Puma (XTRA:PUM) Losses Worsen, Testing Faith in Profit Turnaround Narratives

Reviewed by Simply Wall St

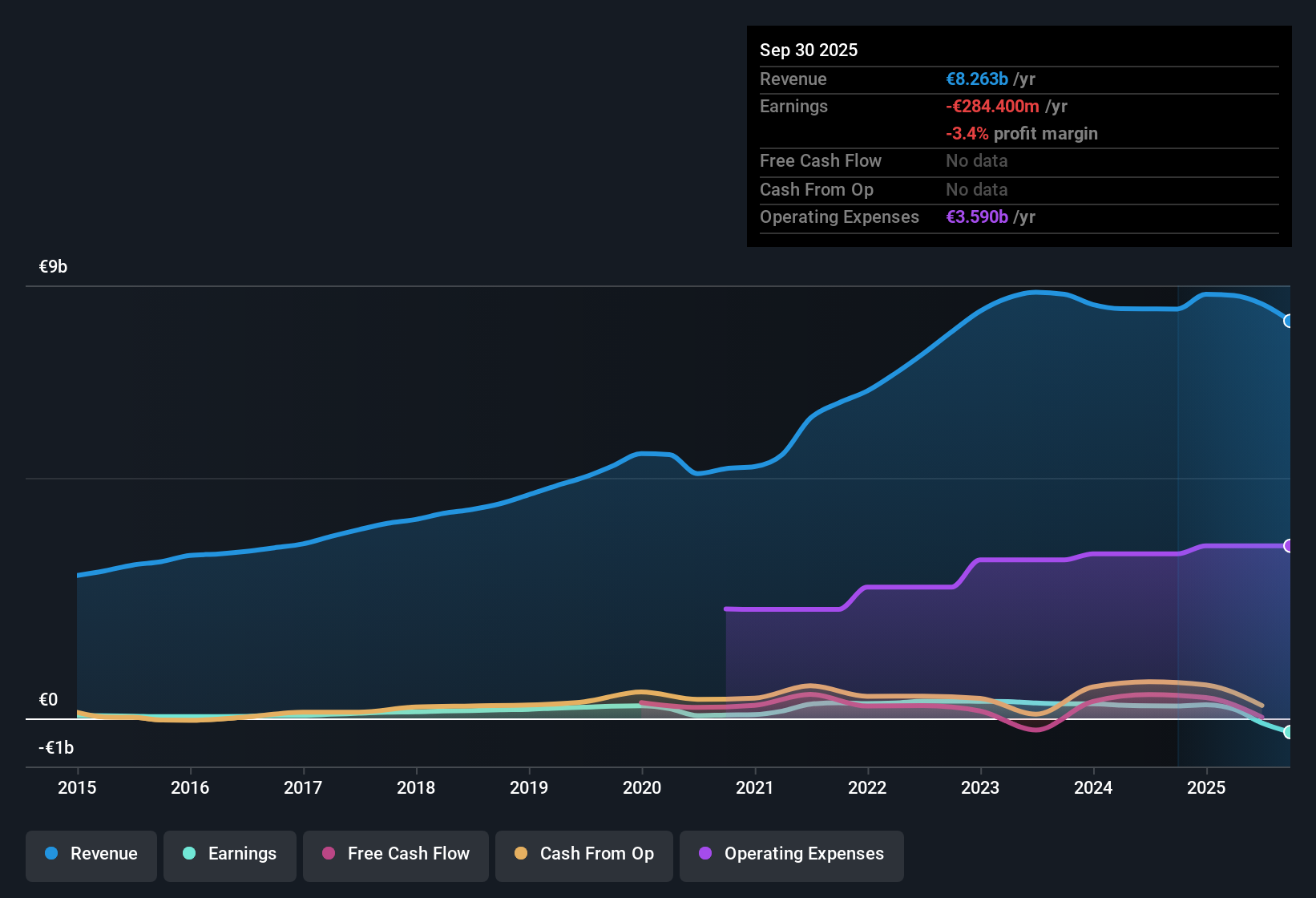

Puma (XTRA:PUM) reported earnings losses that have deepened at an average rate of 11.8% per year over the last five years. Revenue is currently forecast to grow 3.1% annually, which is well behind the German market’s anticipated 6.1% pace. Looking ahead, analysts expect profitability within the next three years. Earnings are projected to grow at a rapid 76.3% per year if those forecasts hold.

See our full analysis for PUMA.Next, we will see how these headline numbers compare to the most widely followed narratives for Puma. This is where we find out which views get reinforced and which may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Share Price Sits Below DCF Fair Value

- Puma’s current share price of €18.42 trades just under its DCF fair value of €18.62. This 1% discount offers only a mild margin of safety but still positions Puma as attractively priced by valuation metrics.

- Puma’s valuation looks compelling compared to its peers and the broader European luxury industry.

- The company’s price-to-sales ratio sits at 0.3x, so investors are paying considerably less for each euro of sales than the average for both direct peers (0.9x) and the wider industry (0.7x). This heavily supports investors focusing on value metrics to underpin the bullish case.

- This discount comes alongside ongoing unprofitability, so the market appears to be weighing Puma’s weaker financial condition against its attractive valuation multiples and possible profits ahead.

Financial Health Concerns Persist

- Puma’s financial position is flagged as “not good” in recent filings, and its dividend is considered unsustainable. Share price stability has also been lacking over the past three months, each factor highlighting short-term risks to balance sheet strength and capital returns.

- Skeptics point to these vulnerabilities as central to the bearish investment case.

- The lack of both stable financial footing and reliable dividends raises ongoing questions about near-term resilience, even as revenue is forecast to grow at 3.1% per year.

- While forecasters anticipate profitability within three years, bears emphasize that recent losses have widened annually at 11.8%. This underscores that operational turnaround is not guaranteed in the short run.

Discount to Peers Offers Entry Point, but Growth Lagging

- Investors seeking value will note Puma’s current price-to-sales of 0.3x versus the peer average of 0.9x. However, its annualized revenue growth rate of 3.1% lags the German market’s 6.1% forecast.

- The main argument for upside rests on potential profit acceleration if Puma delivers on forecasts.

- If profitability materializes as forecast within three years, with earnings growth projected at 76.3% per year, the low market valuation could be a catalyst for outperformance despite slower revenue momentum.

- But actual delivery on this profit turnaround will be closely scrutinized because recent trends have shown widening losses. Investors face a clear tension between low valuation multiples and operational risks.

See what the community is saying about PUMA

See what the community is saying about PUMANext Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PUMA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Puma’s weak financial footing, unsustainable dividend, and recent widening losses highlight major concerns about its short-term resilience and balance sheet strength.

If you want greater confidence in a company’s fundamentals, check out solid balance sheet and fundamentals stocks screener (1984 results) to find businesses with stronger balance sheets and more reliable financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PUM

PUMA

Engages in the development and sale of sports and sports lifestyle products in Germany, rest of Europe, the United States, North America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives