Villeroy & Boch (XTRA:VIB3) Margin Decline Undermines Bullish Narratives Despite Strong Profit Outlook

Reviewed by Simply Wall St

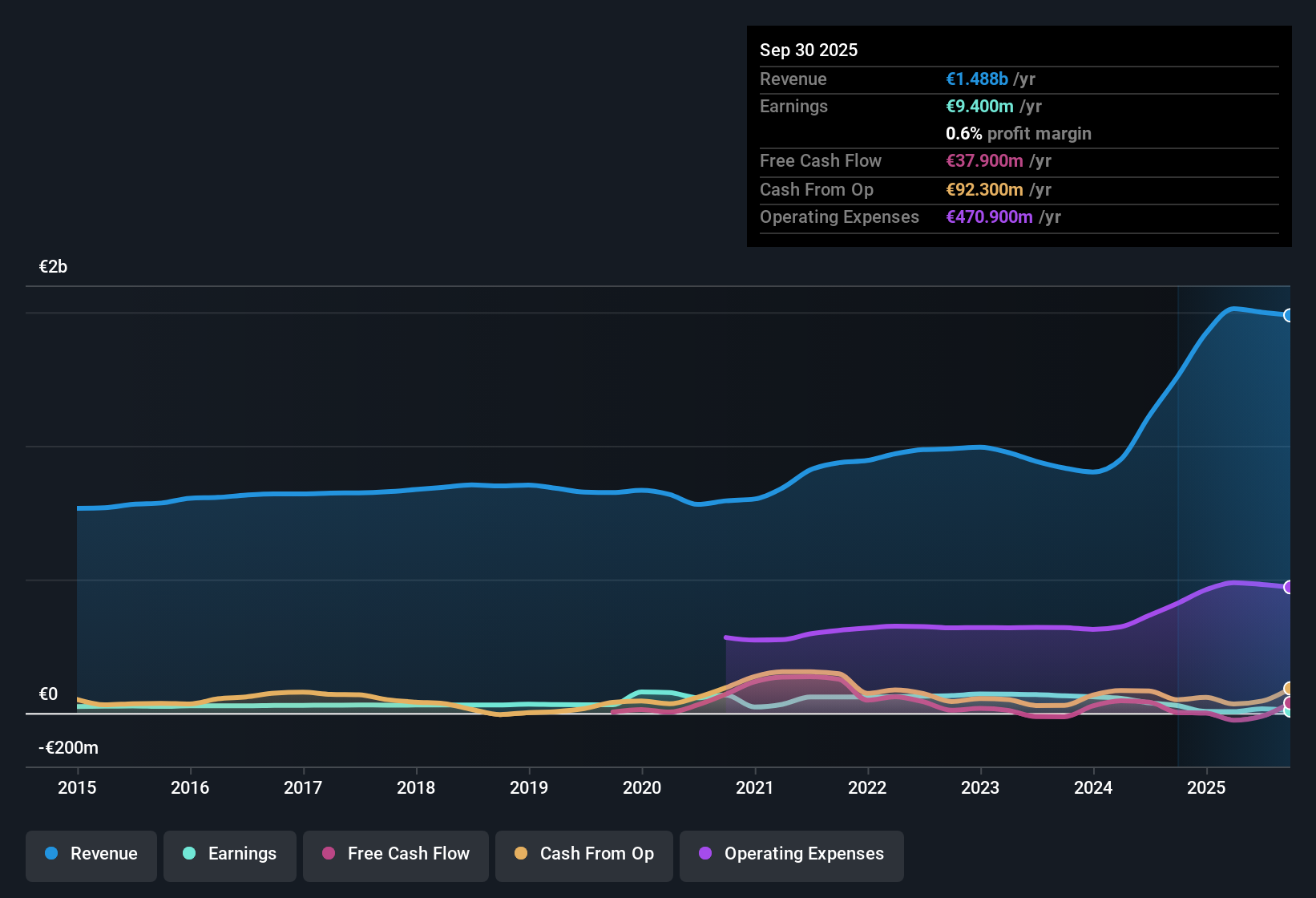

Villeroy & Boch (XTRA:VIB3) reported revenue growth guidance of just 0.9% per year, notably trailing the German market’s 6% per year average. The company’s net profit margin dropped to 1.1% from last year’s 3.5%, with earnings falling at an average rate of 14.5% per year over the past five years. However, management is guiding for a sharp comeback, with profits expected to rise by 58% annually over the next three years, well ahead of the German industry’s consensus growth of 16.6%.

See our full analysis for Villeroy & Boch.Next, we'll see how these numbers compare to the market’s narrative and whether the story around Villeroy & Boch looks set to change.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Under Pressure Despite Brand Strength

- Net profit margin slid to 1.1%, a sharp drop from last year's 3.5%. This intensifies questions about the company’s ability to defend profitability in the face of rising costs.

- Confidence in Villeroy & Boch’s premium positioning is viewed as a key lever for stability. The prevailing market view emphasizes:

- Resilient branding and high perceived quality potentially offer some buffer, but present margin contraction directly tests whether customer loyalty can offset cost headwinds.

- Market conversations highlight steady consumer recognition, yet also point to the urgency of reversing margin pressure to sustain longer-term investor optimism.

Profit Growth Forecast Outpaces Sector

- While historical earnings have fallen by 14.5% annually over five years, management’s guidance now points to a sharp turnaround with 58% yearly profit growth targeted in the next three years. This vastly exceeds the German industry’s 16.6% consensus.

- Bulls point to the upgraded outlook as a pivotal driver for renewed interest, grounded in:

- Guidance dramatically outpacing sector averages, which heavily supports the hopeful scenario for a strong recovery.

- However, maintaining ambitious growth targets rests on executing cost controls and rebuilding margins. Investors will monitor these aspects closely for credibility.

Valuation Offers Discount to Peers

- Shares currently trade at €16.20, below the DCF fair value of €18.07 and the peer group’s average P/E of 29.2x. This suggests the stock is attractively priced relative to direct competitors, though it remains slightly above the industry P/E of 26.4x.

- The prevailing market view centers the valuation debate around:

- Sector momentum backing up the case for a premium, but the margin setback keeps many investors cautious on how durable Villeroy & Boch’s discount really is.

- Historical earnings quality and defensive characteristics bring some support, yet the valuation upside may be capped unless profit recovery is clearly demonstrated.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Villeroy & Boch's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Villeroy & Boch’s shrinking margins and recent profit declines highlight their challenge in delivering consistent growth amid industry pressure.

If you want companies proving they can withstand tough cycles, look for stability and track record with our stable growth stocks screener (2088 results) today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VIB3

Villeroy & Boch

Engages in the manufacture and sale of ceramic products under the Villeroy & Boch brand in Germany.

Average dividend payer and fair value.

Market Insights

Community Narratives