- Germany

- /

- Commercial Services

- /

- XTRA:WAH

Wolftank Group AG's (ETR:WAH) Share Price Is Still Matching Investor Opinion Despite 30% Slump

Wolftank Group AG (ETR:WAH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

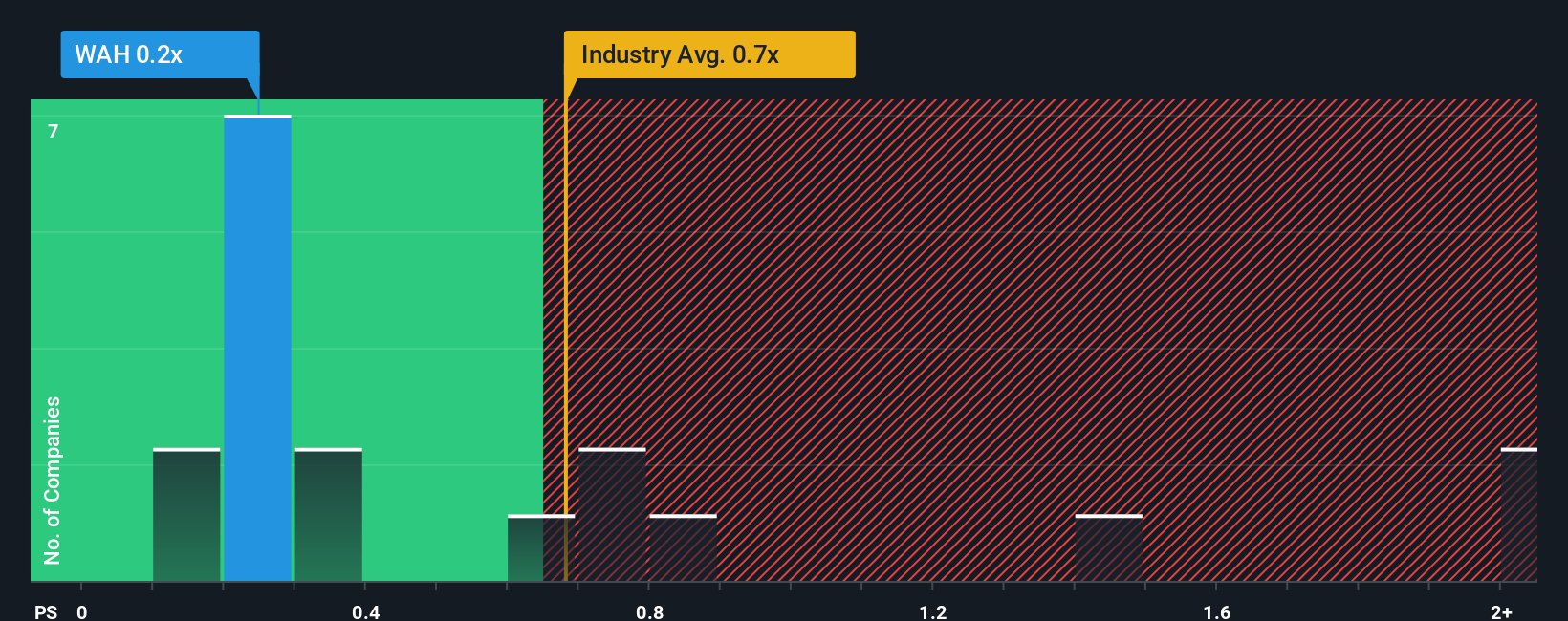

In spite of the heavy fall in price, there still wouldn't be many who think Wolftank Group's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Germany's Commercial Services industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Wolftank Group

How Has Wolftank Group Performed Recently?

With revenue growth that's superior to most other companies of late, Wolftank Group has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Wolftank Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Wolftank Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wolftank Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. The strong recent performance means it was also able to grow revenue by 161% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.1% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.8% per annum, which is not materially different.

With this in mind, it makes sense that Wolftank Group's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Wolftank Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Wolftank Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Commercial Services industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Wolftank Group that you need to be mindful of.

If you're unsure about the strength of Wolftank Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wolftank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WAH

Wolftank Group

Provides environmental remediation and refueling solutions for renewable energies worldwide.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success