- Germany

- /

- Consumer Durables

- /

- XTRA:SUR

Surteco Group (XTRA:SUR) Losses Keep Growing, Challenging Hopes for Fast Profitability Turnaround

Reviewed by Simply Wall St

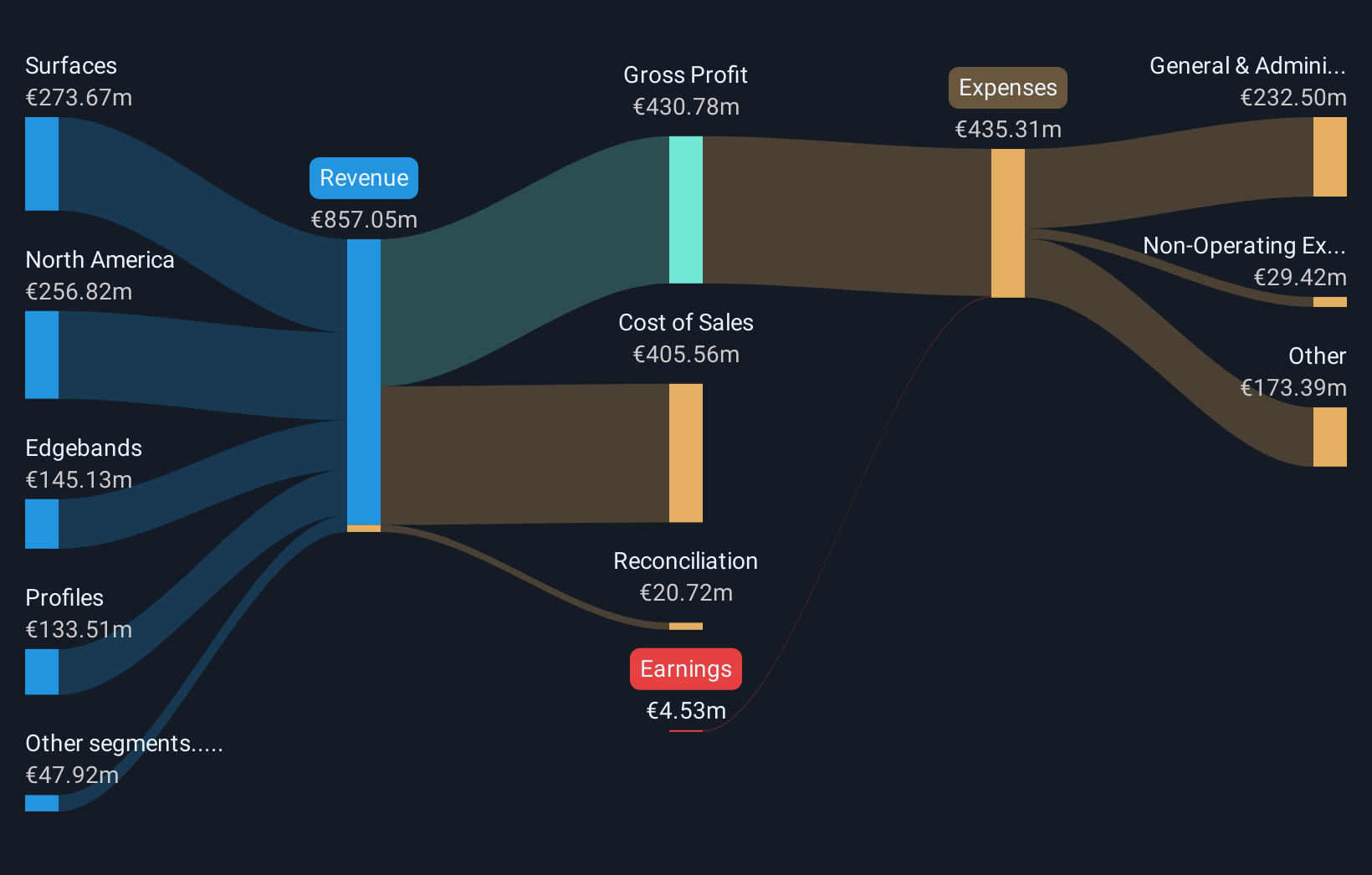

Surteco Group (XTRA:SUR) remains unprofitable, recording losses that have increased at an average annual rate of 41.1% over the past five years. Despite revenue growth forecasts of 3.3% per year, which lag behind the broader German market’s 6.1%, analysts expect earnings to make a turnaround, with robust projected growth of 58.23% per year and a return to profitability anticipated within the next three years. With shares trading at €12.4, a discount to the estimated fair value of €18.61, and a Price-To-Sales Ratio notably below industry peers, the surprisingly low valuation provides some potential upside. However, the improving net profit margin that investors might hope to see has not yet materialized in the financials.

See our full analysis for Surteco Group.The numbers tell one story, but the real test comes when we weigh them against the most-discussed narratives. Some expectations might be confirmed, while others may face a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Growing at 41% Per Year Challenge Fast Turnaround Story

- Annual losses have risen sharply, with Surteco's net loss increasing by 41.1% per year over the past five years. This highlights that bottom-line deterioration continued despite recent optimism for a turnaround.

- What is surprising is that, even as investors hope for rapid improvement, the financials do not yet show a narrowing net loss. This development heavily challenges optimism about an imminent return to profitability.

- Profitability is forecast to arrive within three years. However, the increasing loss pace signals significant work ahead before that inflection point can occur.

- Forecasted earnings growth of 58.23% per year stands in sharp contrast to recent performance. This raises questions about whether expectations are overly aggressive given persistent losses.

Dividend Risk Remains as Financial Position Weakens

- Surteco’s current financial health is cause for concern, and the dividend is flagged as unsustainable according to the EDGAR summary. This introduces an additional risk dimension for yield-seeking investors.

- Critics highlight that the ongoing unprofitability and weak balance sheet directly threaten the sustainability of future dividends, making it difficult to rely on Surteco for steady income.

- The lack of demonstrated improvement in net profit margin means that the company may have to prioritize cash preservation over returning capital to shareholders.

- With losses mounting and no solid evidence of margin recovery, management faces a tough tradeoff between rewarding shareholders and stabilizing the business.

Shares Trade at a Deep Discount to DCF Fair Value

- The stock trades at €12.40, well below the DCF fair value of €18.61 and significantly under the European Consumer Durables industry average Price-To-Sales Ratio of 0.7x. This indicates Surteco is valued at just 0.2x sales.

- The AI-generated narrative points to a rare setup where robust upside potential exists due to the valuation gap, even as short-term fundamentals remain unproven.

- Analysts project earnings growth and multiple expansion as catalysts that could narrow the valuation gap, particularly if a return to profitability takes hold as expected.

- However, the persistent pattern of losses may explain why the discount persists. Market participants are clearly waiting for tangible financial improvement before re-rating the shares higher.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Surteco Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Surteco's ongoing losses, eroding net profit margins, and a fragile dividend highlight significant financial health concerns that could impact both growth and income investors.

If you want confidence in a company’s resilience, check out solid balance sheet and fundamentals stocks screener (1971 results) for businesses prioritizing strong balance sheets and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SUR

Surteco Group

Engages in the development, production, and sale of coated surface materials based on paper and plastic in Germany, rest of Europe, the United States, Asia, Australia, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives