As European markets continue to show resilience, with the STOXX Europe 600 Index and major single-country stock indexes seeing gains, investors are keenly observing opportunities across various sectors. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.65 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.78 | €67.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.08 | €65.33M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.435 | €391.99M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.88 | €75.67M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.848 | €28.4M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Voltatron (DB:VOTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Voltatron AG specializes in electronics and electromobility solutions for industrial applications both in Germany and internationally, with a market cap of €101.31 million.

Operations: Voltatron AG has not reported any specific revenue segments.

Market Cap: €101.31M

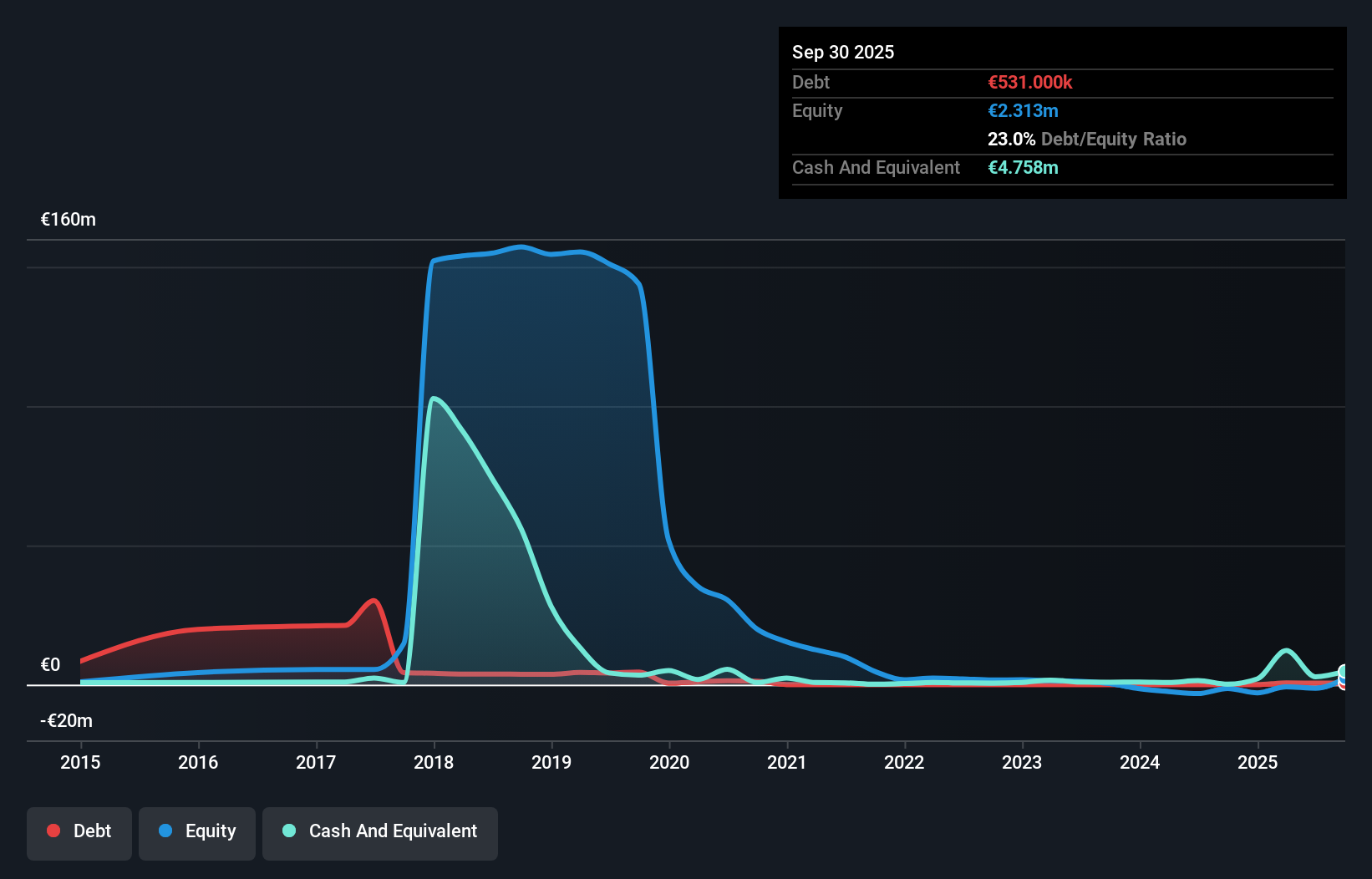

Voltatron AG, with a market cap of €101.31 million, operates in the electronics and electromobility sector. Despite being unprofitable, it has managed to maintain a stable cash runway for over three years due to positive free cash flow growth of 48% annually. Recent earnings reports show a turnaround from losses to a net income of €1.2 million for the nine months ending September 2025, with revenue reaching €16.48 million. However, challenges remain as its board is relatively inexperienced and its share price is highly volatile compared to German peers despite having more cash than debt.

- Navigate through the intricacies of Voltatron with our comprehensive balance sheet health report here.

- Evaluate Voltatron's historical performance by accessing our past performance report.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market cap of €313.07 million.

Operations: The company's revenue is primarily derived from its Window and Door Systems segment, which accounts for €724.41 million, followed by Home Protection at €38.30 million and Outdoor Living at €26.26 million.

Market Cap: €313.07M

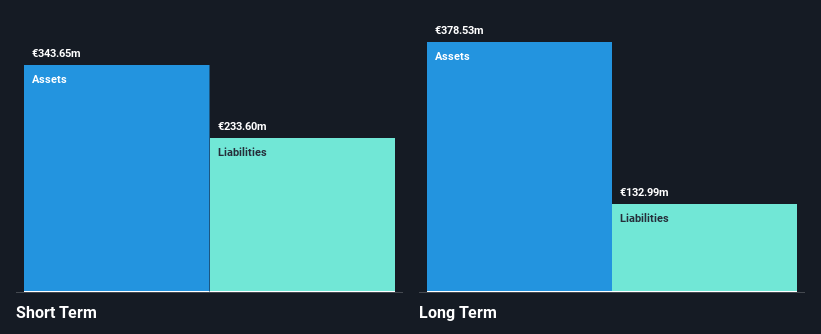

Deceuninck NV, with a market cap of €313.07 million, demonstrates financial stability through its short-term assets (€346.6M) exceeding both short-term (€228.4M) and long-term liabilities (€144.7M). The company shows promising growth potential with earnings surging 811.3% over the past year and forecasted to grow by 32.69% annually, despite a low return on equity (5.7%). Its debt management is commendable as operating cash flow covers 65.4% of its debt and the net debt to equity ratio stands at a satisfactory 33.8%. However, dividend sustainability remains uncertain due to an unstable track record.

- Take a closer look at Deceuninck's potential here in our financial health report.

- Assess Deceuninck's future earnings estimates with our detailed growth reports.

QPR Software Oyj (HLSE:QPR1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QPR Software Oyj offers services and software tools for business process and enterprise architecture development across Finland, Europe, Russia, Turkey, and internationally with a market cap of €18.56 million.

Operations: The company's revenue primarily stems from the operational development of organizations, amounting to €6.34 million.

Market Cap: €18.56M

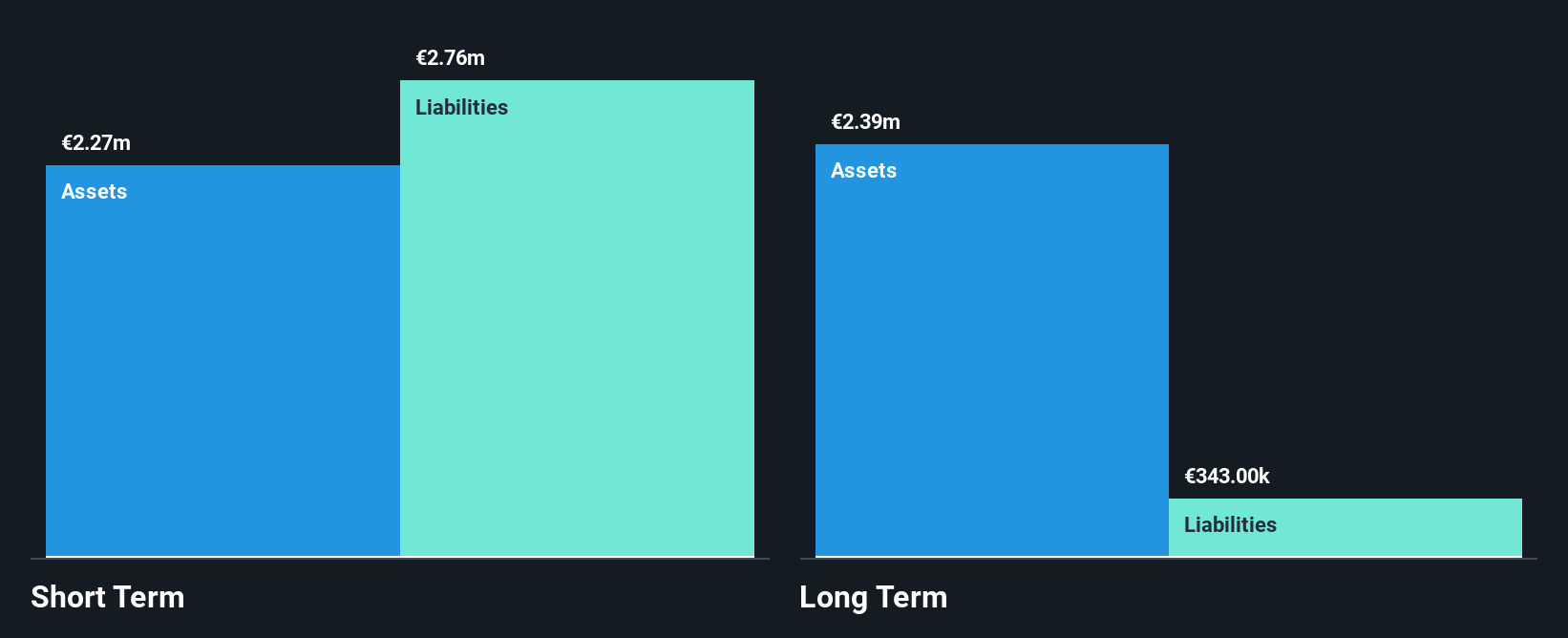

QPR Software Oyj, with a market cap of €18.56 million, is navigating the penny stock landscape by focusing on operational development services across various regions. Despite its unprofitable status and negative return on equity (-39.41%), QPR has made strides in reducing debt and losses over the past five years. Recent client acquisitions, including Santander Bank Poland and a major American wealth management firm, underscore its growing influence in process mining solutions. The launch of AI-powered Root Cause Analysis further enhances its software offerings, potentially boosting data-driven decision-making capabilities for clients worldwide.

- Unlock comprehensive insights into our analysis of QPR Software Oyj stock in this financial health report.

- Understand QPR Software Oyj's earnings outlook by examining our growth report.

Summing It All Up

- Unlock more gems! Our European Penny Stocks screener has unearthed 275 more companies for you to explore.Click here to unveil our expertly curated list of 278 European Penny Stocks.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DECB

Deceuninck

Engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026