- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

Redcare Pharmacy (XTRA:RDC): Valuation Perspectives After Nine-Month Sales Growth and Narrowed Net Loss

Reviewed by Simply Wall St

Redcare Pharmacy (XTRA:RDC) just released its earnings for the first nine months of 2025, showing sales growth to €2,145.71 million and a narrowed net loss of €8.71 million compared to last year.

See our latest analysis for Redcare Pharmacy.

Redcare Pharmacy’s latest earnings update arrives as the share price continues to face headwinds, sliding nearly 46% year-to-date. While the recent results point to real progress on revenue growth and loss reduction, the market remains cautious. With a 1-year total shareholder return of -49% but a strong 3-year total return of 88%, longer-term volatility has been substantial and momentum is still cooling off.

If Redcare’s shifting fortunes have you curious about other themes shaping today’s market, this could be the right moment to discover fast growing stocks with high insider ownership

With momentum slowing and shares trading at a deep discount to analyst targets, the big question is whether Redcare Pharmacy is undervalued at current levels or if the market is already factoring in expectations for brighter days ahead.

Most Popular Narrative: 53.3% Undervalued

Redcare Pharmacy's narrative-implied fair value of €153.75 is 53.3% above yesterday's closing price of €71.8. This points to a notable divergence between market perceptions and the consensus of leading analysts. Investors are left wondering what significant business shifts or assumptions could drive such a wide gap.

Ongoing regulatory modernization in Germany and recent Supreme Court rulings are further opening the prescription drug (Rx) market to Redcare Pharmacy. This is enabling sustained market share gains and improving revenue visibility as Rx digital adoption accelerates post-2026 (impact: revenue growth).

Want to know the secret behind this premium? Analysts are highlighting a combination of surging digital adoption, strong operating leverage, and the potential for future earnings growth. The key drivers behind the target valuation come from evolving projections and shifting consensus.

Result: Fair Value of €153.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if regulatory changes stall or competition intensifies, Redcare Pharmacy’s growth story could face significant hurdles in the coming years.

Find out about the key risks to this Redcare Pharmacy narrative.

Another View: What Do Sales Ratios Say?

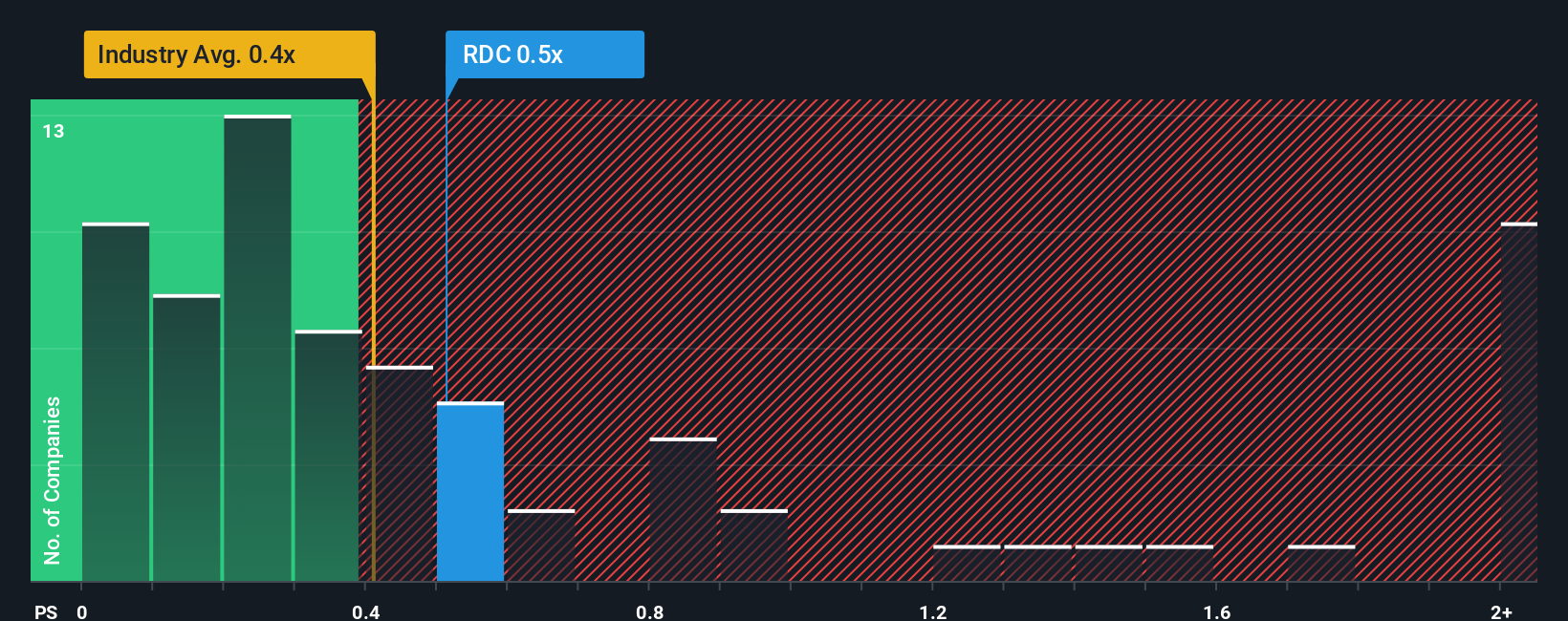

Looking at value through the lens of the price-to-sales ratio tells a different story. Redcare Pharmacy’s ratio of 0.5x is slightly higher than both the industry average (0.4x) and its own fair ratio (0.4x), suggesting shares are not as deeply discounted as some think. Does this soften the upside case?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redcare Pharmacy Narrative

If you see the story differently or want to dig into the numbers yourself, building your own take is quick and straightforward. Do it your way

A great starting point for your Redcare Pharmacy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock fresh opportunities by expanding your search beyond the usual suspects. Missing out now could mean passing up on tomorrow’s standout winners.

- Find game-changing value prospects by scanning these 839 undervalued stocks based on cash flows, which stand out for strong fundamentals and real cash flow opportunities.

- Tap into emerging technologies and future trends with these 26 AI penny stocks, where innovative companies are pushing the boundaries of artificial intelligence.

- Catch robust, income-generating stocks by reviewing these 24 dividend stocks with yields > 3%, offering attractive yields and the potential for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates the online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives