- Ever wondered whether adidas stock is a good deal at today's price? Let’s break down what long-term investors and value seekers should know right now.

- The stock has had a bumpy ride lately, falling 19.6% over the past month and down 35.0% year-to-date. However, it is still up 27.2% for long-term holders over the past three years.

- Recent headlines point to evolving industry trends and shifting consumer preferences, both of which have put extra pressure on shares. In particular, discussions around global supply chains and competition in the sportswear segment have drawn even more attention to adidas’s recent moves.

- If you’re curious about valuation, adidas scores a 4 out of 6 based on our latest checks for undervaluation. We will look at exactly how this score is calculated using different valuation methods. Stick with us to the end for a perspective on valuation you might not see anywhere else.

Approach 1: adidas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts them back to today’s value. This approach estimates what those future earnings are worth in present terms and is widely used by analysts to estimate the real or "intrinsic" value of a stock.

For adidas, the latest report shows its trailing twelve-month Free Cash Flow stands at €364 million. Looking ahead, analysts forecast growing cash flows, with projections reaching €4.4 billion by 2028. Further estimates suggest cash flows could approach €9.0 billion by 2035, based on a combination of analyst estimates and extrapolated growth rates. All these figures are measured in euros, the company's reporting currency.

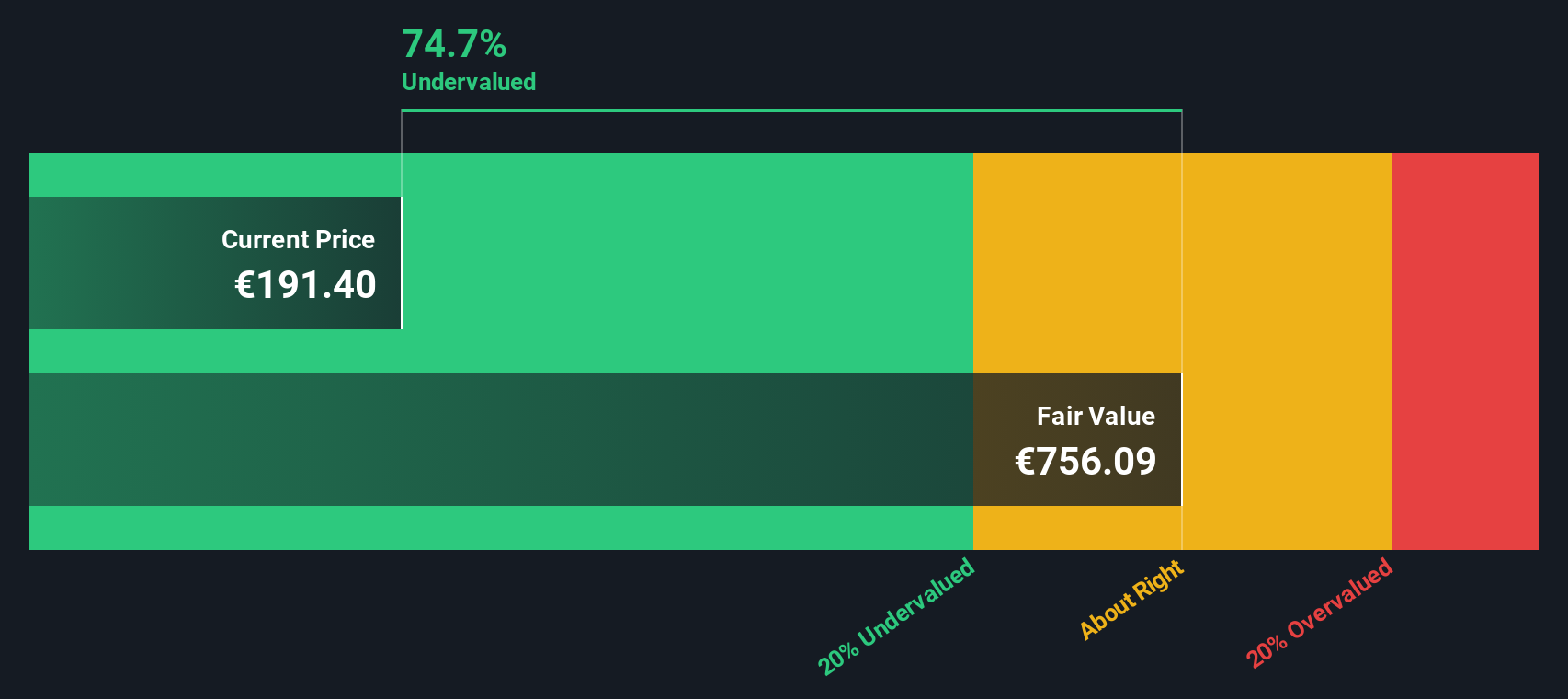

Using the 2 Stage Free Cash Flow to Equity model, Simply Wall St calculates an intrinsic value for adidas at €731.80 per share. This result compares favorably to its current market price and implies a discount of 79.0%. In other words, the DCF model indicates that adidas shares may be significantly undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests adidas is undervalued by 79.0%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: adidas Price vs Earnings

For companies like adidas that generate steady profits, the Price-to-Earnings (PE) ratio is a go-to way for investors to gauge value. It tells you how much you are paying today for each euro of current earnings, making it especially relevant for established, profitable businesses.

However, not all PE ratios are created equal. Higher growth prospects or lower risk usually justify a higher PE, while slower-growing or riskier companies tend to trade at a discount. This means you cannot look at the PE ratio in isolation; context matters.

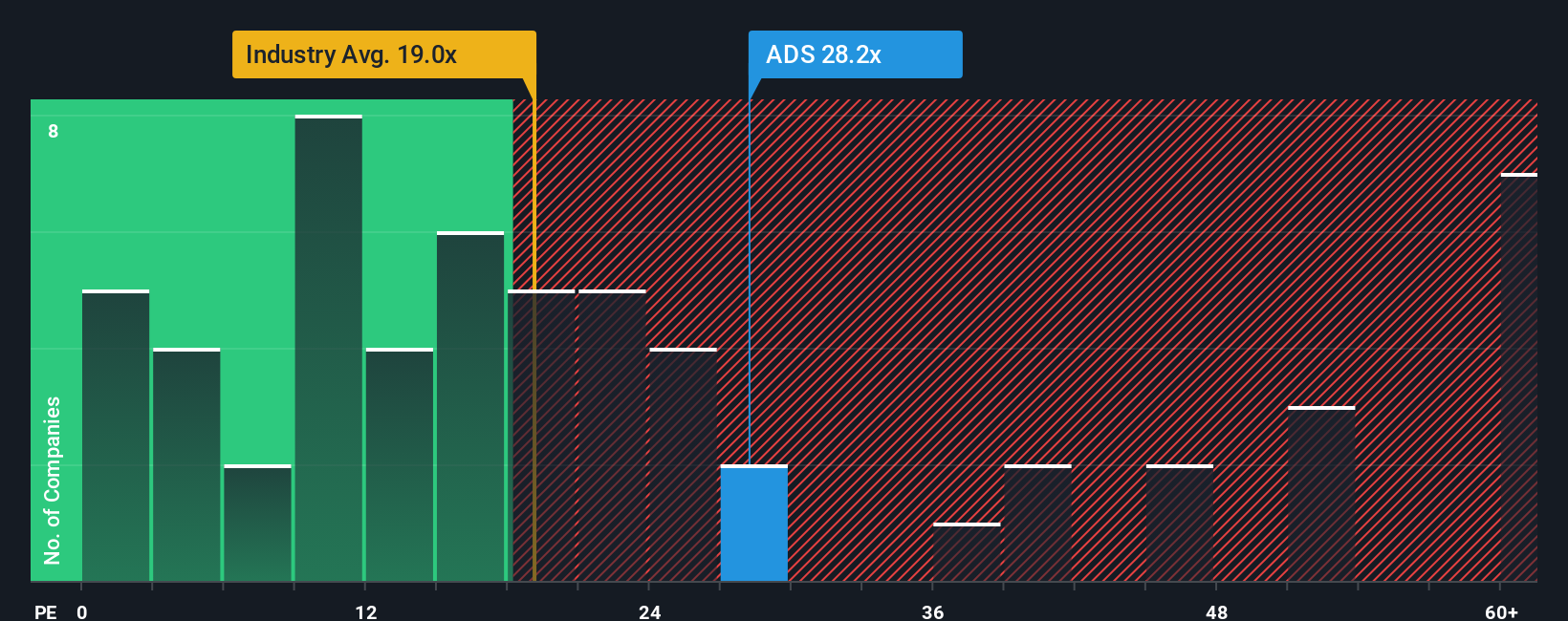

At the moment, adidas trades on a PE ratio of 22.7x. That is above the Luxury industry average of 17.5x, but below the peer group average of 30.4x. To move beyond simple comparisons, Simply Wall St uses a "Fair Ratio" in this case, 21.5x, which is calculated using adidas’s unique earnings growth outlook, profit margin, industry positioning, market cap and risk profile.

The Fair Ratio is a more comprehensive benchmark for value, since it factors in adidas’s own strengths and challenges, not just market averages. By comparing adidas’s current 22.7x PE with its Fair Ratio of 21.5x, the stock appears only slightly more expensive than its fundamentals suggest.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1420 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your adidas Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives.

A Narrative is your personalized view of a company, where you connect its story and outlook to your own financial forecast, such as what you think adidas’s fair value, future revenue, earnings, or profit margins could be based on your expectations and research.

Instead of focusing solely on historical ratios or analyst targets, Narratives link the company’s bigger picture to concrete numbers, guiding you from story to forecast to a fair value that makes sense for you.

With Simply Wall St, millions of investors use Narratives every day on the Community page. This empowers you to craft and update your own view as new information appears, whether from company news, earnings reports, or evolving market dynamics.

This approach makes it easier to decide when to buy, hold, or sell a stock by directly comparing your Narrative-driven Fair Value with the current market Price.

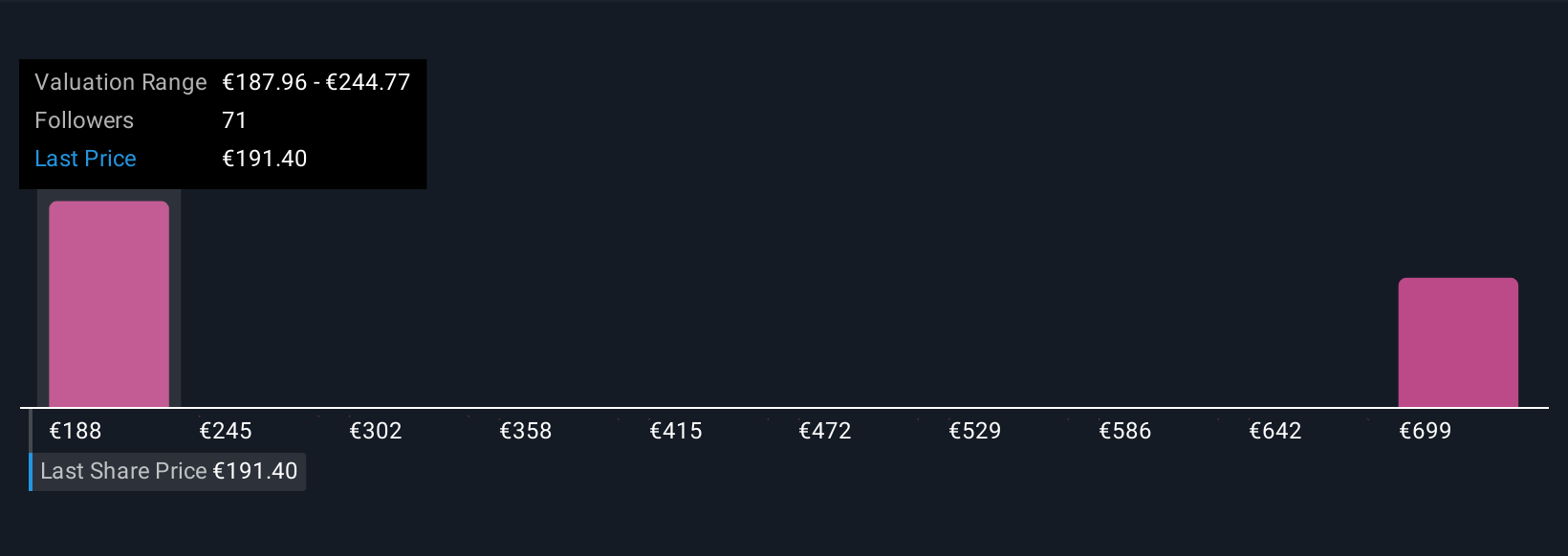

For example, recent adidas analyst Narratives range from bullish scenarios, such as double-digit growth, rising margins, and a fair value of €280 per share, to more cautious outlooks with lower growth, margin pressures, and fair values as low as €182. This allows you to see exactly how different perspectives drive real-world investing decisions.

Do you think there's more to the story for adidas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets a range of athletic and sports lifestyle products in Europe, Greater China, Japan, South Korea, Latin America, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives