- Germany

- /

- Commercial Services

- /

- DB:CWC

How Should Investors React To CEWE Stiftung & Co. KGaA's (FRA:CWC) CEO Pay?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Christian Friege is the CEO of CEWE Stiftung & Co. KGaA (FRA:CWC). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for CEWE Stiftung KGaA

How Does Christian Friege's Compensation Compare With Similar Sized Companies?

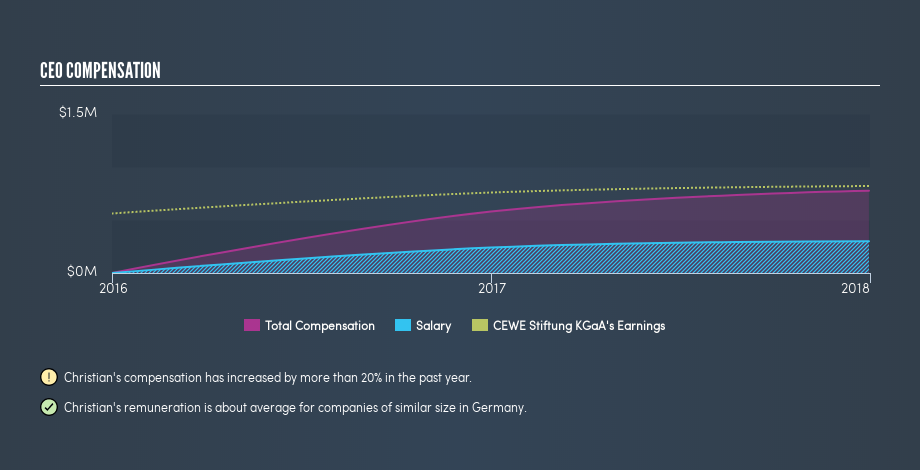

Our data indicates that CEWE Stiftung & Co. KGaA is worth €595m, and total annual CEO compensation is €776k. (This number is for the twelve months until December 2017). While we always look at total compensation first, we note that the salary component is less, at €300k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of €356m to €1.4b. The median total CEO compensation was €1.1m.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at CEWE Stiftung KGaA has changed over time.

Is CEWE Stiftung & Co. KGaA Growing?

On average over the last three years, CEWE Stiftung & Co. KGaA has grown earnings per share (EPS) by 8.7% each year (using a line of best fit). Its revenue is up 9.1% over last year.

I'm not particularly impressed by the revenue growth, but I'm happy with the modest EPS growth. Considering these factors I'd say performance has been pretty decent, though not amazing. Shareholders might be interested in this free visualization of analyst forecasts.

Has CEWE Stiftung & Co. KGaA Been A Good Investment?

I think that the total shareholder return of 60%, over three years, would leave most CEWE Stiftung & Co. KGaA shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

CEWE Stiftung & Co. KGaA is currently paying its CEO below what is normal for companies of its size.

Christian Friege receives relatively low remuneration compared to similar sized companies. And the returns to shareholders were great, over the last few years. Although we could see higher growth, we'd argue the remuneration is modest, based on these observations. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling CEWE Stiftung KGaA (free visualization of insider trades).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:CWC

CEWE Stiftung KGaA

Operates as a photo service and online printing provider in Germany and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success