- Germany

- /

- Hospitality

- /

- XTRA:DHER

Can Delivery Hero's (XTRA:DHER) Asian Recovery Shift the Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- Delivery Hero has announced it expects growth to accelerate in the fourth quarter, with recent gross merchandise value rising 7% like-for-like and a recovery underway in its Asian operations.

- This points to improving stability in one of its key markets and signals potential renewed momentum as the company heads into year-end.

- We’ll now explore how the anticipated rebound in Asia could influence Delivery Hero’s investment narrative and growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Delivery Hero Investment Narrative Recap

To be a Delivery Hero shareholder, you need conviction that its push in fast-growing urban markets, strengthened by operational efficiency and digital payments, is enough to outweigh ongoing regulatory and margin pressures. The latest news of faster-than-expected GMV growth in Asia does support a more optimistic short-term outlook, especially as the region recovers, but does not resolve labor cost concerns in Europe or ongoing margin headwinds, so the impact on the biggest risk remains limited for now.

Of recent announcements, the raised full-year segment revenue forecast from August stands out as particularly relevant. This guidance upgrade was already fueled in part by stronger performance in Asia, tying directly to the current momentum; however, this uplift should be balanced against the persistent challenges of increased regulatory costs and competitive pressure, which still weigh on underlying profitability and may dampen the potential impact of any regional rebound.

By contrast, investors should be aware that even with an improved growth outlook, the unresolved regulatory liabilities in Europe could still...

Read the full narrative on Delivery Hero (it's free!)

Delivery Hero is projected to reach €17.9 billion in revenue and €295.6 million in earnings by 2028, based on analysts' forecasts. This outlook assumes a 10.0% annual revenue growth rate and a €856 million improvement in earnings from the current level of €-560.5 million.

Uncover how Delivery Hero's forecasts yield a €32.53 fair value, a 76% upside to its current price.

Exploring Other Perspectives

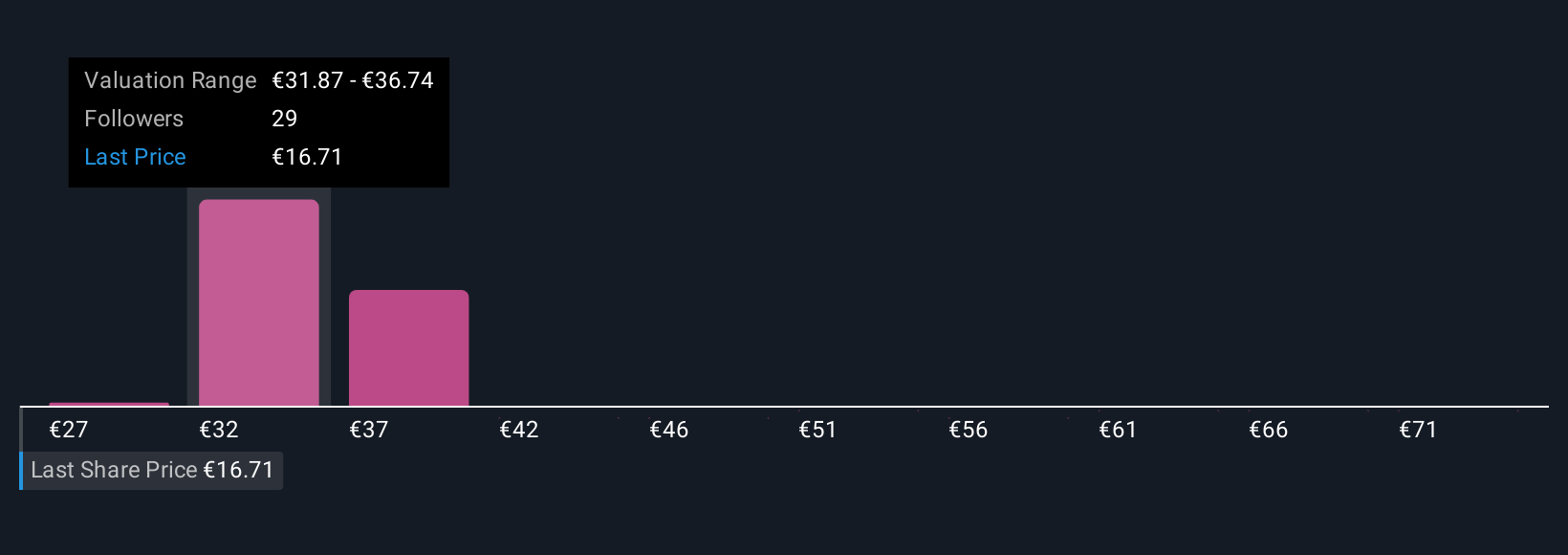

The Simply Wall St Community’s nine fair value estimates for Delivery Hero range widely from €27 to €75.72 per share, reflecting very different expectations. While this shows how much perspectives can vary, stronger growth in Asia could shift sentiment, but persistent regulatory challenges mean you should consider several viewpoints before making your own assessment.

Explore 9 other fair value estimates on Delivery Hero - why the stock might be worth just €27.00!

Build Your Own Delivery Hero Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delivery Hero research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Delivery Hero research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delivery Hero's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DHER

Delivery Hero

Provides online food ordering, quick commerce, and delivery services.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives