- Germany

- /

- Capital Markets

- /

- XTRA:DB1

Deutsche Börse (XTRA:DB1) Margin Expansion Reinforces Quality Narrative, Despite Slowing Revenue Outlook

Reviewed by Simply Wall St

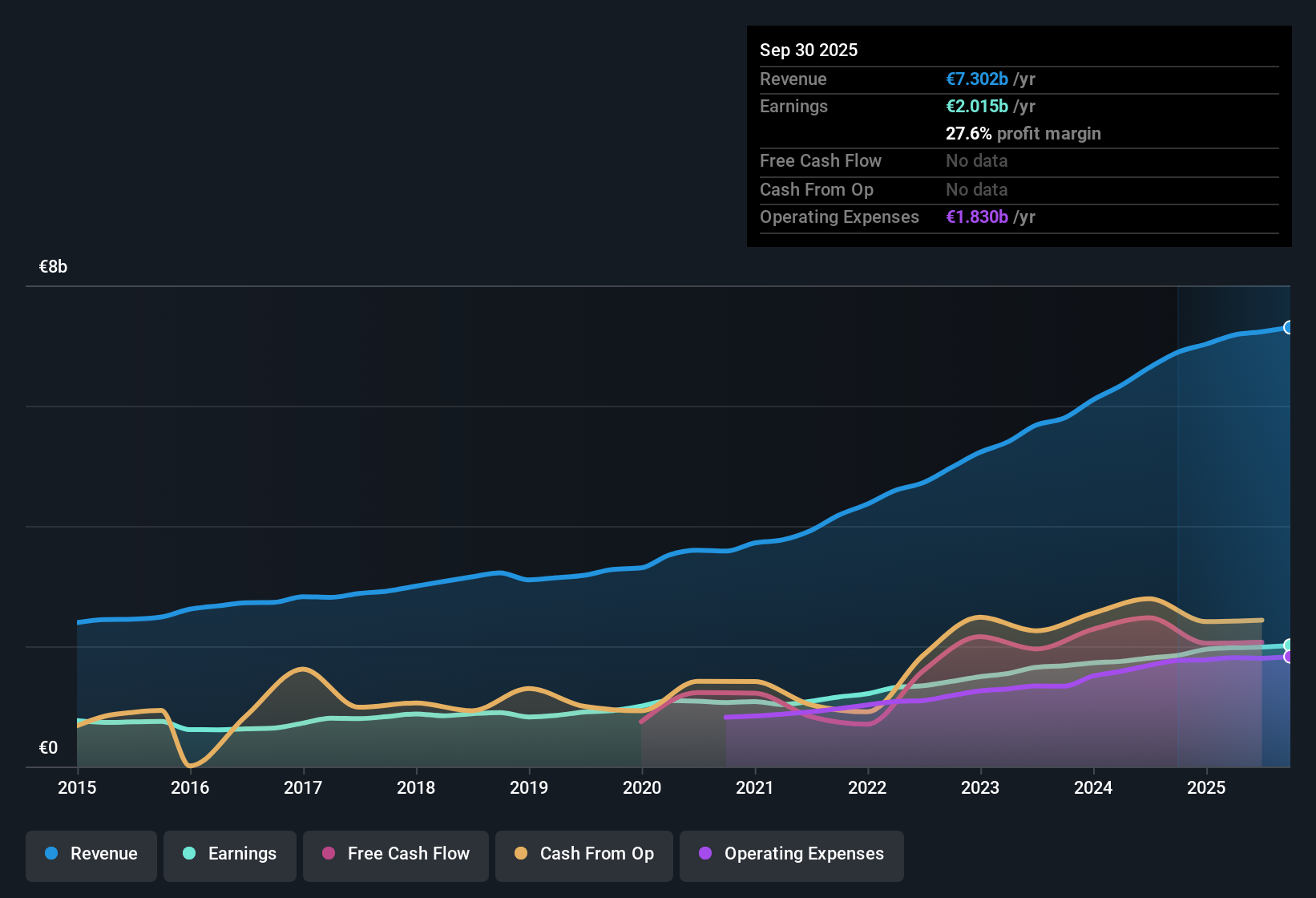

Deutsche Börse (XTRA:DB1) delivered net profit margins of 27.6%, up from 26.8% a year ago. EPS posted 9% growth for the most recent year and a five-year compounded growth rate of 14.3%. Looking ahead, revenue is forecast to decline by 1.3% per year, while EPS is expected to grow at 6.2% per year, trailing the German market’s projected 16.6%. Consistent profit growth, high earnings quality, and reliable dividends continue to anchor investor confidence. However, the prospect of softer revenue and earnings momentum keeps attention firmly on underlying performance.

See our full analysis for Deutsche Börse.Next up, we will put these latest results side by side with the most discussed market narratives, highlighting where expectations and actual performance meet and where surprises might emerge.

See what the community is saying about Deutsche Börse

Margins Projected to Climb from 27.5% to 34.3%

- Analysts anticipate profit margins expanding to 34.3% over the next three years, up from today’s 27.5%, despite flat to slightly declining revenue forecasts.

- According to the analysts' consensus view, the margin outlook heavily supports the case that Deutsche Börse’s continued investments in technology and data services could unlock higher, steadier profitability even as top-line growth slows.

- Margin upswing is expected to come from expanding recurring data and post-trade services, following regulatory initiatives that shift more activity onto central infrastructure.

- Consensus notes that higher margins may compensate for the -1.6% yearly revenue decline forecast, lending more visibility to sustainable earnings.

What stands out, beyond steady margins, is how much analysts believe regulatory-driven data and infrastructure revenues will fuel profit quality, even with revenue growth under pressure. 📈 Read the full Deutsche Börse Consensus Narrative.

DCF Fair Value Sits Below Market Price

- Deutsche Börse’s current share price is €223.30, contrasting with a DCF fair value estimate of €236.97 and an analyst price target of €257.53.

- The consensus narrative flags this valuation dynamic, suggesting the recent margin strength and earnings expansion justify a premium to the DCF fair value. However, it also indicates that most of the upside toward the analyst target may already be priced in.

- Shares now trade at a 20.3x P/E, topping the German Capital Markets sector average of 16.1x, indicating investors are prioritizing resilience and quality.

- The modest 8.5% gap between current price and analyst target points to a market that sees Deutsche Börse as fairly valued, leaving less room for disappointment if top-line growth stays sluggish.

Risk From Leadership Transition and Cost Pressures

- Ongoing leadership changes, including the CFO transition after 15 years, come at the same time as cost pressures from inflation and share-based compensation. This makes execution risk unusually high for the next phase.

- The consensus narrative cautions that these internal and external challenges may threaten the current path of profit margin expansion, especially as strategic projects and technology investments accelerate.

- Escalating costs from strategic initiatives may limit the operating leverage needed for margins to reach analyst forecasts, particularly if inflation persists.

- Leadership transition during critical projects such as ISS STOXX and banking license shifts could cause temporary disruption and affect both expense control and revenue predictability in the medium term.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Deutsche Börse on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Shape the story your way in just a few minutes, share your view and Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Deutsche Börse.

See What Else Is Out There

Deutsche Börse faces slowing revenue growth and limited upside, making its performance more vulnerable if market expectations disappoint or if costs escalate.

For investors seeking more growth and potential upside, now is the time to check out high growth potential stocks screener (60 results) that could deliver faster earnings acceleration and stronger market momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DB1

Deutsche Börse

Operates as an international exchange organization in Germany, rest of Europe, the United States, and the Asia-Pacific.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives