024, projecting revenues between €220 million and €240 million, reflecting an organic growth rate much higher than the German market average. Despite recent losses, Brockhaus is optimistic about returning to profitability within three years and has initiated its first dividend payment at €0.22 per share, signaling confidence in its financial health and future prospects.

- Click to explore a detailed breakdown of our findings in Brockhaus Technologies' earnings growth report.

- In light of our recent valuation report, it seems possible that Brockhaus Technologies is trading behind its estimated value.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

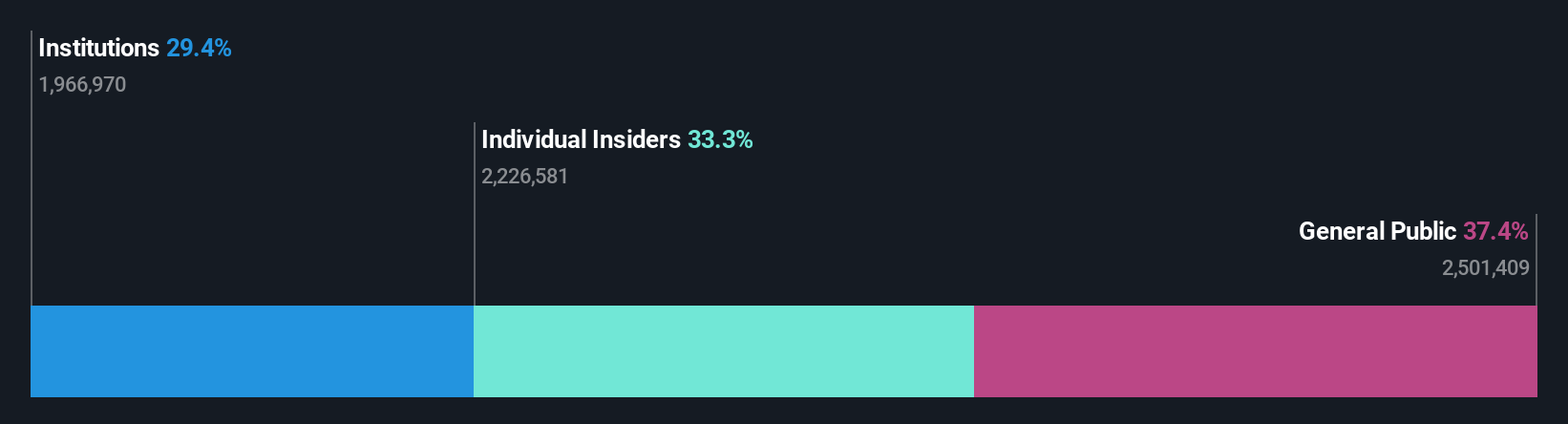

Overview: Hypoport SE is a technology-based financial service provider in Germany, with a market capitalization of approximately €2.15 billion.

Operations: The company generates revenue through its Credit Platform and Insurance Platform, which contributed €155.60 million and €66.29 million respectively.

Insider Ownership: 35.1%

Hypoport SE, a German growth company with substantial insider ownership, demonstrated robust financial performance in the first quarter of 2024 with sales increasing to €107.47 million from €93.72 million year-over-year and net income improving significantly to €3.04 million from €0.503 million. Despite a challenging previous year where annual sales dropped, the company's earnings are expected to grow by 35.85% annually over the next three years, outpacing both its past performance and market averages in Germany.

- Click here to discover the nuances of Hypoport with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hypoport shares in the market.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

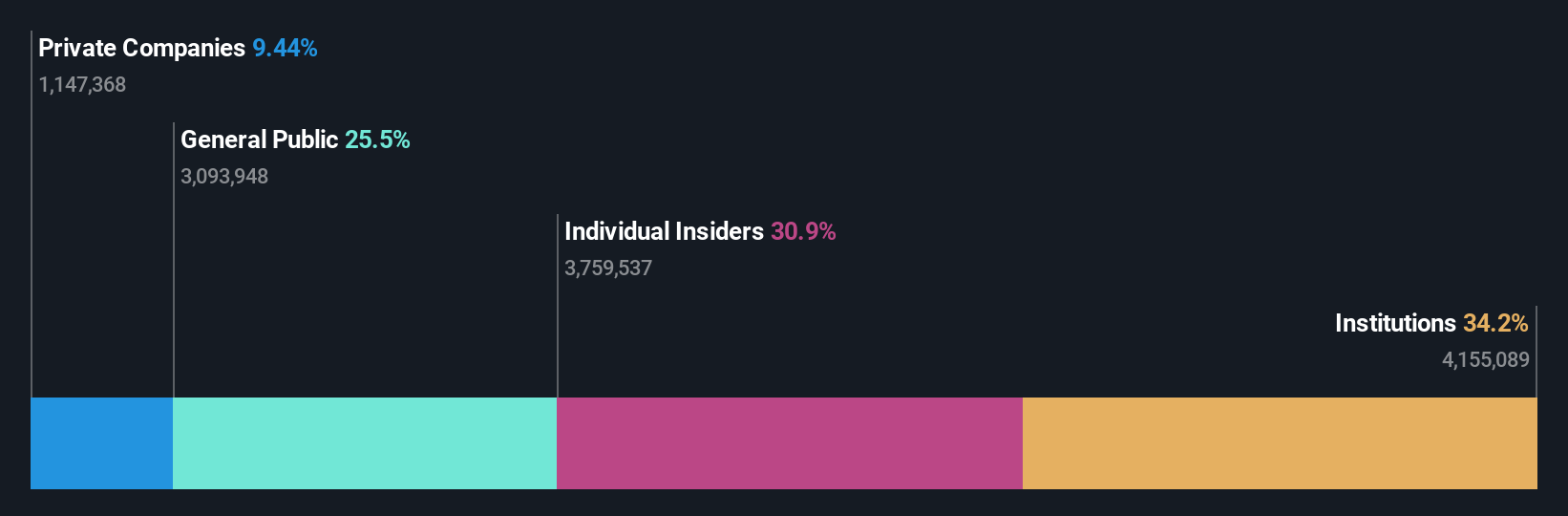

Overview: Stratec SE operates globally, designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences, with a market cap of approximately €543.37 million.

Operations: The company generates revenue through the design and manufacture of automation and instrumentation solutions in the fields of in-vitro diagnostics and life sciences.

Insider Ownership: 30.9%

Stratec SE, while trading at 44.7% below its estimated fair value, faces challenges with a recent decline in sales and net income as reported in Q1 2024, with sales dropping to €50.87 million from €60.48 million year-over-year and net income decreasing to €0.447 million from €1.37 million. Despite these setbacks, the company is expected to see significant earnings growth of 22% annually over the next three years, outstripping the German market forecast of 18.7%. However, Stratec's debt is poorly covered by operating cash flow and its return on equity is anticipated to remain low at 11.1%.

- Navigate through the intricacies of Stratec with our comprehensive analyst estimates report here.

- The analysis detailed in our Stratec valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Take a closer look at our Fast Growing German Companies With High Insider Ownership list of 17 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Hypoport is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Operates as a technology-based financial service provider in Germany.

Reasonable growth potential with adequate balance sheet.