As European markets face renewed concerns about inflated AI stock valuations, the pan-European STOXX Europe 600 Index has seen a decline, reflecting broader uncertainties in the global economic landscape. Amidst this backdrop, growth companies with high insider ownership can offer unique insights into potential investment opportunities, as insiders often invest their own capital when they believe in the long-term prospects of their businesses.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

Plejd (DB:3CA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that specializes in developing smart lighting control products and services across Sweden, Norway, Finland, the Netherlands, Germany, and internationally with a market cap of €8.46 billion.

Operations: The company's revenue segment is focused on Electronic Security Devices, generating SEK 978.99 million.

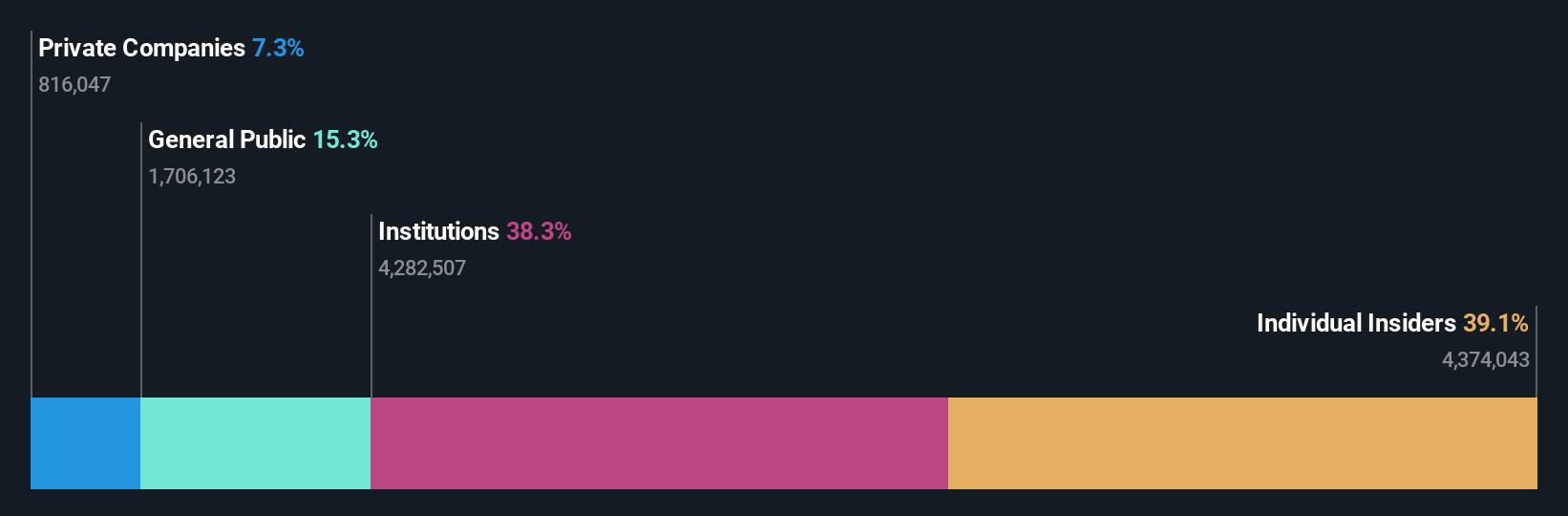

Insider Ownership: 39.1%

Earnings Growth Forecast: 31.9% p.a.

Plejd's recent financial performance highlights robust growth, with Q3 earnings and revenue significantly surpassing last year's figures. The company reported a net income of SEK 35.24 million, up from SEK 20.32 million previously, reflecting strong operational momentum. Forecasts indicate Plejd's earnings are expected to grow at an impressive rate of nearly 32% annually, outpacing the German market average. Despite substantial insider buying in the past three months, significant selling has also occurred recently.

- Dive into the specifics of Plejd here with our thorough growth forecast report.

- Our expertly prepared valuation report Plejd implies its share price may be too high.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bittium Oyj specializes in communications and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring across Finland, Germany, and the United States, with a market cap of €678.36 million.

Operations: The company's revenue segments include €29.00 million from medical, €55.50 million from defense and security, and €14.72 million from engineering services, with group functions contributing €11.08 million.

Insider Ownership: 12.4%

Earnings Growth Forecast: 39.6% p.a.

Bittium Oyj is experiencing significant growth, with earnings projected to rise 39.62% annually, outpacing the Finnish market. Recent product launches, such as the Embedded AI offering and Tough Mobile 3 smartphone, highlight its strategic focus on advanced technology solutions in security and telecommunications. The company reaffirmed its 2025 earnings guidance with expected net sales of €95 million to €105 million. Despite high volatility in share price recently, insider trading activity remains stable without substantial buying or selling.

- Click here and access our complete growth analysis report to understand the dynamics of Bittium Oyj.

- The analysis detailed in our Bittium Oyj valuation report hints at an inflated share price compared to its estimated value.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally, with a market cap of €439.94 million.

Operations: The company generates revenue from intelligent transportation systems solutions for public transportation across the globe.

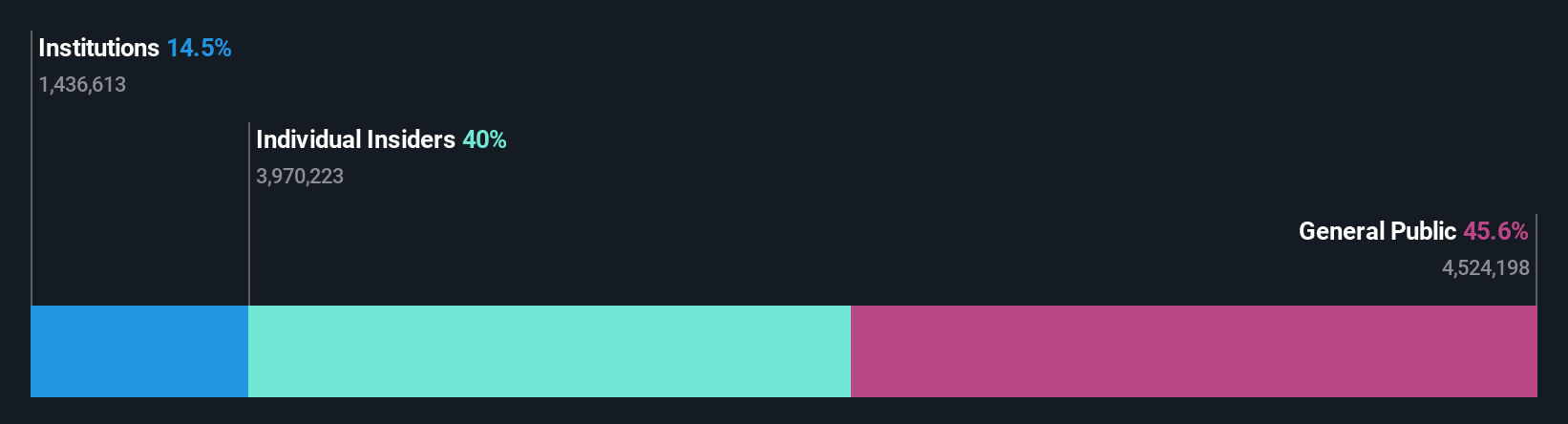

Insider Ownership: 40%

Earnings Growth Forecast: 29.6% p.a.

init innovation in traffic systems SE is poised for growth, with earnings forecast to increase 29.6% annually, surpassing the German market's growth rate. Recent third-quarter results showed sales of €85.12 million and net income of €5.45 million, both up from the previous year, indicating solid performance momentum. The company's shares are trading slightly below fair value estimates, suggesting potential upside. Insider trading activity has been stable over the past three months without significant buying or selling events.

- Unlock comprehensive insights into our analysis of init innovation in traffic systems stock in this growth report.

- According our valuation report, there's an indication that init innovation in traffic systems' share price might be on the expensive side.

Where To Now?

- Reveal the 203 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bittium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BITTI

Bittium Oyj

Provides solutions for communications and connectivity, healthcare technology products and services, and biosignal measuring and monitoring in Finland, Germany, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success