- Germany

- /

- Professional Services

- /

- XTRA:BDT

Bertrandt (XTRA:BDT) Q4 Loss Narrows, Challenging Long‑Term Bearish Profitability Narrative

Reviewed by Simply Wall St

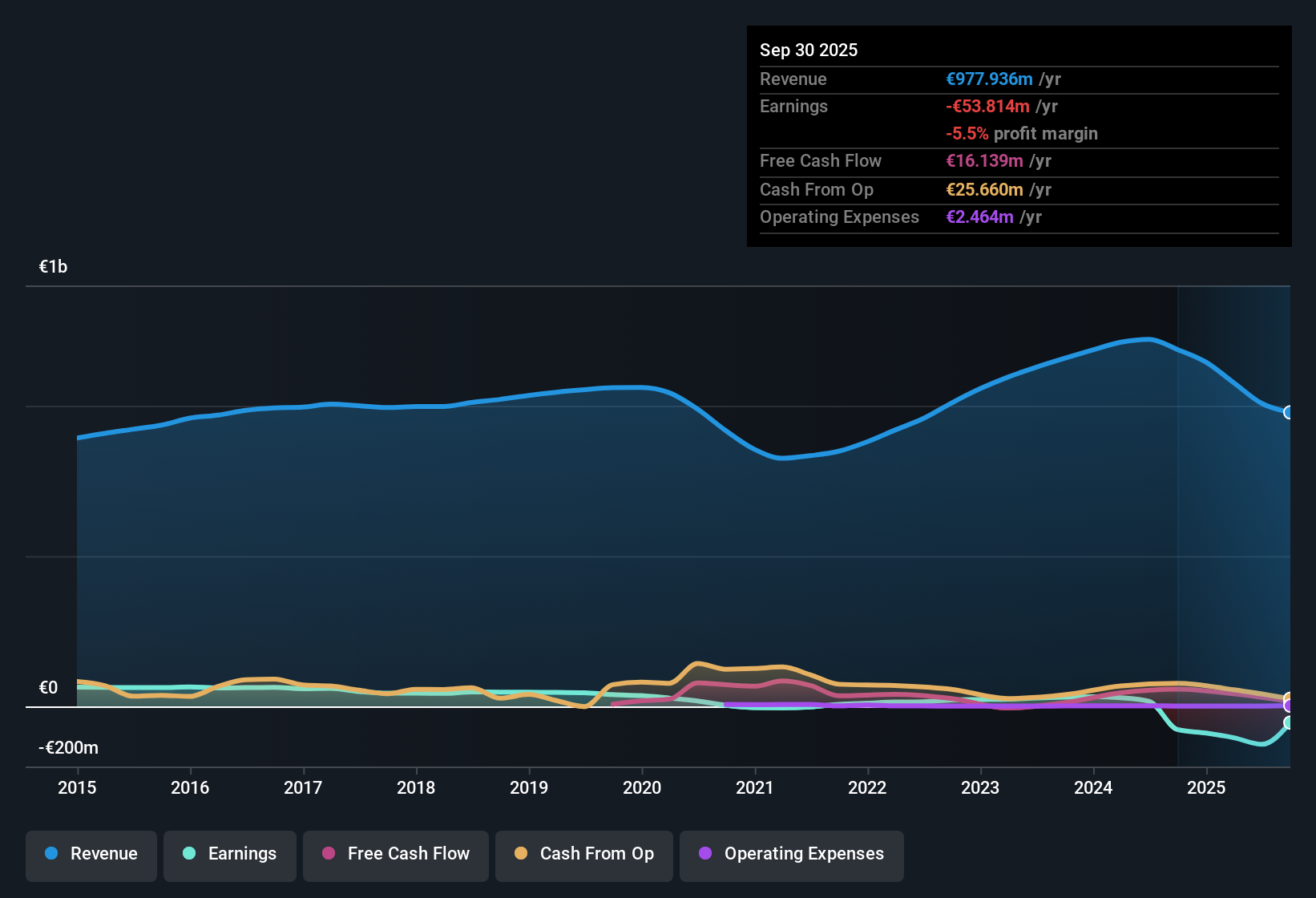

Bertrandt (XTRA:BDT) has wrapped up FY 2025 with fourth quarter revenue of €235.9 million and a basic EPS of -€0.99, underscoring that the headline story is still about losses rather than profit. Over the past few quarters, the company has seen revenue move from €266.5 million in Q1 2025 to €249.9 million in Q2, €225.6 million in Q3 and then €235.9 million in Q4. EPS stayed negative in each period, keeping margins under pressure and investors focused on how quickly the business can stabilize profitability.

See our full analysis for Bertrandt.With the latest numbers on the table, the next step is to see how this margin picture lines up with the dominant narratives around Bertrandt’s trajectory and what investors expect from here.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow on Trailing Basis

- On a trailing 12 month view, net loss shrank from €126.3 million at Q3 2025 to €53.8 million by Q4, while EPS moved from -€12.50 to -€5.32 over the same span.

- Bears focus on the company being unprofitable for five years with losses increasing about 51.5 percent per year, yet this latest trailing step down in losses

- contrasts with the longer term widening loss trend and suggests recent quarters have not deteriorated in line with that five year pace

- still leaves margins in negative territory, as Q4 2025 net income was -€10.0 million on €236.0 million of revenue.

Revenue Trails Market Pace

- Bertrandt is growing revenue around 4.8 percent per year on a trailing basis, below the 6.3 percent growth rate cited for the wider German market.

- Critics highlight that slower top line growth and persistent losses weaken the case for a quick operational rebound

- because trailing 12 month revenue slipped from €1.19 billion at 2024 Q4 to €978.0 million by 2025 Q4 while earnings stayed negative across all reported quarters

- and quarterly revenue has drifted from €266.5 million in Q1 2025 to €235.9 million in Q4, reinforcing that growth is not yet outpacing the broader market.

Deep Discount Versus DCF Value

- The current share price of €18.24 is far below the stated DCF fair value of about €58.76 and reflects a low 0.2 times price to sales multiple versus 0.7 times for the European professional services industry and 1.5 times for peers.

- Bullish investors argue that forecasts for 112.27 percent annual earnings growth and a return to profitability within three years make this valuation gap attractive

- because the stock trades well below the DCF fair value while trailing 12 month losses have already narrowed from €126.3 million to €53.8 million between Q3 and Q4 2025

- yet the same data set flags that debt is not well covered by operating cash flow, which could limit how quickly any forecasted earnings recovery translates into equity value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bertrandt's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Bertrandt combines shrinking but still significant losses with slower than market revenue growth and weak debt coverage, leaving its financial resilience in question.

If that vulnerability makes you uneasy, shift your focus to solid balance sheet and fundamentals stocks screener (1943 results) to find companies with stronger balance sheets, healthier cash coverage, and sturdier downside protection right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bertrandt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BDT

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion