Does Vossloh (XTRA:VOS) Face a Strategic Test Amid Deutsche Bahn Project Delays?

Reviewed by Sasha Jovanovic

- Earlier this week, Kepler Cheuvreux downgraded Vossloh AG from Buy to Hold, citing valuation concerns following a strong rally and highlighting potential delays in infrastructure projects by Deutsche Bahn, Vossloh’s key customer.

- This move has drawn attention to how reliant Vossloh is on timely execution of its main customer’s investment plans, elevating focus on the near-term business outlook.

- We’ll explore how the analyst’s concerns about delays in Deutsche Bahn’s infrastructure projects shape the investment narrative for Vossloh.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Vossloh's Investment Narrative?

To be a shareholder in Vossloh, you need to be confident in the company’s position as a critical supplier to global rail networks, and its ability to benefit from long-term infrastructure spending. Until the recent Kepler Cheuvreux downgrade, much of the investment story hinged on robust contract wins, raised guidance, and a solid outlook for profit growth, despite a high price-to-earnings ratio by machinery sector standards and slowing earnings momentum. However, the downgrade, coming after a strong rally and based on concerns over project phasing at Deutsche Bahn, pushes the reliability of near-term catalysts into sharper focus. If Deutsche Bahn delays materialize, it could temporarily dampen earnings visibility and share momentum, even though analysts see this as a phasing issue, not a sign of deeper trouble for Vossloh’s fundamentals. The catalyst-risk balance has shifted, with execution risk on contracts now a bigger talking point than just valuation.

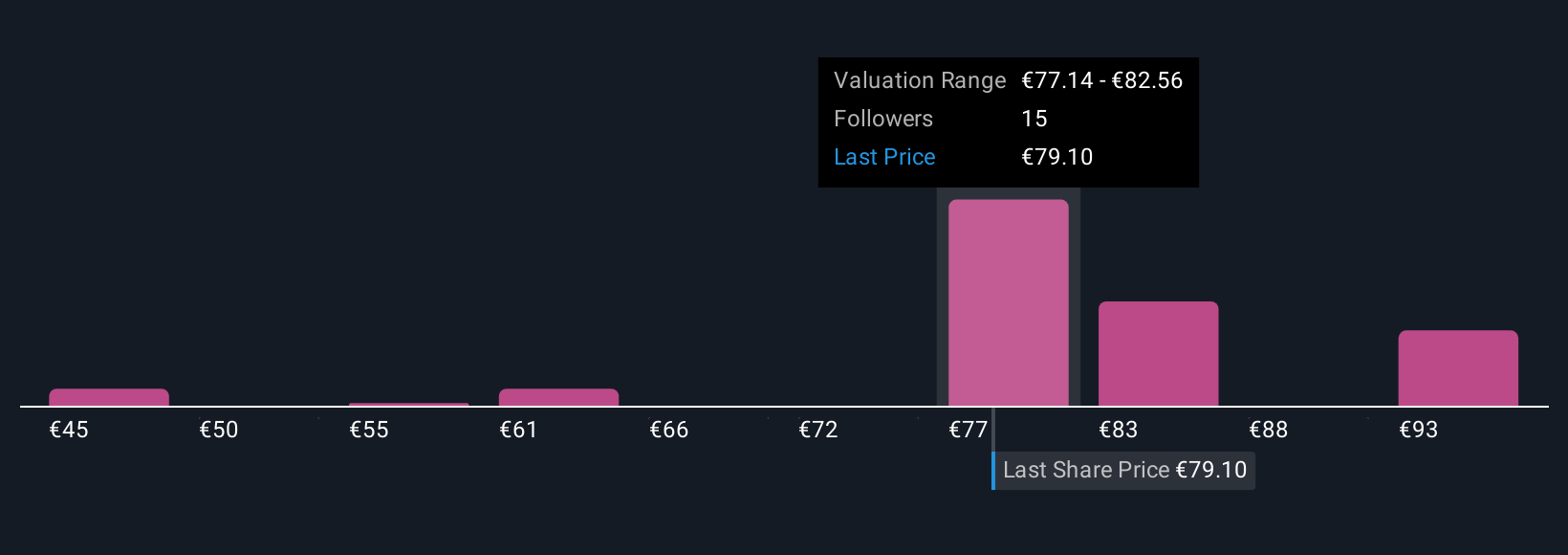

But despite upbeat guidance, project delays at Deutsche Bahn could quickly reshape near-term expectations. Despite retreating, Vossloh's shares might still be trading 21% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 8 other fair value estimates on Vossloh - why the stock might be worth as much as 26% more than the current price!

Build Your Own Vossloh Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vossloh research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vossloh research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vossloh's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOS

Vossloh

Provides rail infrastructure products and services in Germany and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives