- Germany

- /

- Capital Markets

- /

- XTRA:DBK

Is There Still Value in Deutsche Bank After Its 88% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Deutsche Bank's incredible stock gains still leave room for value? You are not alone. We are about to decode what the numbers reveal.

- After climbing 1.8% in the last week, 5.9% over the past month, and an eye-watering 88.2% year-to-date, the stock has grabbed plenty of attention as momentum builds.

- The surge has been driven by upbeat industry sentiment and regulatory changes favoring European banks. Investor optimism around large financial institutions has also risen in the wake of broader sector stability news. These factors have all helped fuel Deutsche Bank's impressive 101.1% return over the last year.

- Right now, Deutsche Bank scores a 4 out of 6 on our valuation checks. We will break down what that score really means, unpack alternative ways to gauge fair value, and reveal one approach investors often overlook at the end of this article.

Approach 1: Deutsche Bank Excess Returns Analysis

The Excess Returns Model examines how effectively Deutsche Bank generates profits above the required return for its equity investors. Unlike other valuation techniques, this approach focuses on the bank’s ability to earn more on its capital than what shareholders demand, accounting for both profitability and risk.

For Deutsche Bank, the numbers provide a mixed picture. The company’s current Book Value stands at €40.98 per share, with expected stable earnings per share (EPS) of €3.57. These estimates are based on weighted future Return on Equity projections from 11 analysts. Meanwhile, the Cost of Equity is €3.71 per share, so for every euro shareholders have invested, the bank is returning slightly less than the required rate.

This shortfall is shown by an excess return of €-0.14 per share and an average Return on Equity of 9.45%. The stable Book Value is set at €37.81 per share based on analyst projections. Together, these figures suggest Deutsche Bank is currently unable to generate consistent returns in excess of its cost of capital.

The Excess Returns analysis produces an intrinsic value that is 12.6% above the current share price, suggesting the stock is undervalued according to this method.

Result: UNDERVALUED

Our Excess Returns analysis suggests Deutsche Bank is undervalued by 12.6%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Deutsche Bank Price vs Earnings

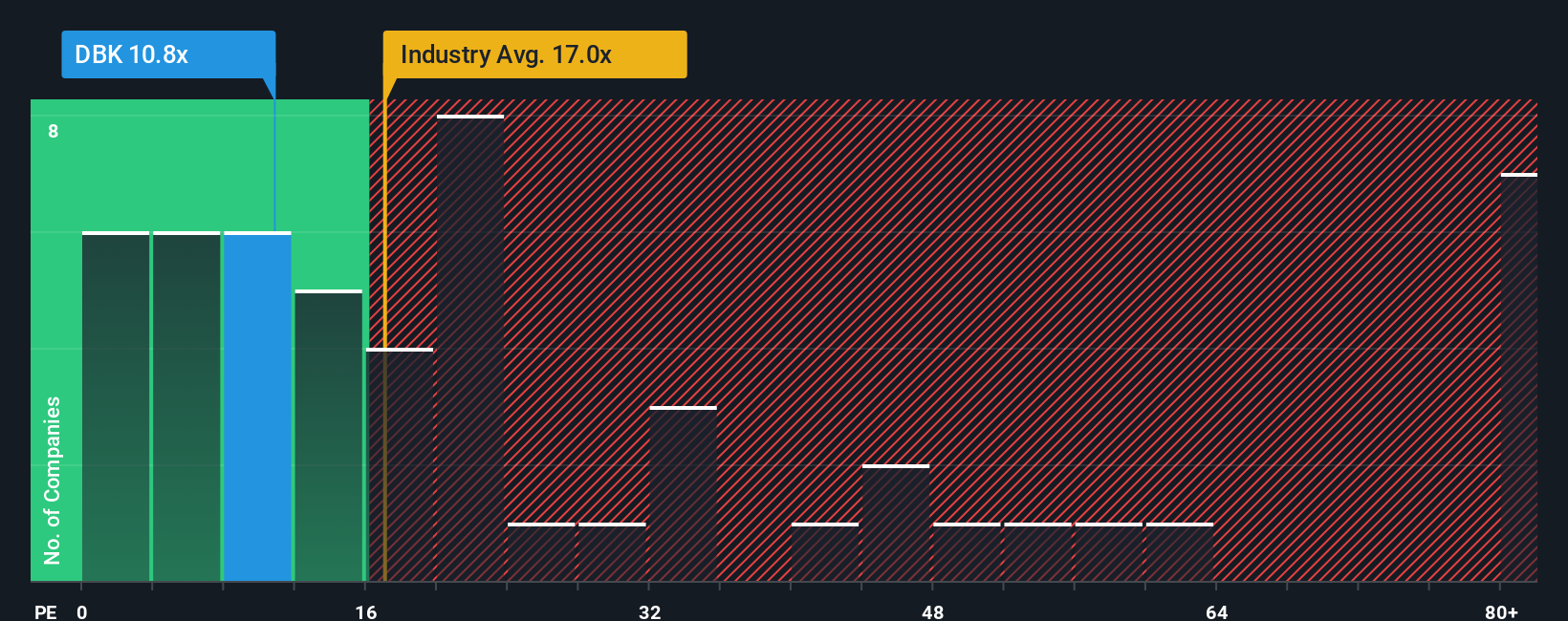

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies like Deutsche Bank because it directly links a company’s market value to its earnings power. Investors use the PE ratio to gauge how much they are paying for every euro of profit the company generates, which can make it easier to compare companies within the same sector.

Growth expectations and perceived risk both play important roles in shaping what is considered a “normal” or “fair” PE ratio. If investors expect higher future earnings growth, or if a company carries less risk, the market is generally willing to pay a higher multiple. Similarly, riskier or slower-growing companies tend to trade at lower PE ratios to compensate for uncertainty or limited upside.

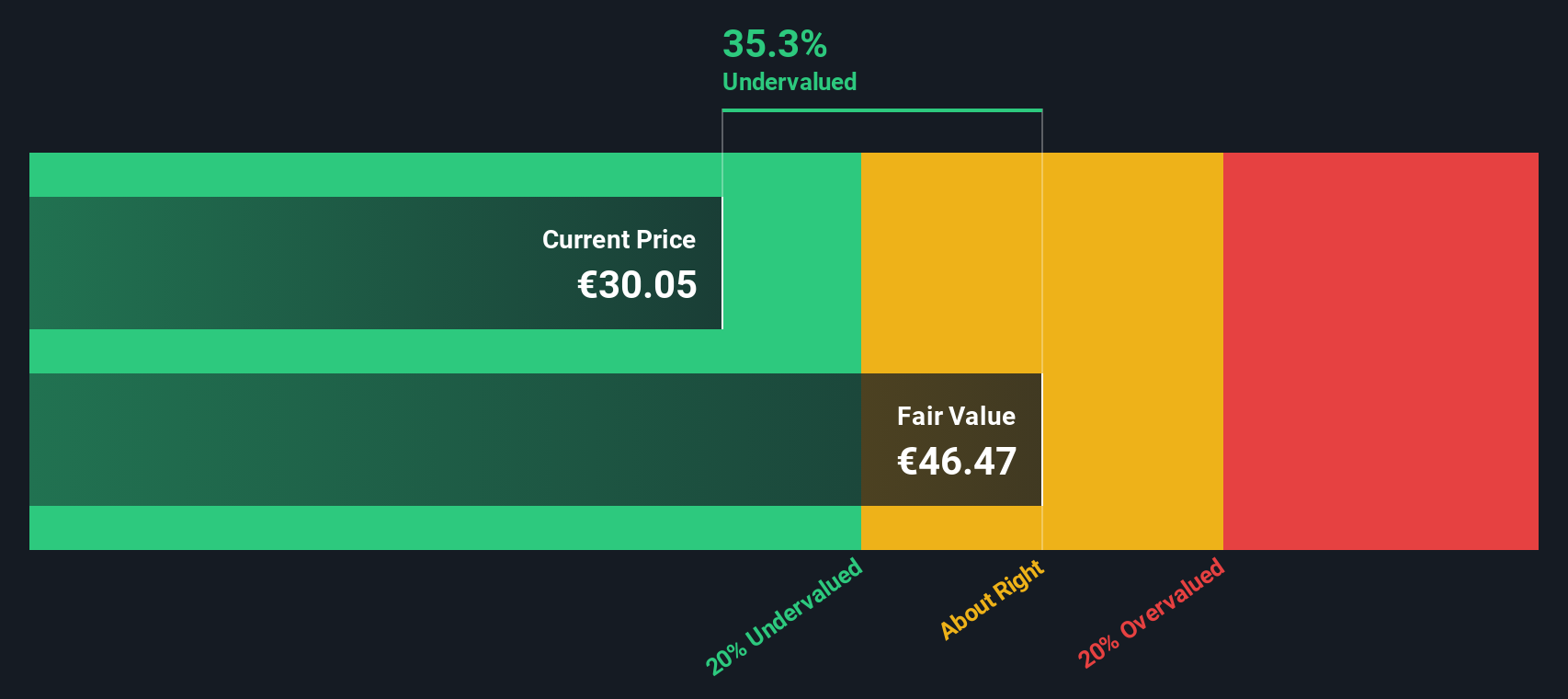

Currently, Deutsche Bank trades at a PE ratio of 12x. This sits below the Capital Markets industry average of 15.18x and is well under the peer average of 19.95x. However, relying only on these benchmarks can be misleading if they do not reflect Deutsche Bank’s own growth prospects, profitability, or risk profile.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Deutsche Bank is calculated at 26.88x, factoring in not just industry dynamics and peer comparisons but also expected growth, company size, profit margins, and risk. This makes it a more tailored and holistic measure of fair value than broad industry averages or peer multiples.

Comparing Deutsche Bank’s current PE of 12x to its Fair Ratio of 26.88x, the stock appears to be undervalued by a considerable margin according to this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a clear, personalized story that explains your perspective on a company like Deutsche Bank by connecting your beliefs about its future revenue, profits, or margins directly to your view of its true value. Narratives help you move beyond the numbers by combining what is happening in the real world with a transparent financial forecast and an estimated fair value. This lets you see exactly how your reasoning leads you to decide whether a stock is under or overvalued.

Narratives are easy to explore on Simply Wall St’s Community page, where millions of investors share and update their perspectives. They make buy or sell decisions clearer by showing how Fair Value compares to the current Price, and they automatically adjust as new earnings or news arrives. For example, among Deutsche Bank investors today, some see standout growth opportunities and set their Fair Value near €35.00, while others remain cautious due to risk and set theirs closer to €10.93. Narratives empower you to invest confidently by understanding the full story behind the share price, tailored to what you believe will happen next.

Do you think there's more to the story for Deutsche Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBK

Deutsche Bank

A stock corporation, provides corporate and investment banking, private clients, and asset management products and services in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives