Revenues Tell The Story For tonies SE (FRA:TNIE) As Its Stock Soars 33%

The tonies SE (FRA:TNIE) share price has done very well over the last month, posting an excellent gain of 33%. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

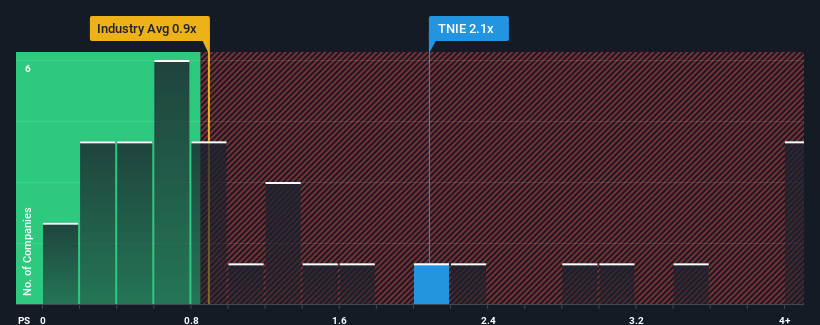

Following the firm bounce in price, when almost half of the companies in Germany's Leisure industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider tonies as a stock probably not worth researching with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for tonies

How tonies Has Been Performing

Recent times have been advantageous for tonies as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think tonies' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as tonies' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. The latest three year period has also seen an excellent 168% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 28% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.8% per annum, which is noticeably less attractive.

With this information, we can see why tonies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

tonies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into tonies shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for tonies with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:TNIE

tonies

Through its subsidiaries, develops, produces, and distributes audio systems in Germany, the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives