- Germany

- /

- Commercial Services

- /

- XTRA:TTK

TAKKT (XTRA:TTK) Losses Worsen, Valuation Gap Widens Versus Turnaround Expectations

Reviewed by Simply Wall St

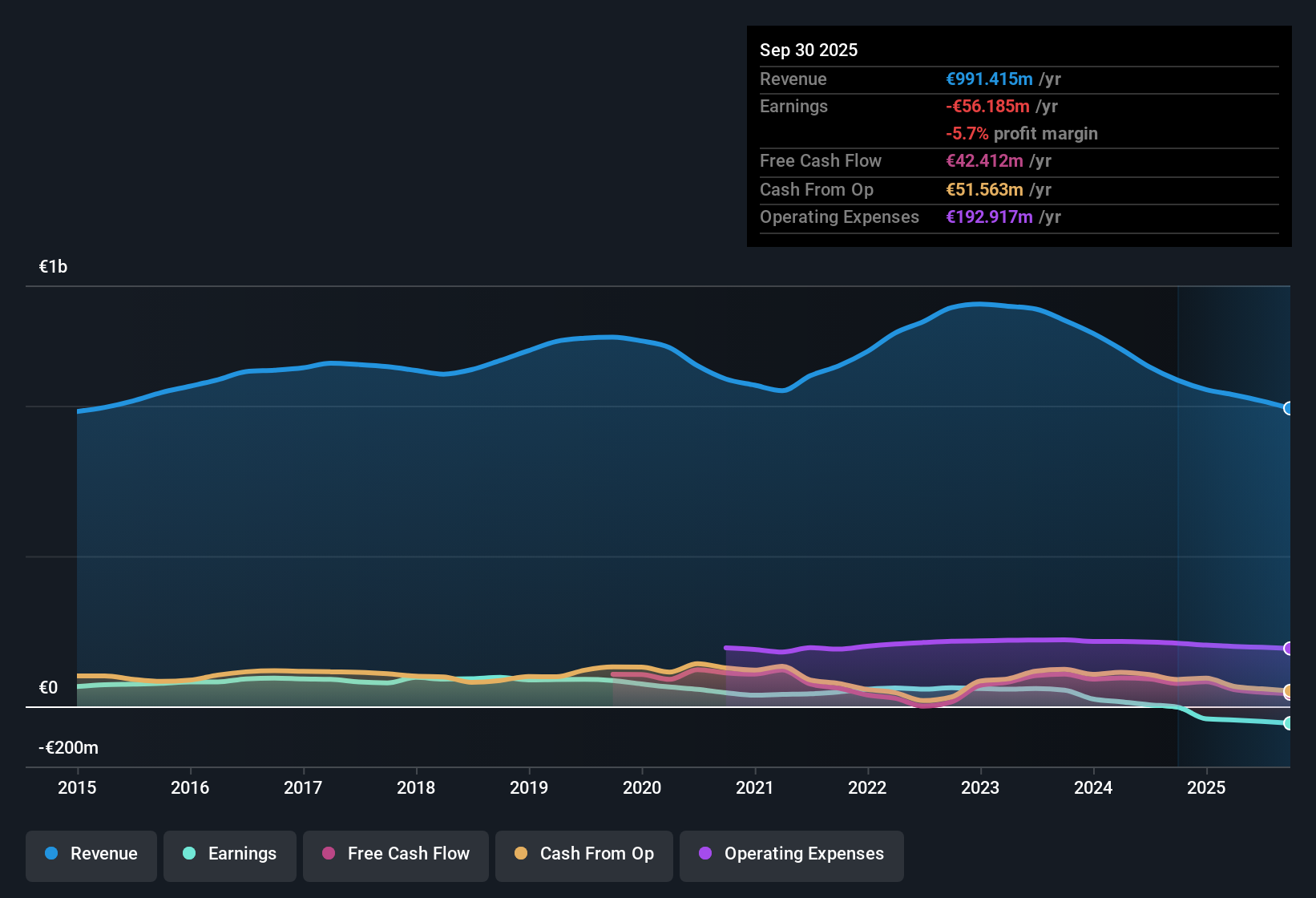

TAKKT (XTRA:TTK) remains in the red, with losses increasing at an annualized rate of 46.5% over the past five years. Despite slower revenue growth at 3.7% per year compared to the German market’s 6.4%, analysts expect earnings to surge 119.42% per year and predict a return to profitability within three years. With a price-to-sales ratio of 0.3x, trading below peer and industry averages, and a share price of €4.61 still well under fair value estimates of €15.41, the setup highlights a turnaround story that is hard for value-focused investors to ignore. However, concerns about dividend sustainability remain on the table.

See our full analysis for TAKKT.Next we’ll see how these headline figures measure up to the dominant narratives shaping market sentiment and investor expectations for TAKKT.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Widen Despite Turnaround Forecast

- Over the past five years, TAKKT's annualized loss rate increased by 46.5%, far outpacing its projected return to profitability within the next three years.

- The prevailing market view highlights an intriguing disconnect. While steep losses have been the norm, the forecast of 119.42% annualized earnings growth creates real tension between the recent financial track record and renewed optimism for a turnaround.

- Despite these aggressive growth expectations, the fact that revenue growth lags the German market average (3.7% vs 6.4%) suggests execution risk remains high, as management must prove it can actually drive the projected earnings rebound.

Dividend Sustainability Under Scrutiny

- Investors are watching closely as concerns mount over dividend stability, especially in a historically loss-making environment with losses accelerating by 46.5% per year.

- The prevailing market view sees dividend sustainability as a sticking point. TAKKT’s attractive value and profitability forecasts may not fully offset caution if cash outflows persist or earnings do not materialize as expected.

- With no evidence yet of turnaround in the payout, management’s ability to balance reward and risk on dividends will shape investor confidence moving forward.

Valuation: Discount to DCF Fair Value

- TAKKT trades at €4.61 per share, which is not only well below its DCF fair value of €15.41, but also cheaper than both peer (0.4x) and industry (0.6x) price-to-sales ratios at just 0.3x.

- The prevailing market view heavily supports the value case here. The gap between trading price and fair value signals that the market may be slow to price in the turnaround story, offering an entry point for investors willing to look past short-term losses.

- On top of the DCF discount, trading at a lower multiple than peers and the wider industry raises the stakes. Should the forecasted profitability materialize, re-rating potential could be significant.

If TAKKT closes the gap to its fair value as profitability improves, the upside could be dramatic for patient investors. 📊 Read the full TAKKT Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TAKKT's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TAKKT's inconsistent earnings and slow revenue growth, along with doubts about its ability to sustain dividends, present clear risks for income-focused investors.

If dividend reliability is your priority, use these these 1995 dividend stocks with yields > 3% to target stocks delivering healthier and more stable yields above 3% even through challenging times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAKKT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TTK

TAKKT

Operates as a B2B direct marketing company for business equipment in Europe and North America.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives