- Germany

- /

- Electrical

- /

- XTRA:VAR1

Even after rising 7.4% this past week, Varta (ETR:VAR1) shareholders are still down 80% over the past three years

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Varta AG (ETR:VAR1) investors who have held the stock for three years as it declined a whopping 81%. That would be a disturbing experience. And over the last year the share price fell 31%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. But this could be related to the weak market, which is down 10% in the same period. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

The recent uptick of 7.4% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Varta

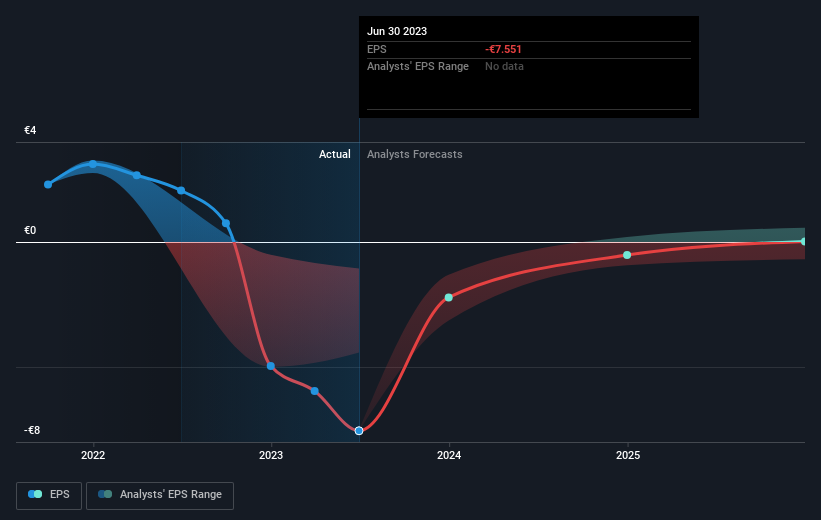

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Varta saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Varta's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 9.8% in the last year, Varta shareholders lost 31%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Varta better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Varta (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VAR1

Varta

Through its subsidiaries, engages in the research, development, production, and sale of micro and household batteries, large-format batteries, battery solutions, and energy storage systems in Europe, Asia, North America, and internationally.

Undervalued with imperfect balance sheet.