- Poland

- /

- Consumer Durables

- /

- WSE:ARH

3 European Stocks Possibly Undervalued By 28.2% To 37.7%

Reviewed by Simply Wall St

As the European market experiences a mix of optimism from the reopening of the U.S. government and tempered gains due to cooling sentiment on artificial intelligence, investors are keenly observing potential opportunities. In this environment, identifying undervalued stocks becomes crucial, as they may offer attractive entry points for those looking to capitalize on market inefficiencies amidst fluctuating economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| STEICO (XTRA:ST5) | €20.15 | €40.14 | 49.8% |

| Spindox (BIT:SPN) | €12.90 | €25.30 | 49% |

| Roche Bobois (ENXTPA:RBO) | €35.10 | €69.87 | 49.8% |

| NOBA Bank Group (OM:NOBA) | SEK100.02 | SEK198.21 | 49.5% |

| NEUCA (WSE:NEU) | PLN784.00 | PLN1553.92 | 49.5% |

| Kitron (OB:KIT) | NOK65.00 | NOK127.02 | 48.8% |

| KB Components (OM:KBC) | SEK41.70 | SEK81.65 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.394 | €0.78 | 49.8% |

| Allcore (BIT:CORE) | €1.33 | €2.66 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK205.00 | SEK401.16 | 48.9% |

Let's review some notable picks from our screened stocks.

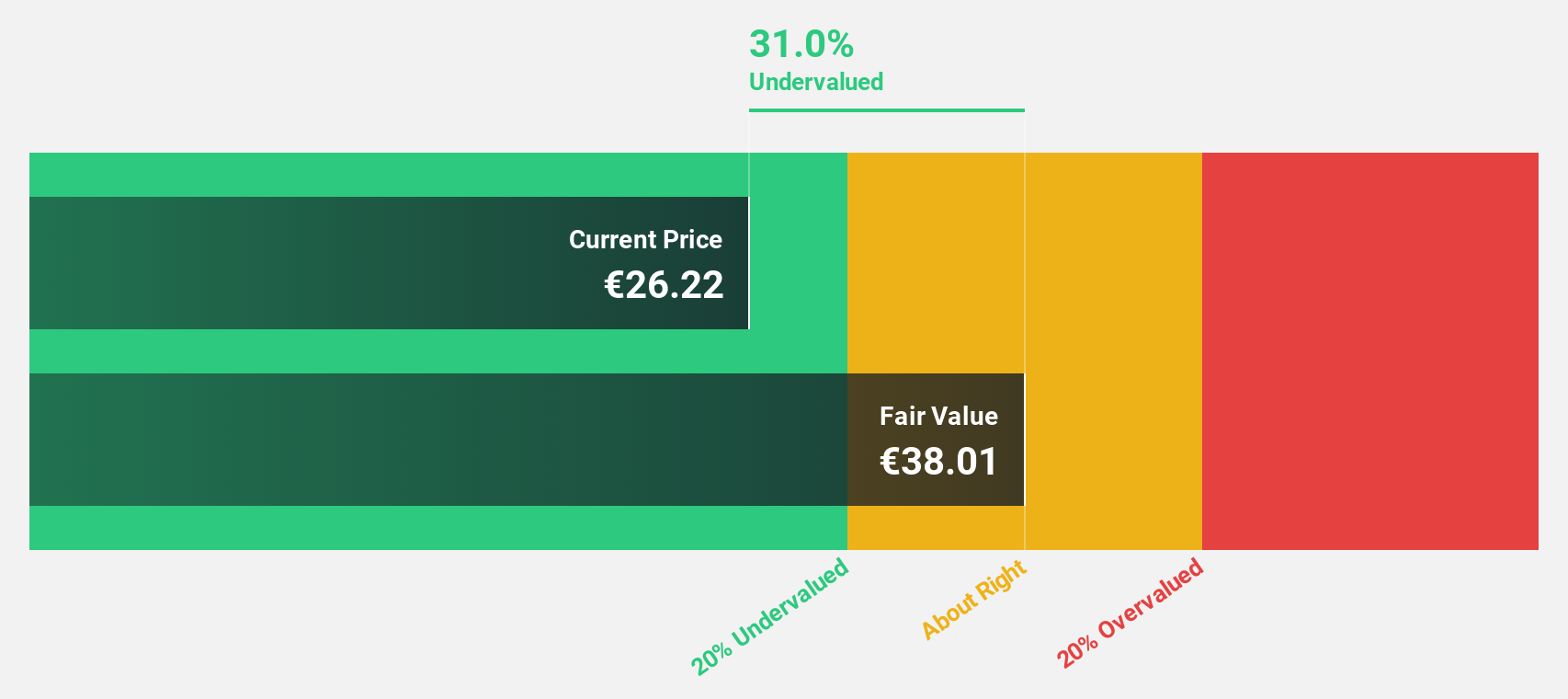

Basic-Fit (ENXTAM:BFIT)

Overview: Basic-Fit N.V., with a market cap of €1.54 billion, operates fitness clubs through its subsidiaries.

Operations: The company's revenue segments consist of €541.70 million from Benelux and €766 million from France, Spain, and Germany.

Estimated Discount To Fair Value: 37.7%

Basic-Fit, trading at €23.48, is significantly undervalued compared to its estimated fair value of €37.71. The company reported a substantial 60% increase in revenue for the first nine months of 2025, totaling €1.03 billion and reaffirmed its annual earnings guidance with expected revenue between €1.38 billion and €1.43 billion for the year. Profitability is anticipated within three years, with earnings projected to grow at an impressive rate of 48.61% annually.

- The growth report we've compiled suggests that Basic-Fit's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Basic-Fit.

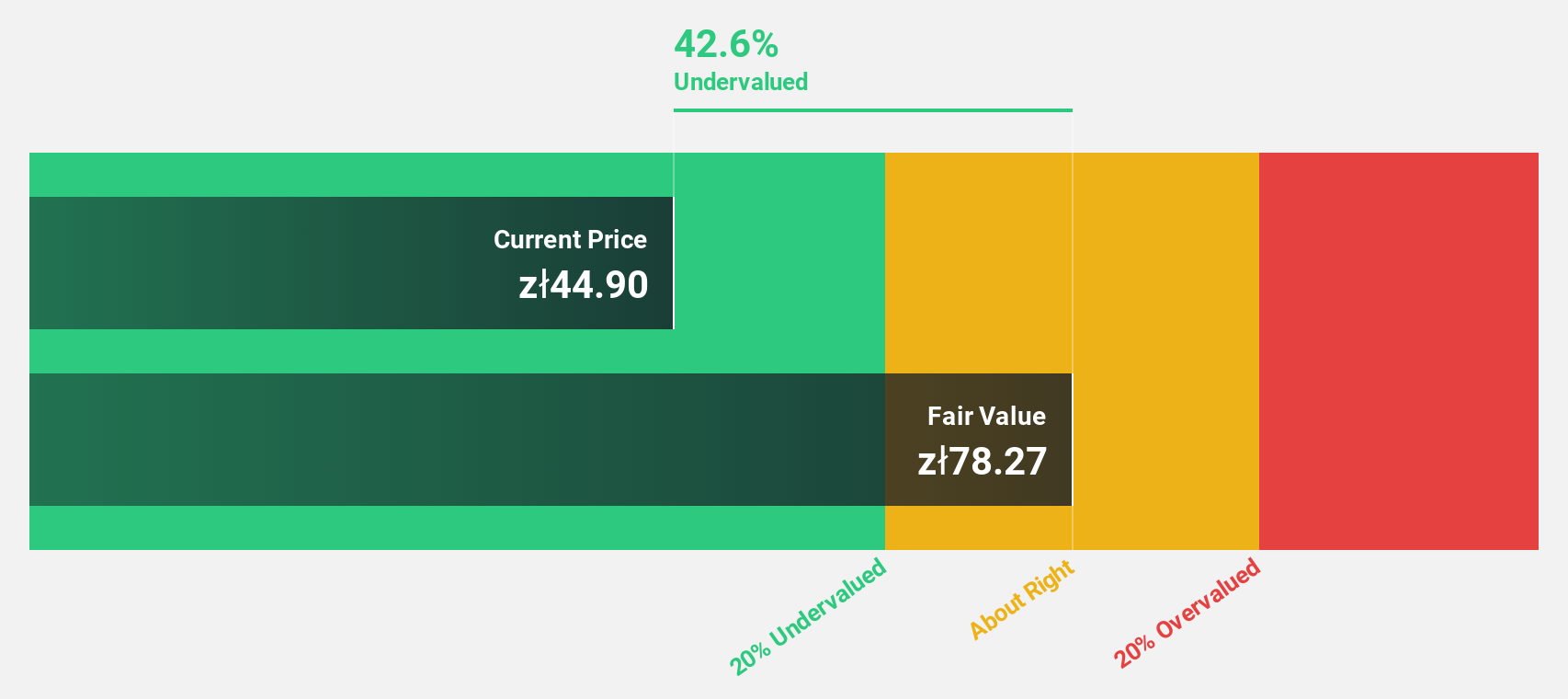

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland with a market capitalization of PLN2.83 billion.

Operations: The company generates revenue from various segments, including PLN227.45 million from supporting companies and housing activities across different cities: PLN51.11 million in Lodz, PLN81.84 million in Cracow, PLN10.59 million in Poznan, PLN431.08 million in Wroclaw, and PLN124.88 million in Warszawa.

Estimated Discount To Fair Value: 33.2%

Archicom is trading at PLN 48.4, significantly below its estimated fair value of PLN 72.41, suggesting it may be undervalued based on cash flows. Despite a recent net loss of PLN 1.05 million for the first half of 2025, earnings are forecast to grow substantially at 44.6% annually over the next three years, outpacing the Polish market's growth rate. However, current profit margins have declined from last year and high debt levels remain a concern.

- Insights from our recent growth report point to a promising forecast for Archicom's business outlook.

- Get an in-depth perspective on Archicom's balance sheet by reading our health report here.

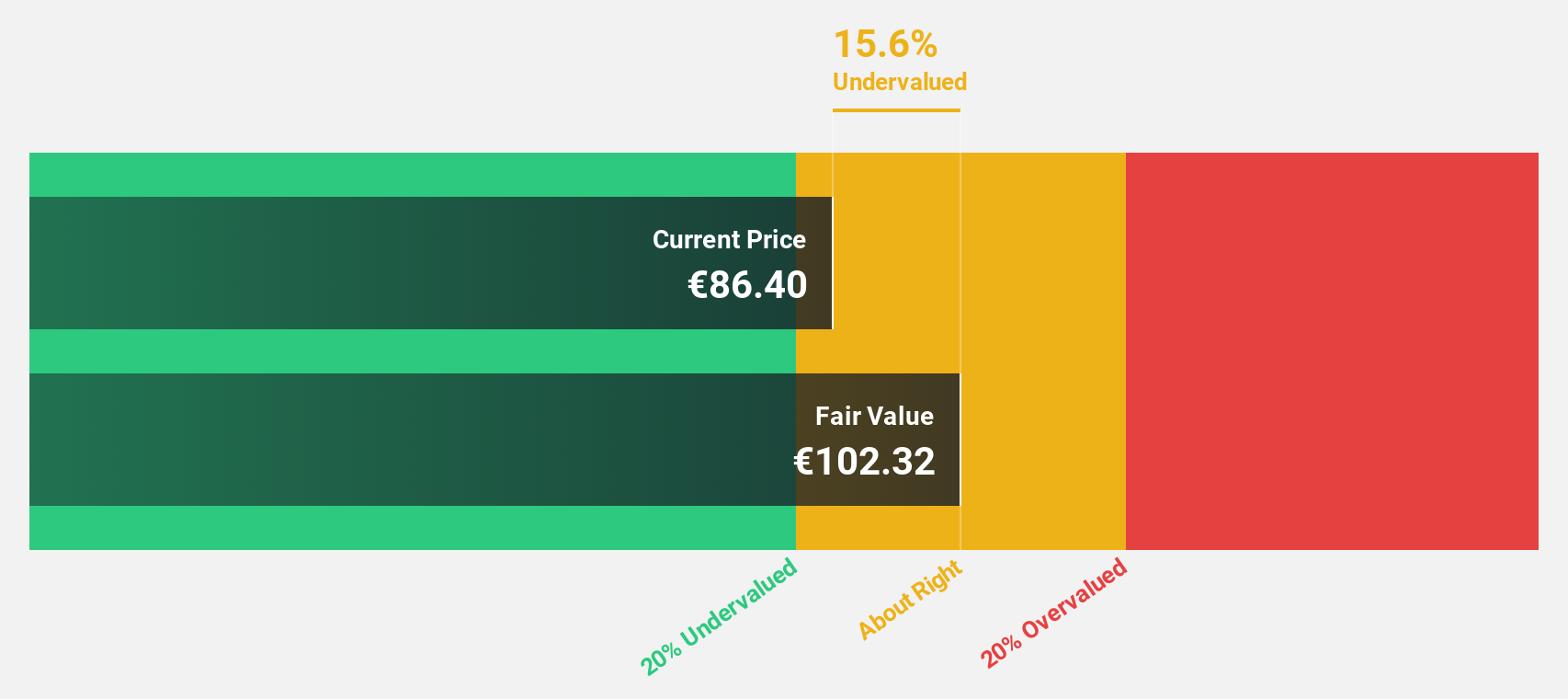

Vossloh (XTRA:VOS)

Overview: Vossloh AG is a company that offers rail infrastructure products and services both in Germany and internationally, with a market cap of approximately €1.34 billion.

Operations: The company's revenue is derived from several segments: Tie Technologies (€147.80 million), Customized Modules (€588.80 million), Lifecycle Solutions (€215.40 million), and Core Components - Fastening Systems (€356 million).

Estimated Discount To Fair Value: 28.2%

Vossloh, trading at €69.5, is significantly below its estimated fair value of €96.77, highlighting potential undervaluation based on cash flows. Despite a dip in net income to €45.5 million from €51.9 million year-over-year, earnings are projected to grow 21.2% annually over the next three years, surpassing the German market's growth rate. Recent strategic wins in China and revised sales guidance between €1.33 billion and €1.4 billion for 2025 bolster its growth prospects despite a low forecasted return on equity of 12.5%.

- Our growth report here indicates Vossloh may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Vossloh's balance sheet health report.

Seize The Opportunity

- Get an in-depth perspective on all 193 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ARH

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives