- Germany

- /

- Commercial Services

- /

- XTRA:TTK

Shareholders Will Most Likely Find TAKKT AG's (ETR:TTK) CEO Compensation Acceptable

Key Insights

- TAKKT's Annual General Meeting to take place on 17th of May

- Total pay for CEO Maria Zesch includes €450.0k salary

- Total compensation is similar to the industry average

- TAKKT's total shareholder return over the past three years was 22% while its EPS was down 27% over the past three years

Despite positive share price growth of 22% for TAKKT AG (ETR:TTK) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 17th of May. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for TAKKT

How Does Total Compensation For Maria Zesch Compare With Other Companies In The Industry?

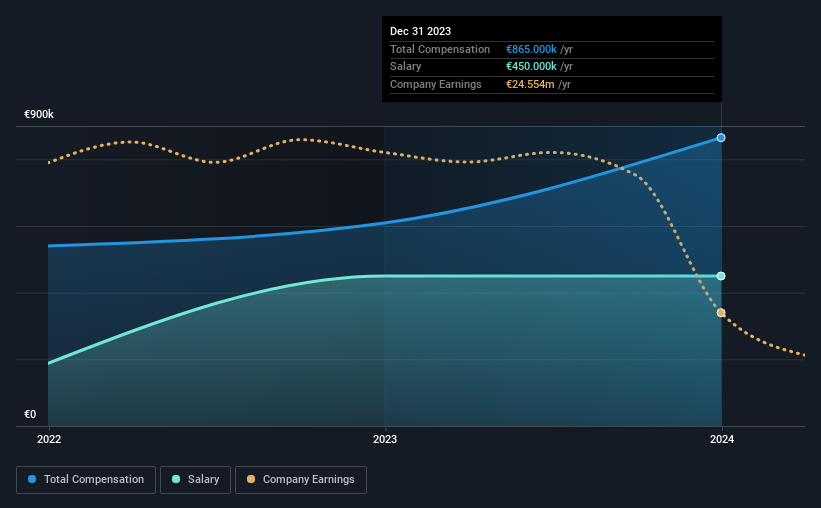

According to our data, TAKKT AG has a market capitalization of €864m, and paid its CEO total annual compensation worth €865k over the year to December 2023. Notably, that's an increase of 42% over the year before. We note that the salary of €450.0k makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the German Commercial Services industry with market capitalizations ranging between €371m and €1.5b had a median total CEO compensation of €846k. So it looks like TAKKT compensates Maria Zesch in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €450k | €450k | 52% |

| Other | €415k | €159k | 48% |

| Total Compensation | €865k | €609k | 100% |

On an industry level, around 56% of total compensation represents salary and 44% is other remuneration. There isn't a significant difference between TAKKT and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

TAKKT AG's Growth

Over the last three years, TAKKT AG has shrunk its earnings per share by 27% per year. In the last year, its revenue is down 11%.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has TAKKT AG Been A Good Investment?

TAKKT AG has served shareholders reasonably well, with a total return of 22% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for TAKKT that investors should be aware of in a dynamic business environment.

Important note: TAKKT is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if TAKKT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TTK

TAKKT

Operates as a B2B direct marketing company for business equipment in Europe and North America.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success